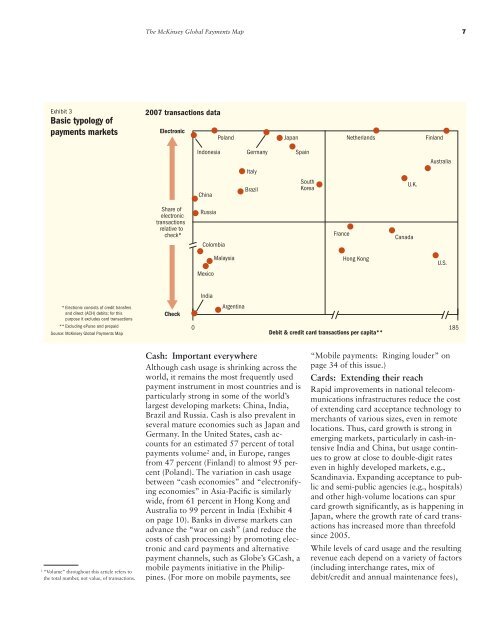

The <str<strong>on</strong>g>McKinsey</str<strong>on</strong>g> Global <strong>Payments</strong> Map7Exhibit 3Basic typology ofpayments markets2007 transacti<strong>on</strong>s dataElectr<strong>on</strong>icPolandJapanNetherlandsFinlandInd<strong>on</strong>esiaChinaGermanyItalyBrazilSpainSouthKoreaU.K.AustraliaShare ofelectr<strong>on</strong>ictransacti<strong>on</strong>srelative tocheck*RussiaColombiaFranceCanadaMexicoMalaysiaH<strong>on</strong>g K<strong>on</strong>gU.S.* Electr<strong>on</strong>ic c<strong>on</strong>sists of credit transfersand direct (ACH) debits; for thispurpose it excludes card transacti<strong>on</strong>s** Excluding ePurse and prepaidSource: <str<strong>on</strong>g>McKinsey</str<strong>on</strong>g> Global <strong>Payments</strong> MapCheckIndiaArgentina0 185Debit & credit card transacti<strong>on</strong>s per capita**2“Volume” throughout this article refers tothe total number, not value, of transacti<strong>on</strong>s.Cash: Important everywhereAlthough cash usage is shrinking across theworld, it remains the most frequently usedpayment instrument in most countries and isparticularly str<strong>on</strong>g in some of the world’slargest developing markets: China, India,Brazil and Russia. Cash is also prevalent inseveral mature ec<strong>on</strong>omies such as Japan andGermany. In the United States, cash accountsfor an estimated 57 percent of totalpayments volume 2 and, in Europe, rangesfrom 47 percent (Finland) to almost 95 percent(Poland). The variati<strong>on</strong> in cash usagebetween “cash ec<strong>on</strong>omies” and “electr<strong>on</strong>ifyingec<strong>on</strong>omies” in Asia-Pacific is similarlywide, from 61 percent in H<strong>on</strong>g K<strong>on</strong>g andAustralia to 99 percent in India (Exhibit 4<strong>on</strong> page 10). Banks in diverse markets canadvance the “war <strong>on</strong> cash” (and reduce thecosts of cash processing) by promoting electr<strong>on</strong>icand card payments and alternativepayment channels, such as Globe’s GCash, amobile payments initiative in the Philippines.(For more <strong>on</strong> mobile payments, see“Mobile payments: Ringing louder” <strong>on</strong>page 34 of this issue.)Cards: Extending their reachRapid improvements in nati<strong>on</strong>al telecommunicati<strong>on</strong>sinfrastructures reduce the costof extending card acceptance technology tomerchants of various sizes, even in remotelocati<strong>on</strong>s. Thus, card growth is str<strong>on</strong>g inemerging markets, particularly in cash-intensiveIndia and China, but usage c<strong>on</strong>tinuesto grow at close to double-digit rateseven in highly developed markets, e.g.,Scandinavia. Expanding acceptance to publicand semi-public agencies (e.g., hospitals)and other high-volume locati<strong>on</strong>s can spurcard growth significantly, as is happening inJapan, where the growth rate of card transacti<strong>on</strong>shas increased more than threefoldsince 2005.While levels of card usage and the resultingrevenue each depend <strong>on</strong> a variety of factors(including interchange rates, mix ofdebit/credit and annual maintenance fees),

8 <str<strong>on</strong>g>McKinsey</str<strong>on</strong>g> <strong>on</strong> <strong>Payments</strong> April 2009those countries where card usage is relativelylow may see the greatest opportunityfor growth in both card transacti<strong>on</strong>s andrevenue. For example, Germany’s 36 cardtransacti<strong>on</strong>s per capita per year is low byEuropean standards, and China’s <strong>on</strong>e transacti<strong>on</strong>per capita is distorted by a high unbankedpopulati<strong>on</strong>. Card transacti<strong>on</strong>revenue in these countries (i.e., debit andcredit, excluding interest) accounts for 6percent and 10 percent of total paymentsrevenue, respectively, suggesting an untappedreserve of revenue from transacti<strong>on</strong>volume. By c<strong>on</strong>trast, in markets like theU.S., with 177 card transacti<strong>on</strong>s per capitaper year, and South Korea, with 63, (a relativelyhigh figure compared to the Asian peergroups) cards c<strong>on</strong>tribute 33 percent and 44percent of total payments revenue, respectively,and the prospects for further revenuegrowth from cards are more measured.Checks: Declining but impossibleto ignoreWhile checks have l<strong>on</strong>g provided the mainalternative to cash in certain countries, theirrelative importance globally is declining rapidly.In countries such as Finland or theNetherlands, checks have actually ceased toexist, which is expected to happen so<strong>on</strong> inmost of northwest Europe as well. As a resultof these trends, check usage is now increasinglyc<strong>on</strong>centrated in North America, afew European countries (e.g., France andthe U.K.) and Latin America, where theproduct proves difficult to replace, due pri-Internati<strong>on</strong>al glossary of paymentsWhile the core offerings of a payments franchise are c<strong>on</strong>sistent from <strong>on</strong>e regi<strong>on</strong> to another, different markets use a variety of English-languageterms to identify the same services. Bankers, therefore, need not <strong>on</strong>ly to understand the distinct behaviors and c<strong>on</strong>venti<strong>on</strong>s of local marketsbut also regi<strong>on</strong>al differences in the payments lexic<strong>on</strong>. The glossary below lists the alternative names for the products discussed in this article.ServiceCard acquirerCharge cardCredit cardCredit card issuerCredit transferAlternative namesMerchant acquirerDeferred debit card,credit cardRevolving credit cardACH credit (in the U.S.);also (in Europe) giro paymentand direct creditDescripti<strong>on</strong>The bank that provides merchants and billers with technology for accepting card transacti<strong>on</strong>sand processes card payments <strong>on</strong> their behalf. Acquirer revenue is based <strong>on</strong> technologyimplementati<strong>on</strong> and taking a small porti<strong>on</strong> of the “discount rate” <strong>on</strong> each transacti<strong>on</strong>.Card allowing holder to charge purchases to a card account up to an authorized limit.Card does not offer extended credit and the full amount of the debt incurred is settledat the end of a specified period. Most cards referred to as “credit cards” in c<strong>on</strong>tinentalEurope are actually “charge cards.”Card allowing holder to charge purchases against a line of credit up to an authorizedamount, with the opti<strong>on</strong> to pay a porti<strong>on</strong> of the balance at the end of a specified periodand “revolve” the remaining balance indefinitely. Customer pays interest <strong>on</strong> the revolvedbalance. In countries where deficit spending is prevalent, credit card holders tend to be“revolvers”; in countries where c<strong>on</strong>sumers maintain high current account balances, theytend to be “transactors,” using credit cards as a form of “deferred debit.”The bank that issues the credit card and associated credit line to the customer. Card issuerrevenue comes from interchange (merchant discount rate), and interest <strong>on</strong> revolvingbalances (in some countries) or membership fees (in other countries), as well as incidentalfees (for late payment and transacti<strong>on</strong>s that exceed the credit limit).Electr<strong>on</strong>ic payment where both payment instructi<strong>on</strong>s and funds move from payor bank topayee bank via batch-transfer system. Traditi<strong>on</strong>ally low-value.