Tax Risk in the Boardroom - Deloitte & Touche Canada

Tax Risk in the Boardroom - Deloitte & Touche Canada

Tax Risk in the Boardroom - Deloitte & Touche Canada

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

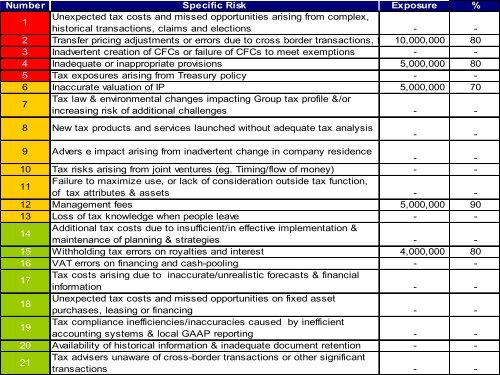

Number Specific <strong>Risk</strong> Exposure %1Unexpected tax costs and missed opportunities aris<strong>in</strong>g from complex,historical transactions, claims and elections - -2 Transfer pric<strong>in</strong>g adjustments or errors due to cross border transactions, f 10,000,000 803 Inadvertent creation of CFCs or failure of CFCs to meet exemptions - -4 Inadequate or <strong>in</strong>appropriate provisions 5,000,000 805 <strong>Tax</strong> exposures aris<strong>in</strong>g from Treasury policy - -6 Inaccurate valuation of IP 5,000,000 707<strong>Tax</strong> law & environmental changes impact<strong>in</strong>g Group tax profile &/or<strong>in</strong>creas<strong>in</strong>g risk of additional challenges - -8 New tax products and services launched without adequate tax analysis- -9 Advers e impact aris<strong>in</strong>g from <strong>in</strong>advertent change <strong>in</strong> company residence- -10 <strong>Tax</strong> risks aris<strong>in</strong>g from jo<strong>in</strong>t ventures (eg. Tim<strong>in</strong>g/flow of money) - -11Failure to maximize use, or lack of consideration outside tax function,of tax attributes & assets - -12 Management fees 5,000,000 9013 Loss of tax knowledge when people leave - -14Additional tax costs due to <strong>in</strong>sufficient/<strong>in</strong> effective implementation &ma<strong>in</strong>tenance of plann<strong>in</strong>g & strategies - -15 Withhold<strong>in</strong>g tax errors on royalties and <strong>in</strong>terest 4,000,000 8016 VAT errors on f<strong>in</strong>anc<strong>in</strong>g and cash-pool<strong>in</strong>g - -17<strong>Tax</strong> costs aris<strong>in</strong>g due to <strong>in</strong>accurate/unrealistic forecasts & f<strong>in</strong>ancial<strong>in</strong>formation - -18Unexpected tax costs and missed opportunities on fixed assetpurchases, leas<strong>in</strong>g or f<strong>in</strong>anc<strong>in</strong>g - -19<strong>Tax</strong> compliance <strong>in</strong>efficiencies/<strong>in</strong>accuracies caused by <strong>in</strong>efficientaccount<strong>in</strong>g systems & local GAAP report<strong>in</strong>g - -20 Availability of historical <strong>in</strong>formation & <strong>in</strong>adequate document retention - -21<strong>Tax</strong> advisers unaware of cross-border transactions or o<strong>the</strong>r significanttransactions - -