OxibL

OxibL

OxibL

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

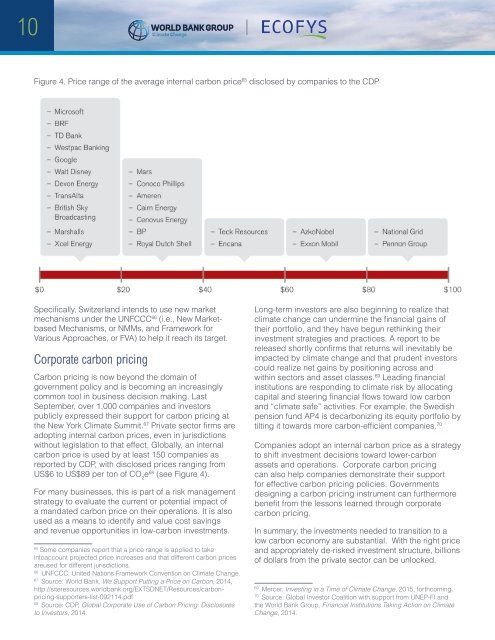

10Figure 4. Price range of the average internal carbon price 65 disclosed by companies to the CDPSpecifically, Switzerland intends to use new market 65mechanisms under the UNFCCC 66 (i.e., New MarketbasedMechanisms, or NMMs, and Framework forVarious Approaches, or FVA) to help it reach its target.Corporate carbon pricingCarbon pricing is now beyond the domain ofgovernment policy and is becoming an increasinglycommon tool in business decision making. LastSeptember, over 1,000 companies and investorspublicly expressed their support for carbon pricing atthe New York Climate Summit. 67 Private sector firms areadopting internal carbon prices, even in jurisdictionswithout legislation to that effect. Globally, an internalcarbon price is used by at least 150 companies asreported by CDP, with disclosed prices ranging fromUS$6 to US$89 per ton of CO 2e 68 (see Figure 4).For many businesses, this is part of a risk managementstrategy to evaluate the current or potential impact ofa mandated carbon price on their operations. It is alsoused as a means to identify and value cost savingsand revenue opportunities in low-carbon investments.65Some companies report that a price range is applied to takeintoaccount projected price increases and that different carbon pricesareused for different jurisdictions.66UNFCCC: United Nations Framework Convention on Climate Change.67Source: World Bank, We Support Putting a Price on Carbon, 2014,http://siteresources.worldbank.org/EXTSDNET/Resources/carbonpricing-supporters-list-092114.pdf68Source: CDP, Global Corporate Use of Carbon Pricing: Disclosuresto Investors, 2014.Long-term investors are also beginning to realize thatclimate change can undermine the financial gains oftheir portfolio, and they have begun rethinking theirinvestment strategies and practices. A report to bereleased shortly confirms that returns will inevitably beimpacted by climate change and that prudent investorscould realize net gains by positioning across andwithin sectors and asset classes. 69 Leading financialinstitutions are responding to climate risk by allocatingcapital and steering financial flows toward low carbonand “climate safe” activities. For example, the Swedishpension fund AP4 is decarbonizing its equity portfolio bytilting it towards more carbon-efficient companies. 70Companies adopt an internal carbon price as a strategyto shift investment decisions toward lower-carbonassets and operations. Corporate carbon pricingcan also help companies demonstrate their supportfor effective carbon pricing policies. Governmentsdesigning a carbon pricing instrument can furthermorebenefit from the lessons learned through corporatecarbon pricing.In summary, the investments needed to transition to alow carbon economy are substantial. With the right priceand appropriately de-risked investment structure, billionsof dollars from the private sector can be unlocked.69Mercer, Investing in a Time of Climate Change, 2015, forthcoming.70Source: Global Investor Coalition with support from UNEP-FI andthe World Bank Group, Financial Institutions Taking Action on ClimateChange, 2014.