IFRS for Microsoft Dynamics AX - 6 Gen

IFRS for Microsoft Dynamics AX - 6 Gen

IFRS for Microsoft Dynamics AX - 6 Gen

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

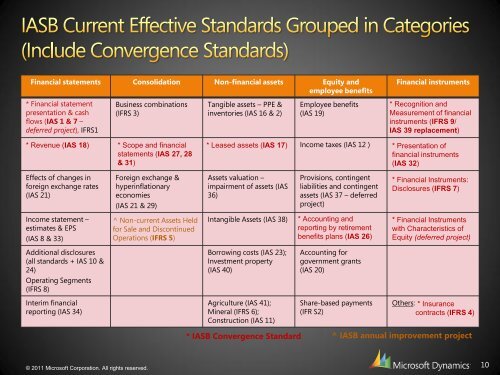

Financial statements Consolidation Non-financial assets Equity andemployee benefits* Financial statementpresentation & cashflows (IAS 1 & 7 –deferred project), <strong>IFRS</strong>1Business combinations(<strong>IFRS</strong> 3)Tangible assets – PPE &inventories (IAS 16 & 2)Employee benefits(IAS 19)Financial instruments* Recognition andMeasurement of financialinstruments (<strong>IFRS</strong> 9/IAS 39 replacement)* Revenue (IAS 18) * Scope and financialstatements (IAS 27, 28& 31)* Leased assets (IAS 17)Income taxes (IAS 12 )* Presentation offinancial instruments(IAS 32)Effects of changes in<strong>for</strong>eign exchange rates(IAS 21)Income statement –estimates & EPS(IAS 8 & 33)Additional disclosures(all standards + IAS 10 &24)Operating Segments(<strong>IFRS</strong> 8)Interim financialreporting (IAS 34)Foreign exchange &hyperinflationaryeconomies(IAS 21 & 29)^ Non-current Assets Held<strong>for</strong> Sale and DiscontinuedOperations (<strong>IFRS</strong> 5)Assets valuation –impairment of assets (IAS36)Intangible Assets (IAS 38)Borrowing costs (IAS 23);Investment property(IAS 40)Agriculture (IAS 41);Mineral (<strong>IFRS</strong> 6);Construction (IAS 11)* IASB Convergence StandardProvisions, contingentliabilities and contingentassets (IAS 37 – deferredproject)* Accounting andreporting by retirementbenefits plans (IAS 26)Accounting <strong>for</strong>government grants(IAS 20)Share-based payments(IFR S2)* Financial Instruments:Disclosures (<strong>IFRS</strong> 7)* Financial Instrumentswith Characteristics ofEquity (deferred project)Others: * Insurancecontracts (<strong>IFRS</strong> 4)^ IASB annual improvement project10