LEGAL AND PRACTICAL SUBROGATION ISSUES IN THE U.S.A.

LEGAL AND PRACTICAL SUBROGATION ISSUES IN THE U.S.A.

LEGAL AND PRACTICAL SUBROGATION ISSUES IN THE U.S.A.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

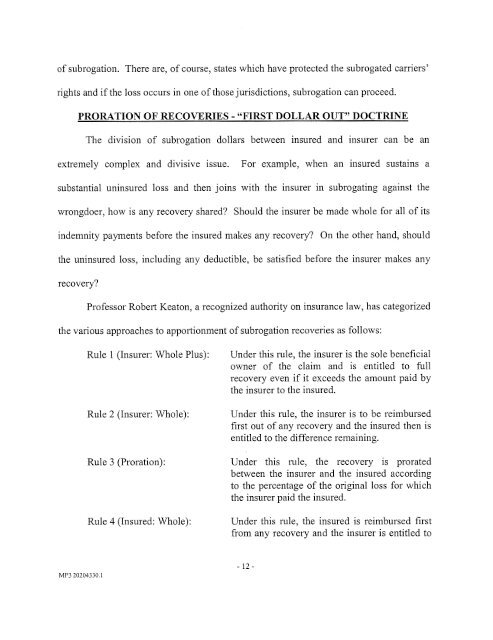

of subrogation. There are, of course, states which have protected the subrogated carriers’rights and if the loss occurs in one of those jurisdictions, subrogation can proceed.PRORATION OF RECOVERIES - “FIRST DOLLAR OUT” DOCTR<strong>IN</strong>EThe division of subrogation dollars between insured and insurer can be anextremely complex and divisive issue.For example, when an insured sustains asubstantial uninsured loss and then joins with the insurer in subrogating against thewrongdoer, how is any recovery shared? Should the insurer be made whole for all of itsindemnity payments before the insured makes any recovery? On the other hand, shouldthe uninsured loss, including any deductible, be satisfied before the insurer makes anyrecovery?Professor Robert Keaton, a recognized authority on insurance law, has categorizedthe various approaches to apportionment of subrogation recoveries as follows:Rule 1 (Insurer: Whole Plus):Rule 2 (Insurer: Whole):Rule 3 (Proration):Rule 4 (Insured: Whole):Under this rule, the insurer is the sole beneficialowner of the claim and is entitled to fullrecovery even if it exceeds the amount paid bythe insurer to the insured.Under this rule, the insurer is to be reimbursedfirst out of any recovery and the insured then isentitled to the difference remaining.Under this rule, the recovery is proratedbetween the insurer and the insured accordingto the percentage of the original loss for whichthe insurer paid the insured.Under this rule, the insured is reimbursed firstfrom any recovery and the insurer is entitled toMP3 20204330.1- 12-