Registration document 2010-11 - Air France-KLM Finance

Registration document 2010-11 - Air France-KLM Finance

Registration document 2010-11 - Air France-KLM Finance

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

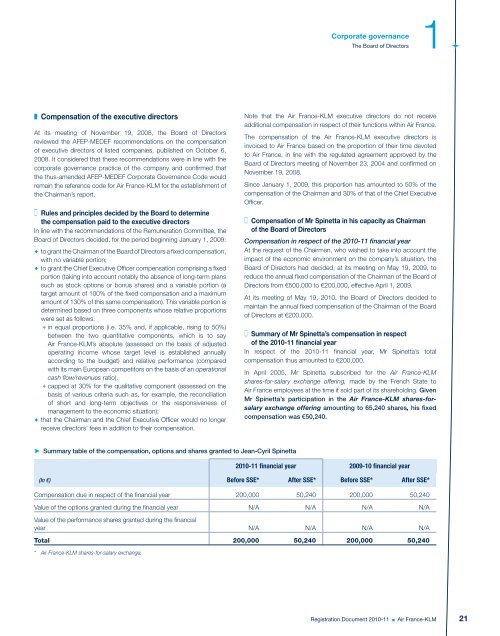

1Corporate governanceThe Board of Directors❚ Compensation of the executive directorsAt its meeting of November 19, 2008, the Board of Directorsreviewed the AFEP-MEDEF recommendations on the compensationof executive directors of listed companies, published on October 6,2008. It considered that these recommendations were in line with thecorporate governance practice of the company and confi rmed thatthe thus-amended AFEP-MEDEF Corporate Governance Code wouldremain the reference code for <strong>Air</strong> <strong>France</strong>-<strong>KLM</strong> for the establishment ofthe Chairman’s report. Rules and principles decided by the Board to determinethe compensation paid to the executive directorsIn line with the recommendations of the Remuneration Committee, theBoard of Directors decided, for the period beginning January 1, 2009:✦ to grant the Chairman of the Board of Directors a fi xed compensation,with no variable portion;✦ to grant the Chief Executive Offi cer compensation comprising a fi xedportion (taking into account notably the absence of long-term planssuch as stock options or bonus shares) and a variable portion (atarget amount of 100% of the fi xed compensation and a maximumamount of 130% of this same compensation). This variable portion isdetermined based on three components whose relative proportionswere set as follows:✦ in equal proportions (i.e. 35% and, if applicable, rising to 50%)between the two quantitative components, which is to say<strong>Air</strong> <strong>France</strong>-<strong>KLM</strong>’s absolute (assessed on the basis of adjustedoperating income whose target level is established annuallyaccording to the budget) and relative performance (comparedwith its main European competitors on the basis of an operationalcash fl ow/revenues ratio),✦ capped at 30% for the qualitative component (assessed on thebasis of various criteria such as, for example, the reconciliationof short and long-term objectives or the responsiveness ofmanagement to the economic situation);✦ that the Chairman and the Chief Executive Offi cer would no longerreceive directors’ fees in addition to their compensation.Note that the <strong>Air</strong> <strong>France</strong>-<strong>KLM</strong> executive directors do not receiveadditional compensation in respect of their functions within <strong>Air</strong> <strong>France</strong>.The compensation of the <strong>Air</strong> <strong>France</strong>-<strong>KLM</strong> executive directors isinvoiced to <strong>Air</strong> <strong>France</strong> based on the proportion of their time devotedto <strong>Air</strong> <strong>France</strong>, in line with the regulated agreement approved by theBoard of Directors meeting of November 23, 2004 and confi rmed onNovember 19, 2008.Since January 1, 2009, this proportion has amounted to 50% of thecompensation of the Chairman and 30% of that of the Chief ExecutiveOffi cer. Compensation of Mr Spinetta in his capacity as Chairmanof the Board of DirectorsCompensation in respect of the <strong>2010</strong>-<strong>11</strong> financial yearAt the request of the Chairman, who wished to take into account theimpact of the economic environment on the company’s situation, theBoard of Directors had decided, at its meeting on May 19, 2009, toreduce the annual fi xed compensation of the Chairman of the Board ofDirectors from €500,000 to €200,000, effective April 1, 2009.At its meeting of May 19, <strong>2010</strong>, the Board of Directors decided tomaintain the annual fi xed compensation of the Chairman of the Boardof Directors at €200,000. Summary of Mr Spinetta’s compensation in respectof the <strong>2010</strong>-<strong>11</strong> financial yearIn respect of the <strong>2010</strong>-<strong>11</strong> fi nancial year, Mr Spinetta’s totalcompensation thus amounted to €200,000.In April 2005, Mr Spinetta subscribed for the <strong>Air</strong> <strong>France</strong>-<strong>KLM</strong>shares-for-salary exchange offering, made by the French State to<strong>Air</strong> <strong>France</strong> employees at the time it sold part of its shareholding. GivenMr Spinetta’s participation in the <strong>Air</strong> <strong>France</strong>-<strong>KLM</strong> shares-forsalaryexchange offering amounting to 65,240 shares, his fixedcompensation was €50,240.➤ Summary table of the compensation, options and shares granted to Jean-Cyril Spinetta<strong>2010</strong>-<strong>11</strong> financial year 2009-10 financial year(In €)Before SSE* After SSE* Before SSE* After SSE*Compensation due in respect of the fi nancial year 200,000 50,240 200,000 50,240Value of the options granted during the fi nancial year N/A N/A N/A N/AValue of the performance shares granted during the fi nancialyear N/A N/A N/A N/ATotal 200,000 50,240 200,000 50,240* <strong>Air</strong> <strong>France</strong>-<strong>KLM</strong> shares-for-salary exchange.<strong>Registration</strong> Document <strong>2010</strong>-<strong>11</strong> ■ <strong>Air</strong> <strong>France</strong>-<strong>KLM</strong>21