read - Securities Lending Times

read - Securities Lending Times

read - Securities Lending Times

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

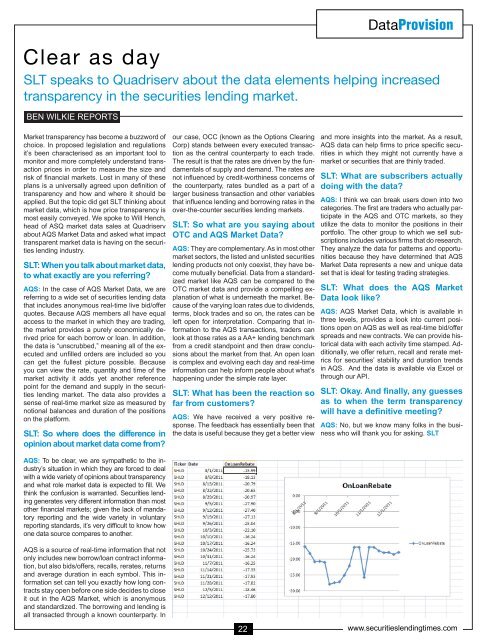

DataProvisionClear as daySLT speaks to Quadriserv about the data elements helping increasedtransparency in the securities lending market.BEN WILKIE REPORTSMarket transparency has become a buzzword ofchoice. In proposed legislation and regulationsit’s been characterised as an important tool tomonitor and more completely understand transactionprices in order to measure the size andrisk of financial markets. Lost in many of theseplans is a universally agreed upon definition oftransparency and how and where it should beapplied. But the topic did get SLT thinking aboutmarket data, which is how price transparency ismost easily conveyed. We spoke to Will Hench,head of ASQ market data sales at Quadriservabout AQS Market Data and asked what impacttransparent market data is having on the securitieslending industry.SLT: When you talk about market data,to what exactly are you referring?AQS: In the case of AQS Market Data, we arereferring to a wide set of securities lending datathat includes anonymous real-time live bid/offerquotes. Because AQS members all have equalaccess to the market in which they are trading,the market provides a purely economically derivedprice for each borrow or loan. In addition,the data is “unscrubbed,” meaning all of the executedand unfilled orders are included so youcan get the fullest picture possible. Becauseyou can view the rate, quantity and time of themarket activity it adds yet another referencepoint for the demand and supply in the securitieslending market. The data also provides asense of real-time market size as measured bynotional balances and duration of the positionson the platform.SLT: So where does the difference inopinion about market data come from?AQS: To be clear, we are sympathetic to the industry’ssituation in which they are forced to dealwith a wide variety of opinions about transparencyand what role market data is expected to fill. Wethink the confusion is warranted. <strong>Securities</strong> lendinggenerates very different information than mostother financial markets; given the lack of mandatoryreporting and the wide variety in voluntaryreporting standards, it’s very difficult to know howone data source compares to another.our case, OCC (known as the Options ClearingCorp) stands between every executed transactionas the central counterparty to each trade.The result is that the rates are driven by the fundamentalsof supply and demand. The rates arenot influenced by credit-worthiness concerns ofthe counterparty, rates bundled as a part of alarger business transaction and other variablesthat influence lending and borrowing rates in theover-the-counter securities lending markets.SLT: So what are you saying aboutOTC and AQS Market Data?AQS: They are complementary. As in most othermarket sectors, the listed and unlisted securitieslending products not only coexist, they have becomemutually beneficial. Data from a standardizedmarket like AQS can be compared to theOTC market data and provide a compelling explanationof what is underneath the market. Becauseof the varying loan rates due to dividends,terms, block trades and so on, the rates can beleft open for interpretation. Comparing that informationto the AQS transactions, traders canlook at those rates as a AA+ lending benchmarkfrom a credit standpoint and then draw conclusionsabout the market from that. An open loanis complex and evolving each day and real-timeinformation can help inform people about what’shappening under the simple rate layer.SLT: What has been the reaction sofar from customers?AQS: We have received a very positive response.The feedback has essentially been thatthe data is useful because they get a better viewand more insights into the market. As a result,AQS data can help firms to price specific securitiesin which they might not currently have amarket or securities that are thinly traded.SLT: What are subscribers actuallydoing with the data?AQS: I think we can break users down into twocategories. The first are traders who actually participatein the AQS and OTC markets, so theyutilize the data to monitor the positions in theirportfolio. The other group to which we sell subscriptionsincludes various firms that do research.They analyze the data for patterns and opportunitiesbecause they have determined that AQSMarket Data represents a new and unique dataset that is ideal for testing trading strategies.SLT: What does the AQS MarketData look like?AQS: AQS Market Data, which is available inthree levels, provides a look into current positionsopen on AQS as well as real-time bid/offersp<strong>read</strong>s and new contracts. We can provide historicaldata with each activity time stamped. Additionally,we offer return, recall and rerate metricsfor securities’ stability and duration trendsin AQS. And the data is available via Excel orthrough our API.SLT: Okay. And finally, any guessesas to when the term transparencywill have a definitive meeting?AQS: No, but we know many folks in the businesswho will thank you for asking. SLTAQS is a source of real-time information that notonly includes new borrow/loan contract information,but also bids/offers, recalls, rerates, returnsand average duration in each symbol. This informationset can tell you exactly how long contractsstay open before one side decides to closeit out in the AQS Market, which is anonymousand standardized. The borrowing and lending isall transacted through a known counterparty. In22www.securitieslendingtimes.com