1. What is the National Solidarity Bond? - Terms and Conditions

1. What is the National Solidarity Bond? - Terms and Conditions

1. What is the National Solidarity Bond? - Terms and Conditions

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

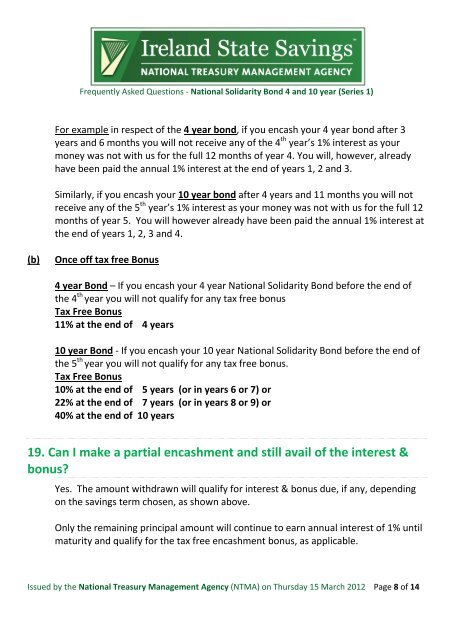

Frequently Asked Questions - <strong>National</strong> <strong>Solidarity</strong> <strong>Bond</strong> 4 <strong>and</strong> 10 year (Series 1)For example in respect of <strong>the</strong> 4 year bond, if you encash your 4 year bond after 3years <strong>and</strong> 6 months you will not receive any of <strong>the</strong> 4 th year’s 1% interest as yourmoney was not with us for <strong>the</strong> full 12 months of year 4. You will, however, alreadyhave been paid <strong>the</strong> annual 1% interest at <strong>the</strong> end of years 1, 2 <strong>and</strong> 3.Similarly, if you encash your 10 year bond after 4 years <strong>and</strong> 11 months you will notreceive any of <strong>the</strong> 5 th year’s 1% interest as your money was not with us for <strong>the</strong> full 12months of year 5. You will however already have been paid <strong>the</strong> annual 1% interest at<strong>the</strong> end of years 1, 2, 3 <strong>and</strong> 4.(b)Once off tax free Bonus4 year <strong>Bond</strong> – If you encash your 4 year <strong>National</strong> <strong>Solidarity</strong> <strong>Bond</strong> before <strong>the</strong> end of<strong>the</strong> 4 th year you will not qualify for any tax free bonusTax Free Bonus11% at <strong>the</strong> end of 4 years10 year <strong>Bond</strong> - If you encash your 10 year <strong>National</strong> <strong>Solidarity</strong> <strong>Bond</strong> before <strong>the</strong> end of<strong>the</strong> 5 th year you will not qualify for any tax free bonus.Tax Free Bonus10% at <strong>the</strong> end of 5 years (or in years 6 or 7) or22% at <strong>the</strong> end of 7 years (or in years 8 or 9) or40% at <strong>the</strong> end of 10 years19. Can I make a partial encashment <strong>and</strong> still avail of <strong>the</strong> interest &bonus?Yes. The amount withdrawn will qualify for interest & bonus due, if any, dependingon <strong>the</strong> savings term chosen, as shown above.Only <strong>the</strong> remaining principal amount will continue to earn annual interest of 1% untilmaturity <strong>and</strong> qualify for <strong>the</strong> tax free encashment bonus, as applicable.Issued by <strong>the</strong> <strong>National</strong> Treasury Management Agency (NTMA) on Thursday 15 March 2012 Page 8 of 14