Guide to Giving - Berkshire Taconic Community Foundation

Guide to Giving - Berkshire Taconic Community Foundation

Guide to Giving - Berkshire Taconic Community Foundation

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

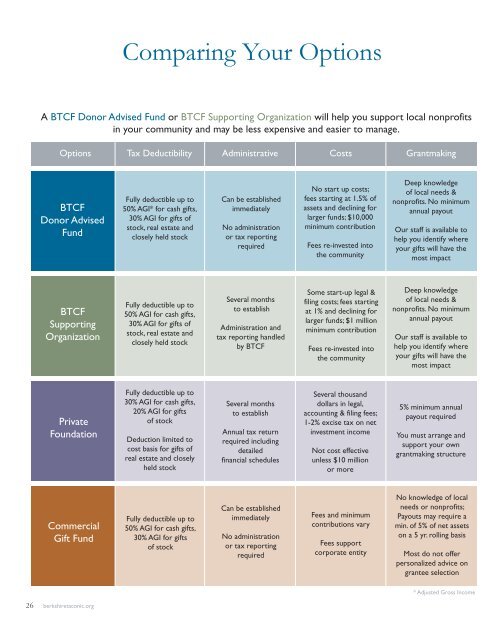

Comparing Your OptionsInvestment ManagementA BTCF Donor Advised Fund or BTCF Supporting Organization will help you support local nonprofitsin your community and may be less expensive and easier <strong>to</strong> manage.The pooled resources of BTCF’s many donors gives you access <strong>to</strong> a highly diversified portfolio with worldclass money managers that would not otherwise be available <strong>to</strong> individuals or many organizations on their own.OptionsBTCFDonor AdvisedFundTax Deductibility Administrative Costs GrantmakingFully deductible up <strong>to</strong>50% AGI* for cash gifts,30% AGI for gifts ofs<strong>to</strong>ck, real estate andclosely held s<strong>to</strong>ckCan be establishedimmediatelyNo administrationor tax reportingrequiredNo start up costs;fees starting at 1.5% ofassets and declining forlarger funds; $10,000minimum contributionFees re-invested in<strong>to</strong>the communityDeep knowledgeof local needs &nonprofits. No minimumannual payoutOur staff is available <strong>to</strong>help you identify whereyour gifts will have themost impactAs stewards of the charitable resources entrusted <strong>to</strong> us, we work meticulously <strong>to</strong> manageyour investments, overseen by our nationally recognized Investment Committee –a group of board and community members with deep institutional investment experience.BTCF’s investment strategy is <strong>to</strong> maximize return while preserving capital andliquidity, producing consistent and stable growth with low <strong>to</strong> moderate risk. Our goal is <strong>to</strong>grow your endowment so that you can grant more <strong>to</strong> the causes you care about.Learn more about our investment strategy and performance at berkshiretaconic.org.BTCFSupportingOrganizationFully deductible up <strong>to</strong>50% AGI for cash gifts,30% AGI for gifts ofs<strong>to</strong>ck, real estate andclosely held s<strong>to</strong>ckSeveral months<strong>to</strong> establishAdministration andtax reporting handledby BTCFSome start-up legal &filing costs; fees startingat 1% and declining forlarger funds; $1 millionminimum contributionFees re-invested in<strong>to</strong>the communityDeep knowledgeof local needs &nonprofits. No minimumannual payoutOur staff is available <strong>to</strong>help you identify whereyour gifts will have themost impactWE HELP YOUR FUND GROW...SO THAT YOU CAN DO MORE GOOD.$1,400,000 bequest in 1996*$1,700,000 value of endowment, 2012$900,000 in scholarships granted from 1997-2012Private<strong>Foundation</strong>CommercialGift FundFully deductible up <strong>to</strong>30% AGI for cash gifts,20% AGI for giftsof s<strong>to</strong>ckDeduction limited <strong>to</strong>cost basis for gifts ofreal estate and closelyheld s<strong>to</strong>ckFully deductible up <strong>to</strong>50% AGI for cash gifts,30% AGI for giftsof s<strong>to</strong>ckSeveral months<strong>to</strong> establishAnnual tax returnrequired includingdetailedfinancial schedulesCan be establishedimmediatelyNo administrationor tax reportingrequiredSeveral thousanddollars in legal,accounting & filing fees;1-2% excise tax on netinvestment incomeNot cost effectiveunless $10 millionor moreFees and minimumcontributions varyFees supportcorporate entity5% minimum annualpayout requiredYou must arrange andsupport your owngrantmaking structureNo knowledge of localneeds or nonprofits;Payouts may require amin. of 5% of net assetson a 5 yr. rolling basisMost do not offerpersonalized advice ongrantee selection* Adjusted Gross IncomeDONOR ADVISED FUNDSMinimum <strong>to</strong> open: $10,000Endowed minimum: $25,0001.5% per year on first $250,0001.25% per year on portion $250,000 - $1 million1.0% per year on portion $1 million - $3 million0.75% per year on portion $3 million and aboveOr 3% of grants given out, whichever is higherMinimum quarterly fee: $87.50*The McLaughlin Wilson ScholarshipAdministrative FeesEach fund pays a fee that covers handling costs and supports <strong>Berkshire</strong> <strong>Taconic</strong>’s wide range of community work.Fees are charged quarterly based on the average daily balance of the fund.DESIGNATED FUNDSMinimum <strong>to</strong> open: $25,0001.5% per year if balance is less than $250,0000.75% per year if balance is more than $250,000Minimum quarterly fee: $125NONPROFIT ENDOWED FUNDSMinimum <strong>to</strong> open: $25,0001.5% per year if balance is less than $250,0000.75% per year if balance is more than $250,000Minimum quarterly fee: $125SCHOLARSHIP & FIELD OFINTEREST FUNDSMinimum <strong>to</strong> open: $25,0002.0% per year on first $250,0001.75% per year on portion $250,000 - $1 million1.0% per year on portion $1 million - $3 million0.75% per year on portion $3 million and aboveMinimum quarterly fee: $12526 berkshiretaconic.orgberkshiretaconic.org 27