Carbon credit Trading - Tata Mutual Fund

Carbon credit Trading - Tata Mutual Fund

Carbon credit Trading - Tata Mutual Fund

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

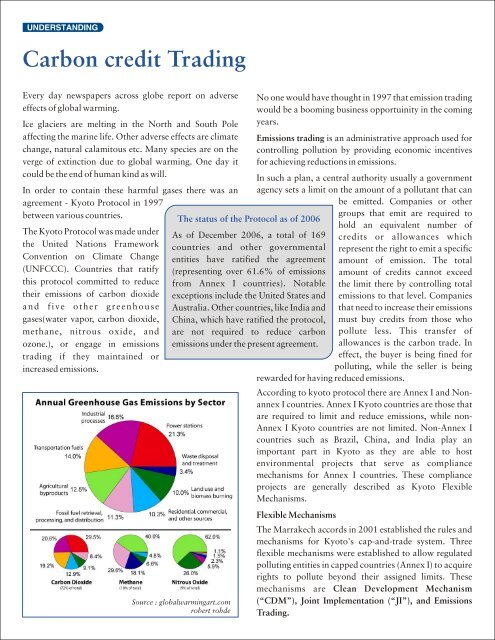

UNDERSTANDING<strong>Carbon</strong> <strong>credit</strong> <strong>Trading</strong>Every day newspapers across globe report on adverseeffects of global warming.Ice glaciers are melting in the North and South Poleaffecting the marine life. Other adverse effects are climatechange, natural calamitous etc. Many species are on theverge of extinction due to global warming. One day itcould be the end of human kind as will.In order to contain these harmful gases there was anagreement - Kyoto Protocol in 1997between various countries.The Kyoto Protocol was made underthe United Nations FrameworkConvention on Climate Change(UNFCCC). Countries that ratifythis protocol committed to reducetheir emissions of carbon dioxideand five other greenhousegases(water vapor, carbon dioxide,methane, nitrous oxide, andozone.), or engage in emissionstrading if they maintained orincreased emissions.The status of the Protocol as of 2006As of December 2006, a total of 169countries and other governmentalentities have ratified the agreement(representing over 61.6% of emissionsfrom Annex I countries). Notableexceptions include the United States andAustralia. Other countries, like India andChina, which have ratified the protocol,are not required to reduce carbonemissions under the present agreement.Source : globalwarmingart.comrobert rohdeNo one would have thought in 1997 that emission tradingwould be a booming business opportuinity in the comingyears.Emissions trading is an administrative approach used forcontrolling pollution by providing economic incentivesfor achieving reductions in emissions.In such a plan, a central authority usually a governmentagency sets a limit on the amount of a pollutant that canbe emitted. Companies or othergroups that emit are required tohold an equivalent number of<strong>credit</strong>s or allowances whichrepresent the right to emit a specificamount of emission. The totalamount of <strong>credit</strong>s cannot exceedthe limit there by controlling totalemissions to that level. Companiesthat need to increase their emissionsmust buy <strong>credit</strong>s from those whopollute less. This transfer ofallowances is the carbon trade. Ineffect, the buyer is being fined forpolluting, while the seller is beingrewarded for having reduced emissions.According to kyoto protocol there are Annex I and NonannexI countries. Annex I Kyoto countries are those thatare required to limit and reduce emissions, while non-Annex I Kyoto countries are not limited. Non-Annex Icountries such as Brazil, China, and India play animportant part in Kyoto as they are able to hostenvironmental projects that serve as compliancemechanisms for Annex I countries. These complianceprojects are generally described as Kyoto FlexibleMechanisms.Flexible MechanismsThe Marrakech accords in 2001 established the rules andmechanisms for Kyoto's cap-and-trade system. Threeflexible mechanisms were established to allow regulatedpolluting entities in capped countries (Annex I) to acquirerights to pollute beyond their assigned limits. Thesemechanisms are Clean Development Mechanism(“CDM”), Joint Implementation (“JI”), and Emissions<strong>Trading</strong>.