- Page 2 and 3: HYPERIONINTERNATIONAL JOURNALOF ECO

- Page 4 and 5: Hyperion International Journal of E

- Page 6 and 7: ECONOPHYSICS Section233

- Page 8 and 9: INDUSTRIAL PROBLEMS OF TECHNICALELE

- Page 10 and 11: In (1): the sought for vector funct

- Page 12 and 13: Where:Further, the system (4) is re

- Page 14 and 15: 2Since ˆ∂ is the particular case

- Page 16 and 17: The second condition in (24) means

- Page 18 and 19: A STUDY OF THE DISTRIBUTION OF WEAL

- Page 20 and 21: trading. We also consider the money

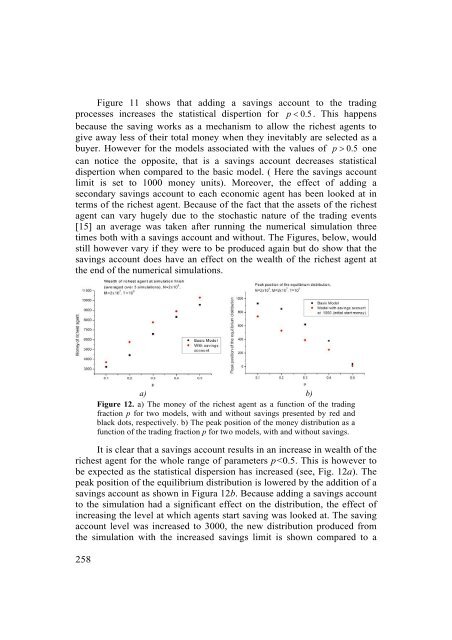

- Page 22 and 23: fraction, p, increases, the shape o

- Page 24 and 25: Market with fluctuations in pIn the

- Page 26 and 27: Both a variation of 0.1 and 0.2 hav

- Page 28: Models with untradeable savingsIt c

- Page 33 and 34: agents are representatives, for exa

- Page 35 and 36: such a market where there is only o

- Page 37 and 38: Figure 18. A snapshot of financial

- Page 39 and 40: Shown in Figure 19 is a diagram sho

- Page 41 and 42: have been adjusted to 100 to make v

- Page 43 and 44: In the future more complicated asse

- Page 45 and 46: AN ECONOPHYSICS MODELFOR THE MIGRAT

- Page 47 and 48: As well, linked to the first two ca

- Page 49 and 50: The economic, linguistic and cultur

- Page 51 and 52: dable [18]. If for the gravity mode

- Page 53 and 54: As in the cases discussed in the pr

- Page 55 and 56: APPENDIXFigure 2. Gold Reserves (mi

- Page 57 and 58: 284Figure 6. Relative dynamics of p

- Page 59 and 60: (i) extreme sensitivity to initial

- Page 61 and 62: This model given by equation (9) is

- Page 63 and 64: ConclusionThis paper suggests concl

- Page 65 and 66: ELASTIC COLLISIONS OF HARD SPHERESV

- Page 67 and 68: governed by strict physical laws gi

- Page 69 and 70: Figure 1 depicts a scattering diagr

- Page 71 and 72: collisions correspond to wealth-exc

- Page 73 and 74: This randomly sharing of the “bet

- Page 75 and 76: conservation implies that with incr

- Page 77 and 78: REFERENCES[1] J. Angle, The Inequal

- Page 79 and 80:

market activity and graphing the pr

- Page 81 and 82:

Figure 2. Fractal property in forei

- Page 83 and 84:

3. B-tree database indexesIn order

- Page 85 and 86:

REFERENCES[1] Hideki Takayasu, Misa

- Page 87 and 88:

The book has both a fundamental and

- Page 89 and 90:

NEW ECONOMY Section317

- Page 91 and 92:

THE QUALITY FUNCTION DEPLOYMENT (QF

- Page 93 and 94:

f) the product delivery and selling

- Page 95 and 96:

In these conditions, the integrated

- Page 97 and 98:

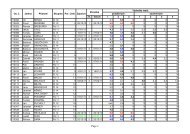

Goal L i S 2 S 1 K i w i Q iG1 10 6

- Page 99 and 100:

4. The Goal-Oriented Framework for

- Page 101 and 102:

EUROPEAN UNION ENERGY POLICYAND GOO

- Page 103 and 104:

- The attempt to create a single ma

- Page 105 and 106:

enewable energy sources from 17.8%

- Page 107 and 108:

of the education system, inadequate

- Page 109 and 110:

vital supplies dangerously low. The

- Page 111 and 112:

FINANCIAL AND ECONOMIC CRISES:ROMAN

- Page 113 and 114:

12000111501000080006000400090247356

- Page 115 and 116:

421.70-2-4-6-8-10-7.10-4.1-4.9-6.7-

- Page 117 and 118:

there was a sharp reduction of thei

- Page 119 and 120:

will not invest and consume. A spec

- Page 121 and 122:

of a fundamental „moral deficit

- Page 123 and 124:

In his ’The 8th Habit: From Effec

- Page 125 and 126:

steered by personal material intere

- Page 127 and 128:

[4] Stiglitz, J., In free fall, Ame

- Page 129 and 130:

examples are proof of this: not inc

- Page 131 and 132:

appropriate, especially now in full

- Page 133 and 134:

market, or the demography challenge

- Page 135 and 136:

From the point of view of Dror Y. 7

- Page 137 and 138:

Territorial units 9 are defined in

- Page 139 and 140:

3. Social: A socially sustainable s

- Page 141 and 142:

REFERENCES[1] James Roberson (2005)

- Page 143 and 144:

Migration causes were diverse, rang

- Page 145 and 146:

Migration Flux by Region in 2005 3R

- Page 147 and 148:

Currently, the provisions of the Tr

- Page 149 and 150:

Free movement of persons, in partic

- Page 151 and 152:

In general, aliens are more vulnera

- Page 153 and 154:

[15] Gabriela Moldoveanu Tinteanu,

- Page 155 and 156:

In order to come to the finality of

- Page 157 and 158:

The analysis of fiscal pressure ove

- Page 159 and 160:

agricultural takeoff. In 1988 the s

- Page 161 and 162:

amortization of permanent capital,

- Page 163 and 164:

[3] A. Duca, Miraculous Tax Triangl

- Page 165 and 166:

“Storm Worm Rages Through Interne

- Page 167 and 168:

of 500 packets per second is enough

- Page 169 and 170:

4. Botnet PatternsBotnets, a major

- Page 171 and 172:

- Email Addresses: 2-4 $/MB- Compro

- Page 173 and 174:

7. Tackling DDoSThere are three asp

- Page 175 and 176:

[15] Symantec Enterprise Security,

- Page 177 and 178:

2. Intercultural NegotiationPerhaps

- Page 179 and 180:

There are certain features of the n

- Page 181 and 182:

can respond on an issue as soon as

- Page 183 and 184:

CONCEPTUAL APPROACHES ABOUTINTERNAT

- Page 185 and 186:

as apparent sacrifices that pursue

- Page 187 and 188:

negotiations, the power balance ten

- Page 189 and 190:

venture value judgment, because the

- Page 191 and 192:

REFERENCES[1] Barelier A., Dupoin J

- Page 193 and 194:

1. Formal and legal authorization c

- Page 195 and 196:

their activities and when confronte

- Page 197 and 198:

3.1. Identification of problems and

- Page 199 and 200:

It should be emphasized that too gr

- Page 201 and 202:

3.2. Formulating the strategy for a

- Page 203 and 204:

accomplishes public tasks included

- Page 205:

PPP comprising a public entity and