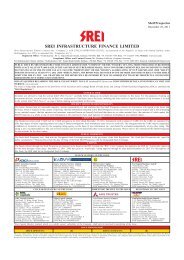

Consolidated Balance Sheet as at 31st March, 2009(Rupees in Lakh)Schedule 2009 2008SOURCES OF FUNDSShareholders' FundsShare Capital 1 11,629 11,629Equity Warrants Issued and Subscribed 1,780 1,780Reserves and Surplus 2 101,529 114,938 58,875 72,284Minority Interest 2,211 762Loan FundsSecured 3 375,155 418,800Unsecured 4 53,074 135,650428,229 554,450Deferred Tax Liability 2,743 1,140Total 548,121 628,636APPLICATION OF FUNDSFixed AssetsGross Block 5 35,610 53,024Less: Depreciation 4,223 9,651Net Block 31,387 43,373Goodwill 622 57Deferred Tax Assets 22 61Investments 6 44,382 32,189Current Assets, Loans and AdvancesInventories 2,401 2,287Sundry Debtors 7 6,759 1,204Cash & Bank Balances 8 48,308 27,931Financial & Other Current Assets 9 297,215 443,607Loans & Advances 10 136,771 105,121491,454 580,150Less: Current Liabilities and ProvisionsLiabilities 11 13,278 20,853Provisions 12 6,728 6,90820,006 27,761Net Current Assets 471,448 552,389Miscellaneous Expenditure 13 260 567(To the extent not written off or adjusted)Total 548,121 628,636Significant accounting policies and noteson financial statements 19The Schedules referred to above form an integral part of the Balance Sheet.This is the Balance Sheet referred to in our report of even date.For Deloitte Haskins & SellsChartered AccountantsOn behalf of the Board of DirectorsAbhijit Bandyopadhyay Hemant Kanoria Salil K. Gupta Sandeep LakhotiaPartner Chairman & Managing Director Chief Mentor & Director Company SecretaryPlace : KolkataDate : 12th June, 0910 Lakh is equal to 1 Million142

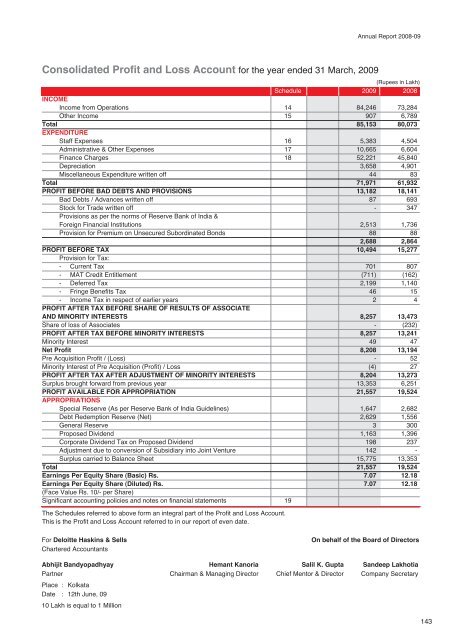

Annual Report 2008-09Consolidated Profit and Loss Account for the year ended 31 March, 2009(Rupees in Lakh)Schedule 2009 2008INCOMEIncome from Operations 14 84,246 73,284Other Income 15 907 6,789Total 85,153 80,073EXPENDITUREStaff Expenses 16 5,383 4,504Administrative & Other Expenses 17 10,665 6,604<strong>Finance</strong> Charges 18 52,221 45,840Depreciation 3,658 4,901Miscellaneous Expenditure written off 44 83Total 71,971 61,932PROFIT BEFORE BAD DEBTS AND PROVISIONS 13,182 18,141Bad Debts / Advances written off 87 693Stock for Trade written off - 347Provisions as per the norms of Reserve Bank of India &Foreign Financial Institutions 2,513 1,736Provision for Premium on Unsecured Subordinated Bonds 88 882,688 2,864PROFIT BEFORE TAX 10,494 15,277Provision for Tax:- Current Tax 701 807- MAT Credit Entitlement (711) (162)- Deferred Tax 2,199 1,140- Fringe Benefits Tax 46 15- Income Tax in respect of earlier years 2 4PROFIT AFTER TAX BEFORE SHARE OF RESULTS OF ASSOCIATEAND MINORITY INTERESTS 8,257 13,473Share of loss of Associates - (232)PROFIT AFTER TAX BEFORE MINORITY INTERESTS 8,257 13,241Minority Interest 49 47Net Profit 8,208 13,194Pre Acquisition Profit / (Loss) - 52Minority Interest of Pre Acquisition (Profit) / Loss (4) 27PROFIT AFTER TAX AFTER ADJUSTMENT OF MINORITY INTERESTS 8,204 13,273Surplus brought forward from previous year 13,353 6,251PROFIT AVAILABLE FOR APPROPRIATION 21,557 19,524APPROPRIATIONSSpecial Reserve (As per Reserve Bank of India Guidelines) 1,647 2,682Debt Redemption Reserve (Net) 2,629 1,556General Reserve 3 300Proposed Dividend 1,163 1,396Corporate Dividend Tax on Proposed Dividend 198 237Adjustment due to conversion of Subsidiary into Joint Venture 142 -Surplus carried to Balance Sheet 15,775 13,353Total 21,557 19,524Earnings Per Equity Share (Basic) Rs. 7.07 12.18Earnings Per Equity Share (Diluted) Rs. 7.07 12.18(Face Value Rs. 10/- per Share)Significant accounting policies and notes on financial statements 19The Schedules referred to above form an integral part of the Profit and Loss Account.This is the Profit and Loss Account referred to in our report of even date.For Deloitte Haskins & SellsChartered AccountantsOn behalf of the Board of DirectorsAbhijit Bandyopadhyay Hemant Kanoria Salil K. Gupta Sandeep LakhotiaPartner Chairman & Managing Director Chief Mentor & Director Company SecretaryPlace : KolkataDate : 12th June, 0910 Lakh is equal to 1 Million143

- Page 4 and 5:

Promoters’ stake30.02%Foreign hol

- Page 6 and 7:

VISIONTo be the most inspiring glob

- Page 8 and 9:

CHAIRMAN & MANAGINGDIRECTOR’S MES

- Page 10 and 11:

Srei’s consolidated total income

- Page 12 and 13:

As you are aware, the JointVenture

- Page 14 and 15:

INFRASTRUCTURE OPPORTUNITY“We pro

- Page 16 and 17:

To be part of the Indian infrastruc

- Page 18 and 19:

PROJECT FINANCING“The Eleventh Pl

- Page 20 and 21:

VALUE INTANGIBLES“We are leveragi

- Page 22 and 23:

INFRASTRUCTURE DEVELOPMENT“As inf

- Page 24 and 25:

EQUIPMENT FINANCING“We are increa

- Page 26 and 27:

EQUIPMENT FINANCINGMinimising NPAs

- Page 28 and 29:

EQUIPMENT FINANCINGManufacturer Par

- Page 30 and 31:

RURAL INFRASTRUCTURE“We are creat

- Page 32 and 33:

FINANCIAL ALLIES“We strengthened

- Page 34 and 35:

32THE SREI STAKEHOLDERS

- Page 36 and 37:

ENTREPRENEURIAL MINDSET“Combinati

- Page 38 and 39:

VALUE INNOVATION“At Srei, innovat

- Page 40 and 41:

Group StructureSrei Infrastructure

- Page 42 and 43:

IIS International Infrastructure Se

- Page 44 and 45:

INFRASTRUCTURE REPORTThe Eleventh F

- Page 46 and 47:

POWERIndia is the world’s sixth l

- Page 48 and 49:

PORTSIndia has 12 major and 187 min

- Page 50 and 51:

RAILWAYSAsia’s largest and the wo

- Page 52 and 53:

TELECOMIndia, among the world’s f

- Page 54 and 55:

AN ANALYSIS OF OURFINANCIAL STATEME

- Page 56 and 57:

Reserves and surplus:Consolidated r

- Page 58 and 59:

MAPPING RISKSMANAGING UNCERTAINTIES

- Page 60 and 61:

PromoterriskSrei is competently pla

- Page 62 and 63:

DIRECTORS' PROFILESitting from L -

- Page 64 and 65:

DIRECTORS’ REPORTYour Directors a

- Page 66 and 67:

The Promoters’ Group ofyour Compa

- Page 68 and 69:

illion, which indicates that Indiac

- Page 70 and 71:

The three main businessareas of you

- Page 72 and 73:

due to crash in the global stock ma

- Page 74 and 75:

BNP Paribas LeaseGroup has invested

- Page 76 and 77:

Infrastructure, etc.The focus of th

- Page 78 and 79:

Your Company has nowbeen awarded th

- Page 80 and 81:

infrastructure institution paired w

- Page 82 and 83:

As of 31st March, 2009,your Company

- Page 84 and 85:

Advisors Limited, a subsidiary of y

- Page 86 and 87:

these Directors have filed Form DDA

- Page 88 and 89:

Particulars of EmployeesInformation

- Page 90 and 91:

REPORT ONCORPORATE GOVERNANCECorpor

- Page 92 and 93:

Mr. Hemant Kanoria, Mr. P. K. Pande

- Page 94 and 95: Committee in Section 292A of the Co

- Page 96 and 97: complaints received were pending as

- Page 98 and 99: ) Independent DirectorsIndependent

- Page 100 and 101: 7. ISIN Numbers8. Stock Codes(Equit

- Page 102 and 103: of the Company in Srei Insurance Br

- Page 104 and 105: 19. Measures adoptedto protect thei

- Page 106 and 107: 23. Nomination24. ElectronicClearin

- Page 108 and 109: 106

- Page 110 and 111: Annexure to the Auditors’ Report(

- Page 112 and 113: Balance Sheet as at 31st March, 200

- Page 114 and 115: 112Cash Flow Statement for the year

- Page 116 and 117: Schedules to the Balance Sheet as a

- Page 118 and 119: Schedules to the Balance Sheet as a

- Page 120 and 121: Schedules to the Balance Sheet as a

- Page 122 and 123: Schedules to the Profit and Loss Ac

- Page 124 and 125: Schedules to the Balance Sheet and

- Page 126 and 127: Schedules to the Balance Sheet and

- Page 128 and 129: Schedules to the Balance Sheet and

- Page 130 and 131: Schedules to the Balance Sheet and

- Page 132 and 133: Schedules to the Balance Sheet and

- Page 134 and 135: Schedules to the Balance Sheet and

- Page 136 and 137: Schedules to the Balance Sheet and

- Page 138 and 139: ANNEXURE I TO NOTES ON FINANCIAL ST

- Page 140 and 141: ANNEXURE II TO NOTES ON FINANCIAL S

- Page 142 and 143: Statement Pursuant to Section 212 o

- Page 146 and 147: Consolidated Cash Flow Statement fo

- Page 148 and 149: Schedules to the Consolidated Balan

- Page 150 and 151: Schedules to the Consolidated Balan

- Page 152 and 153: Schedules to the Consolidated Balan

- Page 154 and 155: 152Schedules to the Consolidated Ba

- Page 156 and 157: Schedules to the Consolidated Balan

- Page 158 and 159: Schedules to the Consolidated Balan

- Page 160 and 161: Schedules to the Consolidated Balan

- Page 162 and 163: Information on Subsidiary Companies

- Page 164 and 165: 162Notes

- Page 166: Srei Infrastructure Finance Limited