10773 AirlingPDF - Aer Lingus

10773 AirlingPDF - Aer Lingus

10773 AirlingPDF - Aer Lingus

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

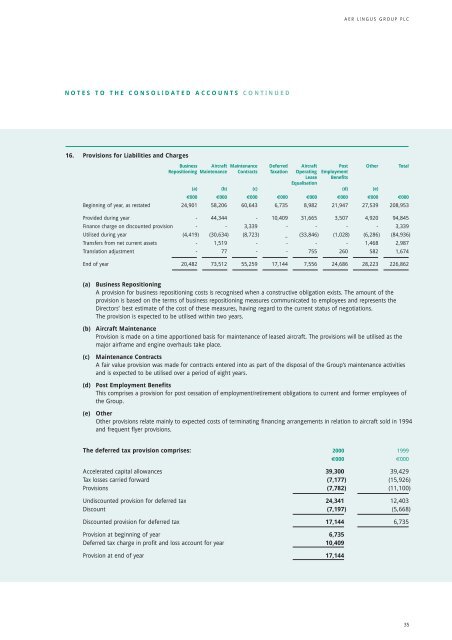

AER LINGUS GROUP PLCNOTES TO THE CONSOLIDATED ACCOUNTS CONTINUED16. Provisions for Liabilities and ChargesBusiness Aircraft Maintenance Deferred Aircraft Post Other TotalRepositioning Maintenance Contracts Taxation Operating EmploymentLease BenefitsEqualisation(a) (b) (c) (d) (e)€000 €000 €000 €000 €000 €000 €000 €000Beginning of year, as restated 24,901 58,206 60,643 6,735 8,982 21,947 27,539 208,953Provided during year - 44,344 - 10,409 31,665 3,507 4,920 94,845Finance charge on discounted provision - - 3,339 - - - - 3,339Utilised during year (4,419) (30,634) (8,723) _ (33,846) (1,028) (6,286) (84,936)Transfers from net current assets - 1,519 - - - - 1,468 2,987Translation adjustment - 77 - - 755 260 582 1,674End of year 20,482 73,512 55,259 17,144 7,556 24,686 28,223 226,862(a)Business RepositioningA provision for business repositioning costs is recognised when a constructive obligation exists. The amount of theprovision is based on the terms of business repositioning measures communicated to employees and represents theDirectors’ best estimate of the cost of these measures, having regard to the current status of negotiations.The provision is expected to be utilised within two years.(b) Aircraft MaintenanceProvision is made on a time apportioned basis for maintenance of leased aircraft. The provisions will be utilised as themajor airframe and engine overhauls take place.(c)Maintenance ContractsA fair value provision was made for contracts entered into as part of the disposal of the Group’s maintenance activitiesand is expected to be utilised over a period of eight years.(d) Post Employment BenefitsThis comprises a provision for post cessation of employment/retirement obligations to current and former employees ofthe Group.(e) OtherOther provisions relate mainly to expected costs of terminating financing arrangements in relation to aircraft sold in 1994and frequent flyer provisions.The deferred tax provision comprises: 2000 1999€000 €000Accelerated capital allowances 39,300 39,429Tax losses carried forward (7,177) (15,926)Provisions (7,782) (11,100)Undiscounted provision for deferred tax 24,341 12,403Discount (7,197) (5,668)Discounted provision for deferred tax 17,144 6,735Provision at beginning of year 6,735Deferred tax charge in profit and loss account for year 10,409Provision at end of year 17,14435