Precious Metals Equity Research - Merrex Gold Inc.

Precious Metals Equity Research - Merrex Gold Inc.

Precious Metals Equity Research - Merrex Gold Inc.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

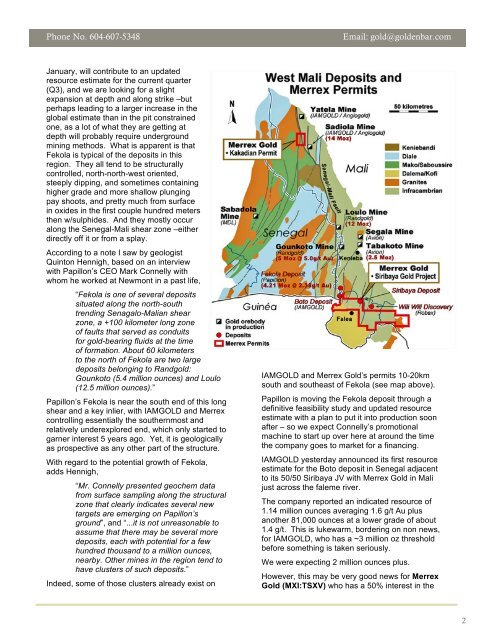

Phone No. 604-607-5348Email: gold@goldenbar.comJanuary, will contribute to an updatedresource estimate for the current quarter(Q3), and we are looking for a slightexpansion at depth and along strike –butperhaps leading to a larger increase in theglobal estimate than in the pit constrainedone, as a lot of what they are getting atdepth will probably require undergroundmining methods. What is apparent is thatFekola is typical of the deposits in thisregion. They all tend to be structurallycontrolled, north-north-west oriented,steeply dipping, and sometimes containinghigher grade and more shallow plungingpay shoots, and pretty much from surfacein oxides in the first couple hundred metersthen w/sulphides. And they mostly occuralong the Senegal-Mali shear zone –eitherdirectly off it or from a splay.According to a note I saw by geologistQuinton Hennigh, based on an interviewwith Papillon’s CEO Mark Connelly withwhom he worked at Newmont in a past life,“Fekola is one of several depositssituated along the north-southtrending Senagalo-Malian shearzone, a +100 kilometer long zoneof faults that served as conduitsfor gold-bearing fluids at the timeof formation. About 60 kilometersto the north of Fekola are two largedeposits belonging to Randgold:Gounkoto (5.4 million ounces) and Loulo(12.5 million ounces).”Papillon’s Fekola is near the south end of this longshear and a key inlier, with IAMGOLD and <strong>Merrex</strong>controlling essentially the southernmost andrelatively underexplored end, which only started togarner interest 5 years ago. Yet, it is geologicallyas prospective as any other part of the structure.With regard to the potential growth of Fekola,adds Hennigh,“Mr. Connelly presented geochem datafrom surface sampling along the structuralzone that clearly indicates several newtargets are emerging on Papillon’sground”, and “...it is not unreasonable toassume that there may be several moredeposits, each with potential for a fewhundred thousand to a million ounces,nearby. Other mines in the region tend tohave clusters of such deposits.”Indeed, some of those clusters already exist onIAMGOLD and <strong>Merrex</strong> <strong>Gold</strong>’s permits 10-20kmsouth and southeast of Fekola (see map above).Papillon is moving the Fekola deposit through adefinitive feasibility study and updated resourceestimate with a plan to put it into production soonafter – so we expect Connelly’s promotionalmachine to start up over here at around the timethe company goes to market for a financing.IAMGOLD yesterday announced its first resourceestimate for the Boto deposit in Senegal adjacentto its 50/50 Siribaya JV with <strong>Merrex</strong> <strong>Gold</strong> in Malijust across the faleme river.The company reported an indicated resource of1.14 million ounces averaging 1.6 g/t Au plusanother 81,000 ounces at a lower grade of about1.4 g/t. This is lukewarm, bordering on non news,for IAMGOLD, who has a ~3 million oz thresholdbefore something is taken seriously.We were expecting 2 million ounces plus.However, this may be very good news for <strong>Merrex</strong><strong>Gold</strong> (MXI:TSXV) who has a 50% interest in the2