2009-2010 Undergraduate Catalog.pdf - Wesley College

2009-2010 Undergraduate Catalog.pdf - Wesley College

2009-2010 Undergraduate Catalog.pdf - Wesley College

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

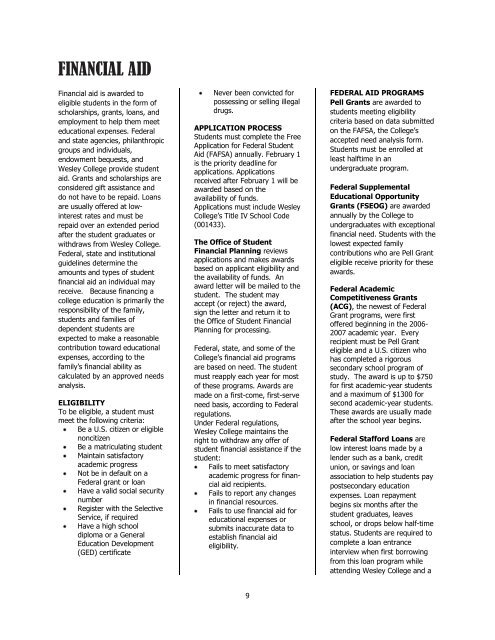

FINANCIAL AIDFINANCIAL AIDFinancial aid is awarded toeligible students in the form ofscholarships, grants, loans, andemployment to help them meeteducational expenses. Federaland state agencies, philanthropicgroups and individuals,endowment bequests, and<strong>Wesley</strong> <strong>College</strong> provide studentaid. Grants and scholarships areconsidered gift assistance anddo not have to be repaid. Loansare usually offered at lowinterestrates and must berepaid over an extended periodafter the student graduates orwithdraws from <strong>Wesley</strong> <strong>College</strong>.Federal, state and institutionalguidelines determine theamounts and types of studentfinancial aid an individual mayreceive. Because financing acollege education is primarily theresponsibility of the family,students and families ofdependent students areexpected to make a reasonablecontribution toward educationalexpenses, according to thefamily‘s financial ability ascalculated by an approved needsanalysis.ELIGIBILITYTo be eligible, a student mustmeet the following criteria:Be a U.S. citizen or eligiblenoncitizenBe a matriculating studentMaintain satisfactoryacademic progressNot be in default on aFederal grant or loanHave a valid social securitynumberRegister with the SelectiveService, if requiredHave a high schooldiploma or a GeneralEducation Development(GED) certificateNever been convicted forpossessing or selling illegaldrugs.APPLICATION PROCESSStudents must complete the FreeApplication for Federal StudentAid (FAFSA) annually. February 1is the priority deadline forapplications. Applicationsreceived after February 1 will beawarded based on theavailability of funds.Applications must include <strong>Wesley</strong><strong>College</strong>‘s Title IV School Code(001433).The Office of StudentFinancial Planning reviewsapplications and makes awardsbased on applicant eligibility andthe availability of funds. Anaward letter will be mailed to thestudent. The student mayaccept (or reject) the award,sign the letter and return it tothe Office of Student FinancialPlanning for processing.Federal, state, and some of the<strong>College</strong>‘s financial aid programsare based on need. The studentmust reapply each year for mostof these programs. Awards aremade on a first-come, first-serveneed basis, according to Federalregulations.Under Federal regulations,<strong>Wesley</strong> <strong>College</strong> maintains theright to withdraw any offer ofstudent financial assistance if thestudent:Fails to meet satisfactoryacademic progress for financialaid recipients.Fails to report any changesin financial resources.Fails to use financial aid foreducational expenses orsubmits inaccurate data toestablish financial aideligibility.FEDERAL AID PROGRAMSPell Grants are awarded tostudents meeting eligibilitycriteria based on data submittedon the FAFSA, the <strong>College</strong>‘saccepted need analysis form.Students must be enrolled atleast halftime in anundergraduate program.Federal SupplementalEducational OpportunityGrants (FSEOG) are awardedannually by the <strong>College</strong> toundergraduates with exceptionalfinancial need. Students with thelowest expected familycontributions who are Pell Granteligible receive priority for theseawards.Federal AcademicCompetitiveness Grants(ACG), the newest of FederalGrant programs, were firstoffered beginning in the 2006-2007 academic year. Everyrecipient must be Pell Granteligible and a U.S. citizen whohas completed a rigoroussecondary school program ofstudy. The award is up to $750for first academic-year studentsand a maximum of $1300 forsecond academic-year students.These awards are usually madeafter the school year begins.Federal Stafford Loans arelow interest loans made by alender such as a bank, creditunion, or savings and loanassociation to help students paypostsecondary educationexpenses. Loan repaymentbegins six months after thestudent graduates, leavesschool, or drops below half-timestatus. Students are required tocomplete a loan entranceinterview when first borrowingfrom this loan program whileattending <strong>Wesley</strong> <strong>College</strong> and a9