Gold Hawk Resources Inc. - Oracle Mining Corp

Gold Hawk Resources Inc. - Oracle Mining Corp

Gold Hawk Resources Inc. - Oracle Mining Corp

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

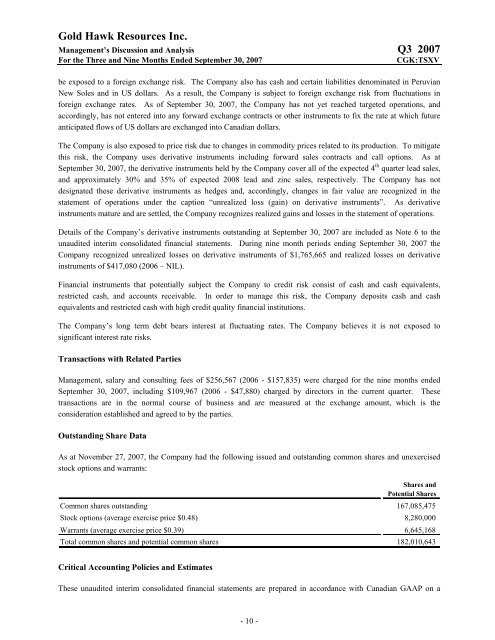

<strong>Gold</strong> <strong>Hawk</strong> <strong>Resources</strong> <strong>Inc</strong>.Management’s Discussion and Analysis Q3 2007For the Three and Nine Months Ended September 30, 2007CGK:TSXVbe exposed to a foreign exchange risk. The Company also has cash and certain liabilities denominated in PeruvianNew Soles and in US dollars. As a result, the Company is subject to foreign exchange risk from fluctuations inforeign exchange rates. As of September 30, 2007, the Company has not yet reached targeted operations, andaccordingly, has not entered into any forward exchange contracts or other instruments to fix the rate at which futureanticipated flows of US dollars are exchanged into Canadian dollars.The Company is also exposed to price risk due to changes in commodity prices related to its production. To mitigatethis risk, the Company uses derivative instruments including forward sales contracts and call options. As atSeptember 30, 2007, the derivative instruments held by the Company cover all of the expected 4 th quarter lead sales,and approximately 30% and 35% of expected 2008 lead and zinc sales, respectively. The Company has notdesignated these derivative instruments as hedges and, accordingly, changes in fair value are recognized in thestatement of operations under the caption “unrealized loss (gain) on derivative instruments”. As derivativeinstruments mature and are settled, the Company recognizes realized gains and losses in the statement of operations.Details of the Company’s derivative instruments outstanding at September 30, 2007 are included as Note 6 to theunaudited interim consolidated financial statements. During nine month periods ending September 30, 2007 theCompany recognized unrealized losses on derivative instruments of $1,765,665 and realized losses on derivativeinstruments of $417,080 (2006 – NIL).Financial instruments that potentially subject the Company to credit risk consist of cash and cash equivalents,restricted cash, and accounts receivable. In order to manage this risk, the Company deposits cash and cashequivalents and restricted cash with high credit quality financial institutions.The Company’s long term debt bears interest at fluctuating rates. The Company believes it is not exposed tosignificant interest rate risks.Transactions with Related PartiesManagement, salary and consulting fees of $256,567 (2006 - $157,835) were charged for the nine months endedSeptember 30, 2007, including $109,967 (2006 - $47,880) charged by directors in the current quarter. Thesetransactions are in the normal course of business and are measured at the exchange amount, which is theconsideration established and agreed to by the parties.Outstanding Share DataAs at November 27, 2007, the Company had the following issued and outstanding common shares and unexercisedstock options and warrants:Shares andPotential SharesCommon shares outstanding 167,085,475Stock options (average exercise price $0.48) 8,280,000Warrants (average exercise price $0.39) 6,645,168Total common shares and potential common shares 182,010,643Critical Accounting Policies and EstimatesThese unaudited interim consolidated financial statements are prepared in accordance with Canadian GAAP on a- 10 -