ANNUAL REPORT 2010/11 - Schumag AG

ANNUAL REPORT 2010/11 - Schumag AG

ANNUAL REPORT 2010/11 - Schumag AG

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

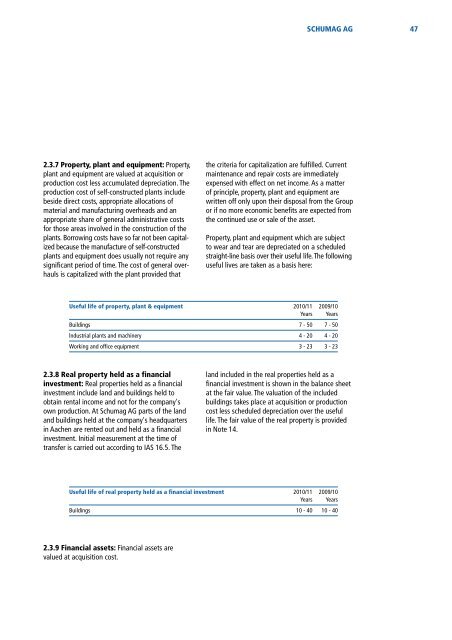

SCHUM<strong>AG</strong> <strong>AG</strong> 472.3.7 Property, plant and equipment: Property,plant and equipment are valued at acquisition orproduction cost less accumulated depreciation. Theproduction cost of self-constructed plants includebeside direct costs, appropriate allocations ofmaterial and manufacturing overheads and anappropriate share of general administrative costsfor those areas involved in the construction of theplants. Borrowing costs have so far not been capitalizedbecause the manufacture of self-constructedplants and equipment does usually not require anysignificant period of time. The cost of general overhaulsis capitalized with the plant provided thatthe criteria for capitalization are fulfilled. Currentmaintenance and repair costs are immediatelyexpensed with effect on net income. As a matterof principle, property, plant and equipment arewritten off only upon their disposal from the Groupor if no more economic benefits are expected fromthe continued use or sale of the asset.Property, plant and equipment which are subjectto wear and tear are depreciated on a scheduledstraight-line basis over their useful life. The followinguseful lives are taken as a basis here:Useful life of property, plant & equipment <strong>2010</strong>/<strong>11</strong> 2009/10Years YearsBuildings 7 - 50 7 - 50lndustrial plants and machinery 4 - 20 4 - 20Working and office equipment 3 - 23 3 - 232.3.8 Real property held as a financialinvestment: Real properties held as a financialinvestment include land and buildings held toobtain rental income and not for the company'sown production. At <strong>Schumag</strong> <strong>AG</strong> parts of the landand buildings held at the company's headquartersin Aachen are rented out and held as a financialinvestment. Initial measurement at the time oftransfer is carried out according to IAS 16.5. Theland included in the real properties held as afinancial investment is shown in the balance sheetat the fair value. The valuation of the includedbuildings takes place at acquisition or productioncost less scheduled depreciation over the usefullife. The fair value of the real property is providedin Note 14.Useful life of real property held as a financial investment <strong>2010</strong>/<strong>11</strong> 2009/10Years YearsBuildings 10 - 40 10 - 402.3.9 Financial assets: Financial assets arevalued at acquisition cost.