MML NEWS | July 2011SNIPPETA KING OR A QUEEN –THE LAW OF SUCCESSIONFollowing the recent marriage of Prince William and KateMiddleton, the expectation of children in the future raisesthe question of succession for the future King or Queen ofNew Zealand.Succession to the British Throne is passed on by“male-preference primogeniture”. The rule has been in placefor over 300 years and means male children are preferred overfemale children and an older child is preferred over a youngerchild of the same gender.The British Government is currently consulting withCommonwealth countries about changing the laws on RoyalSuccession to enable an older sister to succeed over ayounger brother.Recently our own Prime Minister, Hon. John Key, has said heagrees that the current rules, which could block the successionof a fi rst born daughter of Prince William and Kate Middleton,are “old fashioned”. However, because the British Monarchis also head of state of Canada,Australia, nine countries in theCaribbean, three in theSouth Pacifi c as wellas New Zealand, itwould have to beapproved by allthese countries.EMPLOYMENT LAW UPDATEIn the case of Costley v Waimea Nurseries Limited [2011]NZERA Christchurch, the Employment Relations Authority(‘ERA’) found that Mr Costley was unjustifi ably dismissed forusing drugs at work because Waimea did not disclose to MrCostley information that was relevant in reaching their decisionto dismiss him.It was reported to Waimea’s nursery manager, Mr Jameson,that Mr Costley and another employee (Api) may be consumingdrugs during their lunch breaks. Mr Jameson met with eachemployee separately and told them of his suspicions. Apiconfessed that he and Mr Costley were smoking marijuana atlunch time. Mr Costley was not told about Api’s admission orthe identity of the person who raised concerns about theirsuspected drug use.The ERA found that by not disclosing Api’s admission to MrCostley, Waimea had withheld the piece of information thatwas most relevant to the decision to dismiss, and that this was abreach of s4(1A)(c) of the Employment Relations Act 2000.This decision serves as a timely reminder that employers mustfollow a fair procedure when disciplining or dismissing employeesincluding providing the employee with any relevant informationthat may be relied on by the employer in reaching their decision.Sleeping on the JobIn Idea Services (an IHC subsidiary) v Phillip DicksonCA 405/2010, the Court of Appeal affirmed the decisionof the Employment Court that Mr Dickson was workingthroughout his sleepover and was therefore entitled tothe minimum wage for the period of his sleepover.Mr Dickson worked for Idea Services Limited as a communityservice worker providing care and support to people with disabilitieswho live in community homes. A requirement of his position wasthat Mr Dickson sleep overnight in the home so that he could dealwith any issues that arose during the night and for security purposes.He was paid $34.00 per sleepover, and $17.66 per hour for any timeduring which he was required to be actively working and tending tothe needs of the residents. If there were no incidents during the nightMr Dickson would receive $34.00, which amounted to between$3.40 and $4.30 per hour depending on the length of the sleepover.Mr Dickson claimed that he was entitled to the minimum wageprescribed under the Minimum Wage Act 1983 (the ‘Act’) forevery hour of his sleepover. This claim was upheld at both theEmployment Relations Authority and the Employment Court.The Court of Appeal was required to consider whether sleepoversconstitute “work” for the purposes of section six of the Act whichstates: “every worker who belongs to a class of workers in respect ofwhom a minimum rate of wages has been prescribed under this Act,shall be entitled to receive from his employer payment for his workat not less than that minimum rate.”The Court of Appeal agreed with the Employment Court thatthree factors must be considered in order to determine whether thesleepover constituted “work”:• the constraints placed on the employee’s freedom to do as he orshe pleases,• the nature and extent of responsibilities placed on the employee, and• that benefit the employer receives from having the employeeperform the role.Mr Dickson had significant restraints placed on him when sleepingover, important responsibilities that he had to attend to withrespect to both the home and the residents, and the employerderived a correspondingly significant benefit. The Court of Appealtherefore agreed that in this instance all of these factors applied to asignificant degree and therefore Mr Dickson’s sleepovers constitutedwork for the purposes of the Act.The Court of Appeal rejected Idea Services Limited’s alternativeargument that the Act was breached only if the employee’s averagerate of pay over a pay period was less than the prescribed minimum.This decision will have a great impact on the disability servicessector. Ralph Jones, chief executive of Idea Services Limited isquoted as saying this decision would cost the organisation about$176 million in back payments. Idea Services Limited have lodgedan application for an appeal against the Court of Appeal decision,and the outcome is likely to be newsworthy.MORTLOCK-MCCORMACK LAWare proud to be a sponsor of, and associated with:The Radio NetworkSpecial Children’s Christmas Party 201<strong>12</strong>

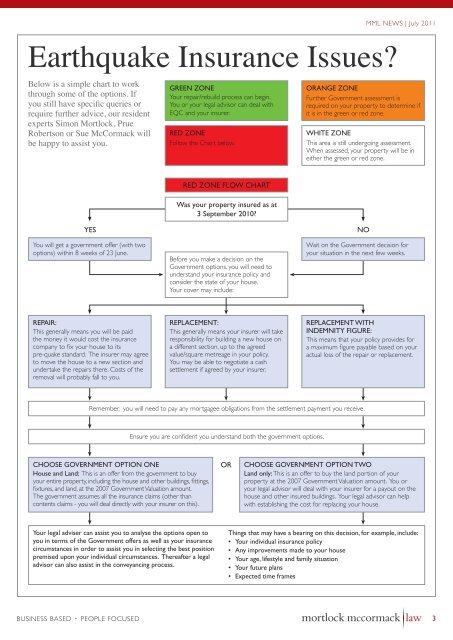

MML NEWS | July 2011Earthquake Insurance <strong>Issue</strong>s?Below is a simple chart to workthrough some of the options. Ifyou still have specific queries orrequire further advice, our residentexperts Simon <strong>Mortlock</strong>, PrueRobertson or Sue <strong>McCormack</strong> willbe happy to assist you.GREEN ZONEYour repair/rebuild process can begin.You or your legal advisor can deal withEQC and your insurer.RED ZONEFollow the Chart below.ORANGE ZONEFurther Government assessment isrequired on your property to determine ifit is in the green or red zone.WHITE ZONEThis area is still undergoing assessment.When assessed, your property will be ineither the green or red zone.YESYou will get a government offer (with twooptions) within 8 weeks of 23 June.RED ZONE FLOW CHARTWas your property insured as at3 September 2010?Before you make a decision on theGovernment options, you will need tounderstand your insurance policy andconsider the state of your house.Your cover may include:NOWait on the Government decision foryour situation in the next few weeks.REPAIR:This generally means you will be paidthe money it would cost the insurancecompany to fi x your house to itspre-quake standard. The insurer may agreeto move the house to a new section andundertake the repairs there. Costs of theremoval will probably fall to you.REPLACEMENT:This generally means your insurer will takeresponsibility for building a new house ona different section, up to the agreedvalue/square metreage in your policy.You may be able to negotiate a cashsettlement if agreed by your insurer.REPLACEMENT WITHINDEMNITY FIGURE:This means that your policy provides fora maximum fi gure payable based on youractual loss of the repair or replacement.Remember, you will need to pay any mortgagee obligations from the settlement payment you receive.Ensure you are confi dent you understand both the government options.CHOOSE GOVERNMENT OPTION ONEHouse and Land: This is an offer from the government to buyyour entire property, including the house and other buildings, fi ttings,fi xtures, and land, at the 2007 Government Valuation amount.The government assumes all the insurance claims (other thancontents claims - you will deal directly with your insurer on this).ORCHOOSE GOVERNMENT OPTION TWOLand only: This is an offer to buy the land portion of yourproperty at the 2007 Government Valuation amount. You oryour legal advisor will deal with your insurer for a payout on thehouse and other insured buildings. Your legal advisor can helpwith establishing the cost for replacing your house.Your legal adviser can assist you to analyse the options open toyou in terms of the Government offers as well as your insurancecircumstances in order to assist you in selecting the best positionpremised upon your individual circumstances. Thereafter a legaladvisor can also assist in the conveyancing process.Things that may have a bearing on this decision, for example, include:• Your individual insurance policy• Any improvements made to your house• Your age, lifestyle and family situation• Your future plans• Expected time frames3