Notes to the Financial Statements - SingTel

Notes to the Financial Statements - SingTel

Notes to the Financial Statements - SingTel

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

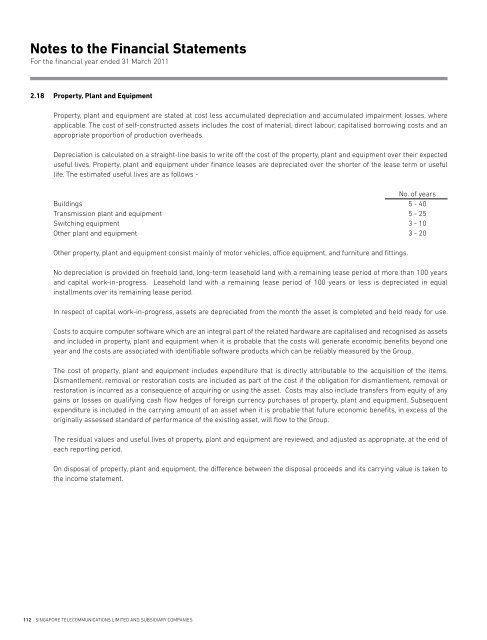

<strong>Notes</strong> <strong>to</strong> <strong>the</strong> <strong>Financial</strong> <strong>Statements</strong>For <strong>the</strong> financial year ended 31 March 20112.18 Property, Plant and EquipmentProperty, plant and equipment are stated at cost less accumulated depreciation and accumulated impairment losses, whereapplicable. The cost of self-constructed assets includes <strong>the</strong> cost of material, direct labour, capitalised borrowing costs and anappropriate proportion of production overheads.Depreciation is calculated on a straight-line basis <strong>to</strong> write off <strong>the</strong> cost of <strong>the</strong> property, plant and equipment over <strong>the</strong>ir expecteduseful lives. Property, plant and equipment under finance leases are depreciated over <strong>the</strong> shorter of <strong>the</strong> lease term or usefullife. The estimated useful lives are as follows -No. of yearsBuildings 5 - 40Transmission plant and equipment 5 - 25Switching equipment 3 - 10O<strong>the</strong>r plant and equipment 3 - 20O<strong>the</strong>r property, plant and equipment consist mainly of mo<strong>to</strong>r vehicles, office equipment, and furniture and fittings.No depreciation is provided on freehold land, long-term leasehold land with a remaining lease period of more than 100 yearsand capital work-in-progress. Leasehold land with a remaining lease period of 100 years or less is depreciated in equalinstallments over its remaining lease period.In respect of capital work-in-progress, assets are depreciated from <strong>the</strong> month <strong>the</strong> asset is completed and held ready for use.Costs <strong>to</strong> acquire computer software which are an integral part of <strong>the</strong> related hardware are capitalised and recognised as assetsand included in property, plant and equipment when it is probable that <strong>the</strong> costs will generate economic benefits beyond oneyear and <strong>the</strong> costs are associated with identifiable software products which can be reliably measured by <strong>the</strong> Group.The cost of property, plant and equipment includes expenditure that is directly attributable <strong>to</strong> <strong>the</strong> acquisition of <strong>the</strong> items.Dismantlement, removal or res<strong>to</strong>ration costs are included as part of <strong>the</strong> cost if <strong>the</strong> obligation for dismantlement, removal orres<strong>to</strong>ration is incurred as a consequence of acquiring or using <strong>the</strong> asset. Costs may also include transfers from equity of anygains or losses on qualifying cash flow hedges of foreign currency purchases of property, plant and equipment. Subsequentexpenditure is included in <strong>the</strong> carrying amount of an asset when it is probable that future economic benefits, in excess of <strong>the</strong>originally assessed standard of performance of <strong>the</strong> existing asset, will flow <strong>to</strong> <strong>the</strong> Group.The residual values and useful lives of property, plant and equipment are reviewed, and adjusted as appropriate, at <strong>the</strong> end ofeach reporting period.On disposal of property, plant and equipment, <strong>the</strong> difference between <strong>the</strong> disposal proceeds and its carrying value is taken <strong>to</strong><strong>the</strong> income statement.112 SINGAPORE TELECOMMUNICATIONS LIMITED AND SUBSIDIARY COMPANIES