ELMEC SPORT BULGARIA EOOD

ELMEC SPORT BULGARIA EOOD

ELMEC SPORT BULGARIA EOOD

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

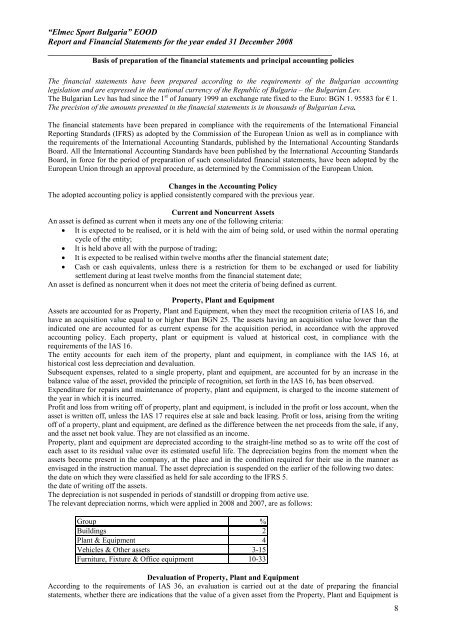

“Elmec Sport Bulgaria” ЕООDReport and Financial Statements for the year ended 31 December 2008____________________________________________________________________Basis of preparation of the financial statements and principal accounting policiesThe financial statements have been prepared according to the requirements of the Bulgarian accountinglegislation and are expressed in the national currency of the Republic of Bulgaria – the Bulgarian Lev.The Bulgarian Lev has had since the 1 st of January 1999 an exchange rate fixed to the Euro: BGN 1. 95583 for € 1.The precision of the amounts presented in the financial statements is in thousands of Bulgarian Leva.The financial statements have been prepared in compliance with the requirements of the International FinancialReporting Standards (IFRS) as adopted by the Commission of the European Union as well as in compliance withthe requirements of the International Accounting Standards, published by the International Accounting StandardsBoard. All the International Accounting Standards have been published by the International Accounting StandardsBoard, in force for the period of preparation of such consolidated financial statements, have been adopted by theEuropean Union through an approval procedure, as determined by the Commission of the European Union.Changes in the Accounting PolicyThe adopted accounting policy is applied consistently compared with the previous year.Current and Noncurrent AssetsAn asset is defined as current when it meets any one of the following criteria:• It is expected to be realised, or it is held with the aim of being sold, or used within the normal operatingcycle of the entity;• It is held above all with the purpose of trading;• It is expected to be realised within twelve months after the financial statement date;• Cash or cash equivalents, unless there is a restriction for them to be exchanged or used for liabilitysettlement during at least twelve months from the financial statement date;An asset is defined as noncurrent when it does not meet the criteria of being defined as current.Property, Plant and EquipmentAssets are accounted for as Property, Plant and Equipment, when they meet the recognition criteria of IAS 16, andhave an acquisition value equal to or higher than BGN 25. The assets having an acquisition value lower than theindicated one are accounted for as current expense for the acquisition period, in accordance with the approvedaccounting policy. Each property, plant or equipment is valued at historical cost, in compliance with therequirements of the IAS 16.The entity accounts for each item of the property, plant and equipment, in compliance with the IAS 16, athistorical cost less depreciation and devaluation.Subsequent expenses, related to a single property, plant and equipment, are accounted for by an increase in thebalance value of the asset, provided the principle of recognition, set forth in the IAS 16, has been observed.Expenditure for repairs and maintenance of property, plant and equipment, is charged to the income statement ofthe year in which it is incurred.Profit and loss from writing off of property, plant and equipment, is included in the profit or loss account, when theasset is written off, unless the IAS 17 requires else at sale and back leasing. Profit or loss, arising from the writingoff of a property, plant and equipment, are defined as the difference between the net proceeds from the sale, if any,and the asset net book value. They are not classified as an income.Property, plant and equipment are depreciated according to the straight-line method so as to write off the cost ofeach asset to its residual value over its estimated useful life. The depreciation begins from the moment when theassets become present in the company, at the place and in the condition required for their use in the manner asenvisaged in the instruction manual. The asset depreciation is suspended on the earlier of the following two dates:the date on which they were classified as held for sale according to the IFRS 5.the date of writing off the assets.The depreciation is not suspended in periods of standstill or dropping from active use.The relevant depreciation norms, which were applied in 2008 and 2007, are as follows:Group %Buildings 2Plant & Equipment 4Vehicles & Other assets 3-15Furniture, Fixture & Office equipment 10-33Devaluation of Property, Plant and EquipmentAccording to the requirements of IAS 36, an evaluation is carried out at the date of preparing the financialstatements, whether there are indications that the value of a given asset from the Property, Plant and Equipment is8