RiverSource® RAVA 5 Select variable annuity

RiverSource® RAVA 5 Select variable annuity

RiverSource® RAVA 5 Select variable annuity

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

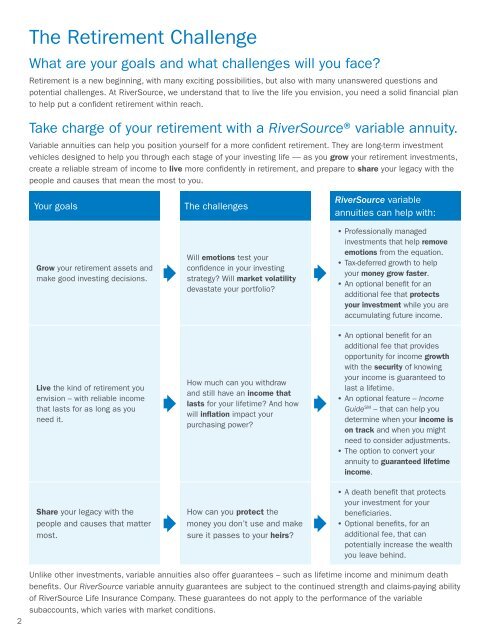

The Retirement ChallengeWhat are your goals and what challenges will you face?Retirement is a new beginning, with many exciting possibilities, but also with many unanswered questions andpotential challenges. At RiverSource, we understand that to live the life you envision, you need a solid financial planto help put a confident retirement within reach.Take charge of your retirement with a RiverSource® <strong>variable</strong> <strong>annuity</strong>.Variable annuities can help you position yourself for a more confident retirement. They are long-term investmentvehicles designed to help you through each stage of your investing life — as you grow your retirement investments,create a reliable stream of income to live more confidently in retirement, and prepare to share your legacy with thepeople and causes that mean the most to you.Your goalsGrow your retirement assets andmake good investing decisions.Live the kind of retirement youenvision – with reliable incomethat lasts for as long as youneed it.Share your legacy with thepeople and causes that mattermost.The challengesWill emotions test yourconfidence in your investingstrategy? Will market volatilitydevastate your portfolio?How much can you withdrawand still have an income thatlasts for your lifetime? And howwill inflation impact yourpurchasing power?How can you protect themoney you don’t use and makesure it passes to your heirs?RiverSource <strong>variable</strong>annuities can help with:• Professionally managedinvestments that help removeemotions from the equation.• Tax-deferred growth to helpyour money grow faster.• An optional benefit for anadditional fee that protectsyour investment while you areaccumulating future income.• An optional benefit for anadditional fee that providesopportunity for income growthwith the security of knowingyour income is guaranteed tolast a lifetime.• An optional feature – IncomeGuide SM – that can help youdetermine when your income ison track and when you mightneed to consider adjustments.• The option to convert your<strong>annuity</strong> to guaranteed lifetimeincome.• A death benefit that protectsyour investment for yourbeneficiaries.• Optional benefits, for anadditional fee, that canpotentially increase the wealthyou leave behind.2Unlike other investments, <strong>variable</strong> annuities also offer guarantees – such as lifetime income and minimum deathbenefits. Our RiverSource <strong>variable</strong> <strong>annuity</strong> guarantees are subject to the continued strength and claims-paying abilityof RiverSource Life Insurance Company. These guarantees do not apply to the performance of the <strong>variable</strong>subaccounts, which varies with market conditions.