Annual report 2009 - Crédit Agricole CIB

Annual report 2009 - Crédit Agricole CIB

Annual report 2009 - Crédit Agricole CIB

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

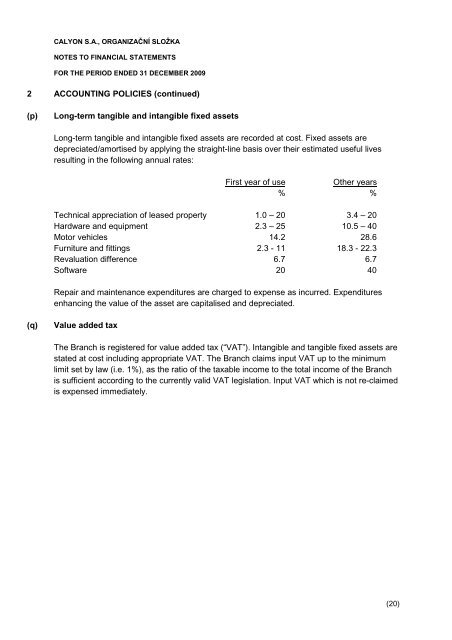

CALYON S.A., ORGANIZAČNÍ SLOŽKANOTES TO FINANCIAL STATEMENTSFOR THE PERIOD ENDED 31 DECEMBER <strong>2009</strong>2 ACCOUNTING POLICIES (continued)(p)Long-term tangible and intangible fixed assetsLong-term tangible and intangible fixed assets are recorded at cost. Fixed assets aredepreciated/amortised by applying the straight-line basis over their estimated useful livesresulting in the following annual rates:First year of useOther years% %Technical appreciation of leased property 1.0 – 20 3.4 – 20Hardware and equipment 2.3 – 25 10.5 – 40Motor vehicles 14.2 28.6Furniture and fittings 2.3 - 11 18.3 - 22.3Revaluation difference 6.7 6.7Software 20 40Repair and maintenance expenditures are charged to expense as incurred. Expendituresenhancing the value of the asset are capitalised and depreciated.(q)Value added taxThe Branch is registered for value added tax (“VAT”). Intangible and tangible fixed assets arestated at cost including appropriate VAT. The Branch claims input VAT up to the minimumlimit set by law (i.e. 1%), as the ratio of the taxable income to the total income of the Branchis sufficient according to the currently valid VAT legislation. Input VAT which is not re-claimedis expensed immediately.(20)