application for long-term loan or guarantee - Export-Import Bank of ...

application for long-term loan or guarantee - Export-Import Bank of ...

application for long-term loan or guarantee - Export-Import Bank of ...

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

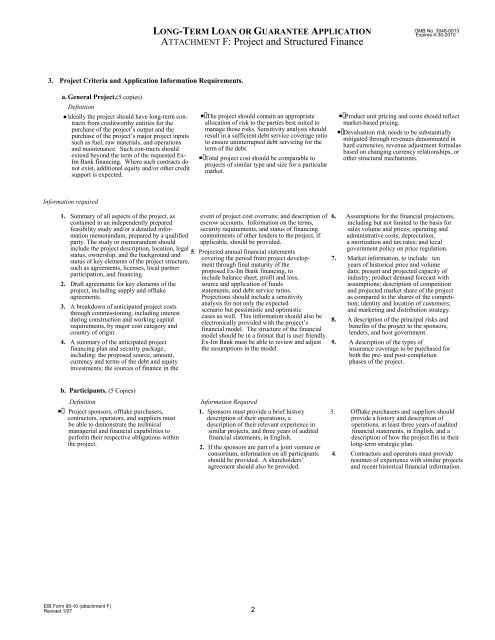

OMB No. 3048-0013LONG-TERM LOAN OR GUARANTEE APPLICATIONExpires 4-30-2010ATTACHMENT F: Project and Structured Finance3. Project Criteria and Application In<strong>f<strong>or</strong></strong>mation Requirements.a. General Project.(5 copies)DefinitionP Ideally the project should have <strong>long</strong>-<strong>term</strong> contractsfrom creditw<strong>or</strong>thy entities <strong>f<strong>or</strong></strong> thepurchase <strong>of</strong> the project’s output and thepurchase <strong>of</strong> the project’s maj<strong>or</strong> project inputssuch as fuel, raw materials, and operationsand maintenance. Such con-tracts shouldextend beyond the <strong>term</strong> <strong>of</strong> the requested Ex-Im <strong>Bank</strong> financing. Where such contracts donot exist, additional equity and/<strong>or</strong> other creditsupp<strong>or</strong>t is expected.P The project should contain an appropriate allocation <strong>of</strong> risk to the parties best suited tomanage those risks. Sensitivity analysis should result in a sufficient debt service coverage ratioto ensure uninterrupted debt servicing <strong>f<strong>or</strong></strong> the <strong>term</strong> <strong>of</strong> the debt. P Total project cost should be comparable toprojects <strong>of</strong> similar type and size <strong>f<strong>or</strong></strong> a particularmarket.P Product unit pricing and costs should reflectmarket-based pricing.P Devaluation risk needs to be substantiallymitigated through revenues denominated inhard currencies, revenue adjustment <strong>f<strong>or</strong></strong>mulasbased on changing currency relationships, <strong>or</strong>other structural mechanisms.In<strong>f<strong>or</strong></strong>mation required1. Summary <strong>of</strong> all aspects <strong>of</strong> the project, ascontained in an independently preparedfeasibility study and/<strong>or</strong> a detailed in<strong>f<strong>or</strong></strong>mationmem<strong>or</strong>andum, prepared by a qualifiedparty. The study <strong>or</strong> mem<strong>or</strong>andum shouldinclude the project description, location, legal 5.status, ownership, and the background andstatus <strong>of</strong> key elements <strong>of</strong> the project structure,such as agreements, licenses, local partnerparticipation, and financing.2. Draft agreements <strong>f<strong>or</strong></strong> key elements <strong>of</strong> theproject, including supply and <strong>of</strong>ftakeagreements.3. A breakdown <strong>of</strong> anticipated project coststhrough commissioning, including interestduring construction and w<strong>or</strong>king capitalrequirements, by maj<strong>or</strong> cost categ<strong>or</strong>y andcountry <strong>of</strong> <strong>or</strong>igin.4. A summary <strong>of</strong> the anticipated projectfinancing plan and security package,including: the proposed source, amount,currency and <strong>term</strong>s <strong>of</strong> the debt and equityinvestments; the sources <strong>of</strong> finance in theevent <strong>of</strong> project cost overruns; and description <strong>of</strong> 6. escrow accounts. In<strong>f<strong>or</strong></strong>mation on the <strong>term</strong>s, security requirements, and status <strong>of</strong> financing commitments <strong>of</strong> other lenders to the project, if applicable, should be provided. Projected annual financial statements covering the period from project develop- 7. ment through final maturity <strong>of</strong> the proposed Ex-Im <strong>Bank</strong> financing, to include balance sheet, pr<strong>of</strong>it and loss, source and <strong>application</strong> <strong>of</strong> funds statements, and debt service ratios. Projections should include a sensitivityanalysis <strong>f<strong>or</strong></strong> not only the expected scenario but pessimistic and optimistic cases as well. This in<strong>f<strong>or</strong></strong>mation should also beelectronically provided with the project’s 8.financial model. The structure <strong>of</strong> the financial model should be in a <strong>f<strong>or</strong></strong>mat that is user friendly. Ex-Im <strong>Bank</strong> must be able to review and adjust 9. the assumptions in the model. Assumptions <strong>f<strong>or</strong></strong> the financial projections,including but not limited to the basis <strong>f<strong>or</strong></strong>sales volume and prices; operating andadministrative costs; depreciation,a m<strong>or</strong>tization and tax rates; and localgovernment policy on price regulation.Market in<strong>f<strong>or</strong></strong>mation, to include: tenyears <strong>of</strong> hist<strong>or</strong>ical price and volumedata; present and projected capacity <strong>of</strong>industry; product demand <strong>f<strong>or</strong></strong>ecast withassumptions; description <strong>of</strong> competitionand projected market share <strong>of</strong> the projectas compared to the shares <strong>of</strong> the competition;identity and location <strong>of</strong> customers;and marketing and distribution strategy.A description <strong>of</strong> the principal risks andbenefits <strong>of</strong> the project to the spons<strong>or</strong>s,lenders, and host government.A description <strong>of</strong> the types <strong>of</strong>insurance coverage to be purchased <strong>f<strong>or</strong></strong>both the pre- and post-completionphases <strong>of</strong> the project.b. Participants. (5 Copies)DefinitionP Project spons<strong>or</strong>s, <strong>of</strong>ftake purchasers,contract<strong>or</strong>s, operat<strong>or</strong>s, and suppliers mustbe able to demonstrate the technicalmanagerial and financial capabilities toper<strong>f<strong>or</strong></strong>m their respective obligations withinthe project.In<strong>f<strong>or</strong></strong>mation Required1. Spons<strong>or</strong>s must provide a brief hist<strong>or</strong>y 3.description <strong>of</strong> their operations, adescription <strong>of</strong> their relevant experience insimilar projects, and three years <strong>of</strong> auditedfinancial statements, in English.2. If the spons<strong>or</strong>s are part <strong>of</strong> a joint venture <strong>or</strong>cons<strong>or</strong>tium, in<strong>f<strong>or</strong></strong>mation on all participants 4.should be provided. A shareholders’agreement should also be provided.Offtake purchasers and suppliers shouldprovide a hist<strong>or</strong>y and description <strong>of</strong>operations, at least three years <strong>of</strong> auditedfinancial statements, in English, and adescription <strong>of</strong> how the project fits in their<strong>long</strong>-<strong>term</strong> strategic plan.Contract<strong>or</strong>s and operat<strong>or</strong>s must provideresumes <strong>of</strong> experience with similar projectsand recent hist<strong>or</strong>ical financial in<strong>f<strong>or</strong></strong>mation.EIB F<strong>or</strong>m 95-10 (attachment F)Revised 1/072