Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

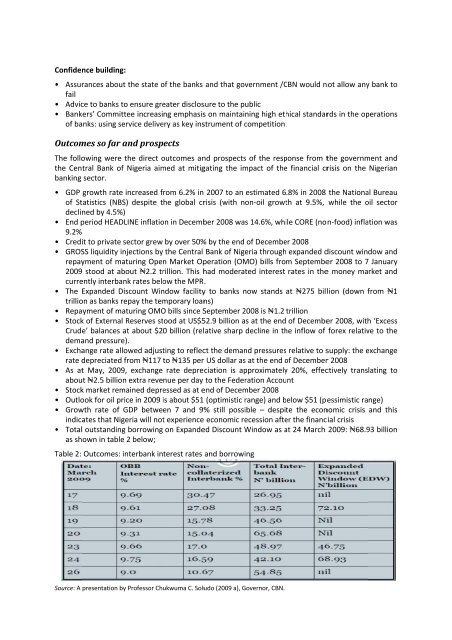

Confidence building:• Assurances about the state of the banks and that government /CBN would not allow anybank tofail• Advice to banks to ensure greater disclosure to the public• Bankers’ Committee increasing emphasiss on maintaining high ethical standards in the operationsof banks: using service delivery as key instrument of competition.Outcomes so far and prospectsThe following were the direct outcomes and prospectss of the response from the government andthe Central Bank ofNigeria aimed at mitigating the impact of thee financial crisis on the Nigerianbanking sector.• GDP growth rateincreased from 6.2% in 2007 to an estimated 6.8% in 2008 the National Bureauof Statistics (NBS) despite the global crisis (with non‐oil growth at 9.5%, while the oil sectordeclined by 4.5% %)• End period HEADLINE inflation in December 2008 was 14.6%, while CORE (non‐food) inflation was9.2%• Credit to private sector grew by over 50% % by the end of December 2008• GROSS liquidity injections by the Central Bank of Nigeria through expanded discount window andrepayment of maturing OpenMarket Operation (OMO) bills from September 2008 to 7 January2009stood at about ₦2.2 trillion. This had moderated interest rates in thee money market andcurrently interbank rates below the MPR.• The Expanded Discount Window facilityy to banks now stands at ₦275 billion (down from ₦1trillion as banks repay the temporary loans)• Repayment of maturing OMOO bills since September 2008 is ₦1.2 trillion• Stockof External Reserves stood at US$52.9 billion as at the end of December 2008, with ‘ExcessCrude’ balances at about $20billion (relative sharp decline in the inflow of forex relative to thedemand pressure).• Exchange rate allowed adjusting to reflect the demand pressuress relative to supply: the exchangerate depreciated from ₦117 to t ₦135 per r US dollar asat the end of o Decemberr 2008• As atMay, 2009, exchange rate depreciation is approximatelyy 20%, effectively translating toabout ₦2.5 billion extra revenue per day to the Federation Account• Stockmarket remained depressed as at end of December 2008• Outlook for oil price in 2009 is i about $51 (optimistic range) and below b $51 (pessimistic range)• Growth rate of GDP between 7 and 9% % still possible – despite the economic crisis and thisindicates that Nigeria will nott experience economic recession after the financial crisis• Totaloutstandingborrowing on Expanded Discount Window as at a 24 March 2009: ₦68.93 billionas shown in table2 below;Table 2: Outcomes: interbank interest rates and borrowingSource: A presentation by Professor Chukwuma C. Soludo (2009 a), Governor, CBN.