Notes to the <strong>Financial</strong> Statements30 June 20<strong>06</strong> (Continued)NOTE 32. RELATED PARTIES AND RELATED PARTY TRANSACTIONSDirectorsThe Directors who held office during the financial year and up to the date of this report are noted in the Directors’ <strong>Report</strong>.Directors have been appointed by:• Hastings Funds Management Ltd – Mr Alistair Barker, Mr Alexander Wheeler (resigned 16 September <strong>2005</strong>), Mr Michael Fitzpatrick(resigned 31 August <strong>2005</strong>), Mr Peter Taylor (resigned 16 August 20<strong>06</strong>).• Utilities of Australia Pty Ltd – Dr Allan Griffin, Mr Ronald Doubikin, Mr Alan Good, Mr Richard Hoskins.• BAA Australia Pty Ltd – Mr Dominic Helmsley, Mr Stuart Condie.• Colonial First State Private Capital and National Nominees Ltd – Mr Duncan Taylor (resigned 12 January 20<strong>06</strong>).• Colonial First State Private Capital – Mr Stephen Vineburg, Mr Alan Dundas, Mr Philip Williams (ceased 1 July 20<strong>06</strong>).• Westscheme Pty Ltd – Mr Lyndon Rowe, Mr Toby Buscombe, Mr Graham Mathews (resigned 26 July 20<strong>06</strong>).Directors Remuneration SchemeIn 2004/05 the WAC Board approved the implementation of a Directors Remuneration Scheme (DRS), which provides for payment of Directors feesof $1 million p.a. to Directors appointed by shareholders in proportion to the respective shareholding of each shareholder in the parent entity (ADG).Where shareholders have elected, their representative Director receives the proportionate Director’s fee. If shareholders elect for theirrepresentative Director not to receive any remuneration, the shareholder receives the proportionate Director fee as consideration for theprocurement of the representative Director. At 30 June 20<strong>06</strong> accounts payable included $112,500 (<strong>2005</strong>: $961,042) of fees payable to theshareholders as per the election made by the individual shareholders. Information on remuneration of Directors and key managementpersonnel is disclosed in note 5.Subordinated Shareholder LoansThe purchase of the <strong>Perth</strong> <strong>Airport</strong> lease was partly funded by way of shareholder sponsored subordinated debt. Interest is payable on the debtat the National Australia Bank’s Indicator Lending Rate (or equivalent indicative rate) for 1 year commercial bills exceeding $1,000,000 as atthe first day of the financial year plus a 4% margin. $22,500,000 of the principal was repaid during the financial year. At 30 June 20<strong>06</strong>,accounts payable included $3,8<strong>06</strong>,136 (<strong>2005</strong>: $4,551,241) of accrued interest on subordinated debt. A total of $18,559,619 (<strong>2005</strong>:$20,599,276) interest was charged during the year.Where at the end of any period, interest on the debt is not paid by WAC because such a payment would be in breach of the bank financeagreement provisions then:• interest for that period will be capitalised; and• shall be paid in full on the repayment date of the loan.PERTH AIRPORT I PAGEOther Related PartiesA technical service agreement exists between WAC and Port of Portland Holdings Pty Ltd (POPH, previously known as Infratil Australia Pty Ltd(IAPL), an entity jointly owned by the Australian Infrastructure Fund and the Utilities Trust of Australia), which engages POPH for the purposeof providing technical advice about management, operations and maintenance of the airport. The contract was based on normal commercialterms and conditions. A total of $1,366,985 (<strong>2005</strong>: $1,165,167) was paid to POPH during the financial year. At 30 June 20<strong>06</strong>, accountspayable included $301,903 (<strong>2005</strong>: $366,997) of accrued technical service fees.A consulting agreement exists between WAC and BAA International Limited (BAA), under which BAA provides advice and assistance inconnection with the planning, operation, management and development of the airport businesses carried on at <strong>Perth</strong> <strong>Airport</strong>. The contract isbased upon normal commercial terms and conditions. A total of $1,785,143 (2004: $2,072,480) was paid to BAA during the financial year.At 30 June 20<strong>06</strong>, accounts payable included $4,658,407 (2004: $323,467) of accrued consulting and bonus fees and reimbursable expenses.Westscheme Pty Ltd is the fund manager of the Westscheme superannuation fund. Westscheme is the default superannuation fund foremployees of Westralia <strong>Airport</strong>s Corporation.Colonial First State Private Capital Ltd (CFI) and the Officers Superannuation Fund’s interests in ADG are managed under an InvestmentMandate Agreement by Colonial First State Investments Limited (CFSIL). CFSIL is wholly owned by Commonwealth Bank Ltd (CBA). CBAprovides financial services and debt facilities to the entity on normal commercial terms and conditions.48

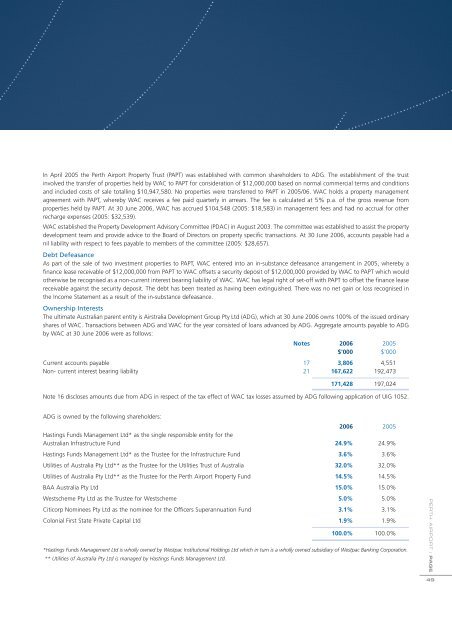

In April <strong>2005</strong> the <strong>Perth</strong> <strong>Airport</strong> Property Trust (PAPT) was established with common shareholders to ADG. The establishment of the trustinvolved the transfer of properties held by WAC to PAPT for consideration of $12,000,000 based on normal commercial terms and conditionsand included costs of sale totalling $10,947,580. No properties were transferred to PAPT in <strong>2005</strong>/<strong>06</strong>. WAC holds a property managementagreement with PAPT, whereby WAC receives a fee paid quarterly in arrears. The fee is calculated at 5% p.a. of the gross revenue fromproperties held by PAPT. At 30 June 20<strong>06</strong>, WAC has accrued $104,548 (<strong>2005</strong>: $18,583) in management fees and had no accrual for otherrecharge expenses (<strong>2005</strong>: $32,539).WAC established the Property Development Advisory Committee (PDAC) in August 2003. The committee was established to assist the propertydevelopment team and provide advice to the Board of Directors on property specific transactions. At 30 June 20<strong>06</strong>, accounts payable had anil liability with respect to fees payable to members of the committee (<strong>2005</strong>: $28,657).Debt DefeasanceAs part of the sale of two investment properties to PAPT, WAC entered into an in-substance defeasance arrangement in <strong>2005</strong>, whereby afinance lease receivable of $12,000,000 from PAPT to WAC offsets a security deposit of $12,000,000 provided by WAC to PAPT which wouldotherwise be recognised as a non-current interest bearing liability of WAC. WAC has legal right of set-off with PAPT to offset the finance leasereceivable against the security deposit. The debt has been treated as having been extinguished. There was no net gain or loss recognised inthe Income Statement as a result of the in-substance defeasance.Ownership InterestsThe ultimate Australian parent entity is Airstralia Development Group Pty Ltd (ADG), which at 30 June 20<strong>06</strong> owns 100% of the issued ordinaryshares of WAC. Transactions between ADG and WAC for the year consisted of loans advanced by ADG. Aggregate amounts payable to ADGby WAC at 30 June 20<strong>06</strong> were as follows:Notes 20<strong>06</strong> <strong>2005</strong>$'000 $'000Current accounts payable 17 3,8<strong>06</strong> 4,551Non- current interest bearing liability 21 167,622 192,473171,428 197,024Note 16 discloses amounts due from ADG in respect of the tax effect of WAC tax losses assumed by ADG following application of UIG 1052.ADG is owned by the following shareholders:20<strong>06</strong> <strong>2005</strong>Hastings Funds Management Ltd* as the single responsible entity for theAustralian Infrastructure Fund 24.9% 24.9%Hastings Funds Management Ltd* as the Trustee for the Infrastructure Fund 3.6% 3.6%Utilities of Australia Pty Ltd** as the Trustee for the Utilities Trust of Australia 32.0% 32.0%Utilities of Australia Pty Ltd** as the Trustee for the <strong>Perth</strong> <strong>Airport</strong> Property Fund 14.5% 14.5%BAA Australia Pty Ltd 15.0% 15.0%Westscheme Pty Ltd as the Trustee for Westscheme 5.0% 5.0%Citicorp Nominees Pty Ltd as the nominee for the Officers Superannuation Fund 3.1% 3.1%Colonial First State Private Capital Ltd 1.9% 1.9%100.0% 100.0%*Hastings Funds Management Ltd is wholly owned by Westpac Institutional Holdings Ltd which in turn is a wholly owned subsidiary of Westpac Banking Corporation.** Utilities of Australia Pty Ltd is managed by Hastings Funds Management Ltd.PERTH AIRPORT I PAGE49