2 0 questions - Canadian Institute of Chartered Accountants

2 0 questions - Canadian Institute of Chartered Accountants

2 0 questions - Canadian Institute of Chartered Accountants

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

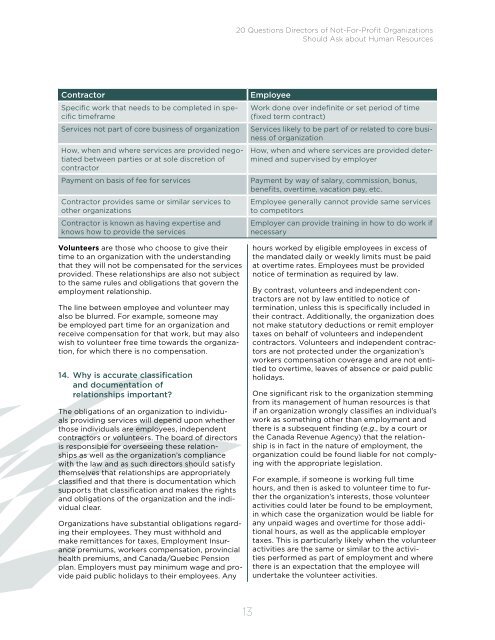

20 Questions Directors <strong>of</strong> Not-For-Pr<strong>of</strong>it OrganizationsShould Ask about Human ResourcesContractorSpecific work that needs to be completed in specifictimeframeServices not part <strong>of</strong> core business <strong>of</strong> organizationHow, when and where services are provided negotiatedbetween parties or at sole discretion <strong>of</strong>contractorPayment on basis <strong>of</strong> fee for servicesContractor provides same or similar services toother organizationsContractor is known as having expertise andknows how to provide the servicesVolunteers are those who choose to give theirtime to an organization with the understandingthat they will not be compensated for the servicesprovided. These relationships are also not subjectto the same rules and obligations that govern theemployment relationship.The line between employee and volunteer mayalso be blurred. For example, someone maybe employed part time for an organization andreceive compensation for that work, but may alsowish to volunteer free time towards the organization,for which there is no compensation.14. Why is accurate classificationand documentation <strong>of</strong>relationships important?The obligations <strong>of</strong> an organization to individualsproviding services will depend upon whetherthose individuals are employees, independentcontractors or volunteers. The board <strong>of</strong> directorsis responsible for overseeing these relationshipsas well as the organization’s compliancewith the law and as such directors should satisfythemselves that relationships are appropriatelyclassified and that there is documentation whichsupports that classification and makes the rightsand obligations <strong>of</strong> the organization and the individualclear.Organizations have substantial obligations regardingtheir employees. They must withhold andmake remittances for taxes, Employment Insurancepremiums, workers compensation, provincialhealth premiums, and Canada/Quebec Pensionplan. Employers must pay minimum wage and providepaid public holidays to their employees. AnyEmployeeWork done over indefinite or set period <strong>of</strong> time(fixed term contract)Services likely to be part <strong>of</strong> or related to core business<strong>of</strong> organizationHow, when and where services are provided determinedand supervised by employerPayment by way <strong>of</strong> salary, commission, bonus,benefits, overtime, vacation pay, etc.Employee generally cannot provide same servicesto competitorsEmployer can provide training in how to do work ifnecessaryhours worked by eligible employees in excess <strong>of</strong>the mandated daily or weekly limits must be paidat overtime rates. Employees must be providednotice <strong>of</strong> termination as required by law.By contrast, volunteers and independent contractorsare not by law entitled to notice <strong>of</strong>termination, unless this is specifically included intheir contract. Additionally, the organization doesnot make statutory deductions or remit employertaxes on behalf <strong>of</strong> volunteers and independentcontractors. Volunteers and independent contractorsare not protected under the organization’sworkers compensation coverage and are not entitledto overtime, leaves <strong>of</strong> absence or paid publicholidays.One significant risk to the organization stemmingfrom its management <strong>of</strong> human resources is thatif an organization wrongly classifies an individual’swork as something other than employment andthere is a subsequent finding (e.g., by a court orthe Canada Revenue Agency) that the relationshipis in fact in the nature <strong>of</strong> employment, theorganization could be found liable for not complyingwith the appropriate legislation.For example, if someone is working full timehours, and then is asked to volunteer time to furtherthe organization’s interests, those volunteeractivities could later be found to be employment,in which case the organization would be liable forany unpaid wages and overtime for those additionalhours, as well as the applicable employertaxes. This is particularly likely when the volunteeractivities are the same or similar to the activitiesperformed as part <strong>of</strong> employment and wherethere is an expectation that the employee willundertake the volunteer activities.13