Savings and Investments - Magazine

Savings and Investments - Magazine

Savings and Investments - Magazine

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

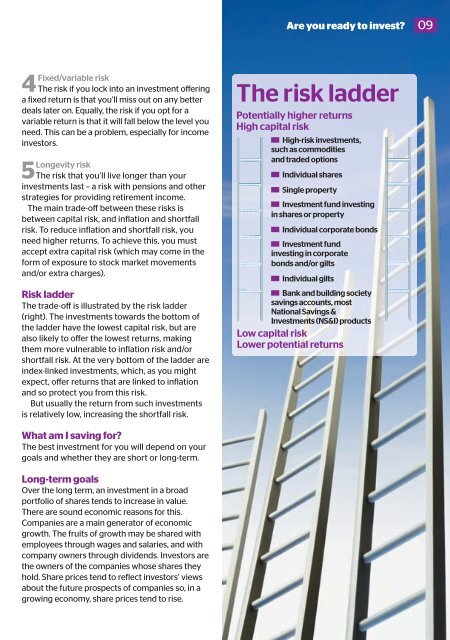

Are you ready to invest? 09Fixed/variable risk4 The risk if you lock into an investment offeringa fixed return is that you’ll miss out on any betterdeals later on. Equally, the risk if you opt for avariable return is that it will fall below the level youneed. This can be a problem, especially for incomeinvestors.Longevity risk5 The risk that you’ll live longer than yourinvestments last – a risk with pensions <strong>and</strong> otherstrategies for providing retirement income.The main trade-off between these risks isbetween capital risk, <strong>and</strong> inflation <strong>and</strong> shortfallrisk. To reduce inflation <strong>and</strong> shortfall risk, youneed higher returns. To achieve this, you mustaccept extra capital risk (which may come in theform of exposure to stock market movements<strong>and</strong>/or extra charges).Risk ladderThe trade-off is illustrated by the risk ladder(right). The investments towards the bottom ofthe ladder have the lowest capital risk, but arealso likely to offer the lowest returns, makingthem more vulnerable to inflation risk <strong>and</strong>/orshortfall risk. At the very bottom of the ladder areindex-linked investments, which, as you mightexpect, offer returns that are linked to inflation<strong>and</strong> so protect you from this risk.But usually the return from such investmentsis relatively low, increasing the shortfall risk.The risk ladderPotentially higher returnsHigh capital riskHigh-risk investments,such as commodities<strong>and</strong> traded optionsIndividual sharesSingle propertyInvestment fund investingin shares or propertyIndividual corporate bondsInvestment fundinvesting in corporatebonds <strong>and</strong>/or giltsIndividual giltsBank <strong>and</strong> building societysavings accounts, mostNational <strong>Savings</strong> &<strong>Investments</strong> (NS&I) productsLow capital riskLower potential returnsWhat am I saving for?The best investment for you will depend on yourgoals <strong>and</strong> whether they are short or long-term.Long-term goalsOver the long term, an investment in a broadportfolio of shares tends to increase in value.There are sound economic reasons for this.Companies are a main generator of economicgrowth. The fruits of growth may be shared withemployees through wages <strong>and</strong> salaries, <strong>and</strong> withcompany owners through dividends. Investors arethe owners of the companies whose shares theyhold. Share prices tend to reflect investors’ viewsabout the future prospects of companies so, in agrowing economy, share prices tend to rise.