Company Accounts, Cost and Management Accounting - Icsi

Company Accounts, Cost and Management Accounting - Icsi

Company Accounts, Cost and Management Accounting - Icsi

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

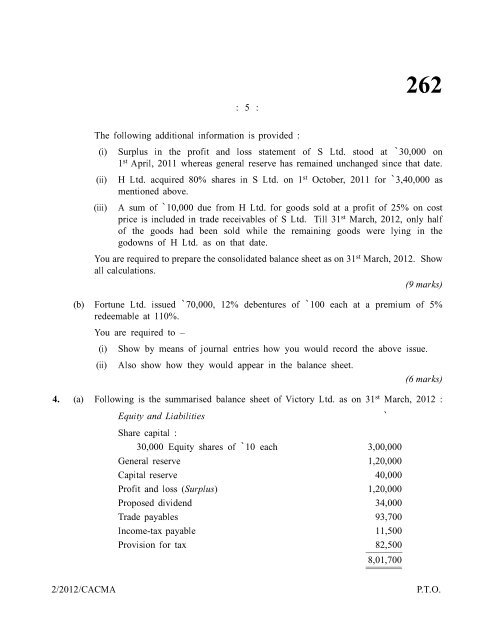

: 5 :262The following additional information is provided :(i)(ii)(iii)Surplus in the profit <strong>and</strong> loss statement of S Ltd. stood at `30,000 on1 st April, 2011 whereas general reserve has remained unchanged since that date.H Ltd. acquired 80% shares in S Ltd. on 1 st October, 2011 for `3,40,000 asmentioned above.A sum of `10,000 due from H Ltd. for goods sold at a profit of 25% on costprice is included in trade receivables of S Ltd. Till 31 st March, 2012, only halfof the goods had been sold while the remaining goods were lying in thegodowns of H Ltd. as on that date.You are required to prepare the consolidated balance sheet as on 31 st March, 2012. Showall calculations.(9 marks)(b) Fortune Ltd. issued `70,000, 12% debentures of `100 each at a premium of 5%redeemable at 110%.You are required to —(i)(ii)Show by means of journal entries how you would record the above issue.Also show how they would appear in the balance sheet.(6 marks)4. (a) Following is the summarised balance sheet of Victory Ltd. as on 31 st March, 2012 :Equity <strong>and</strong> LiabilitiesShare capital :30,000 Equity shares of `10 each 3,00,000General reserve 1,20,000Capital reserve 40,000Profit <strong>and</strong> loss (Surplus) 1,20,000Proposed dividend 34,000Trade payables 93,700Income-tax payable 11,500Provision for tax 82,500`8,01,7002/2012/CACMAP.T.O.262/4