DEBIT CARD BASICS - Practical Money Skills

DEBIT CARD BASICS - Practical Money Skills

DEBIT CARD BASICS - Practical Money Skills

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

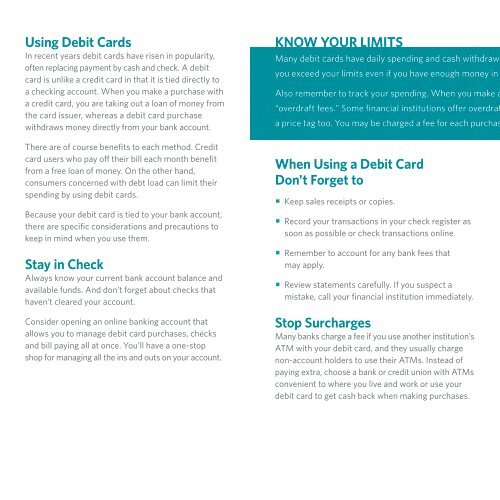

Using Debit CardsIn recent years debit cards have risen in popularity,often replacing payment by cash and check. A debitcard is unlike a credit card in that it is tied directly toa checking account. When you make a purchase witha credit card, you are taking out a loan of money fromthe card issuer, whereas a debit card purchasewithdraws money directly from your bank account.KNOW YOUR LIMITSMany debit cards have daily spending and cash withdrawal limits. These limits are meant to protect you in case your card is stolen. But remember, your card might be declined ifyou exceed your limits even if you have enough money in the bank. Know your limits and contact your lender if you need to raise or lower amounts.Also remember to track your spending. When you make a purchase, withdraw money from your account or pay bills that exceed your account balance, you may be subject to“overdraft fees.” Some financial institutions offer overdraft protection, and they’ll cover your check or debit transaction so it doesn’t bounce. But this protection often comes witha price tag too. You may be charged a fee for each purchase that uses overdraft, as well as an additional fee for being overdrawn. Balance your account regularly to avoid added fees.There are of course benefits to each method. Creditcard users who pay off their bill each month benefitfrom a free loan of money. On the other hand,consumers concerned with debt load can limit theirspending by using debit cards.Because your debit card is tied to your bank account,there are specific considerations and precautions tokeep in mind when you use them.Stay in CheckAlways know your current bank account balance andavailable funds. And don’t forget about checks thathaven’t cleared your account.Consider opening an online banking account thatallows you to manage debit card purchases, checksand bill paying all at once. You’ll have a one-stopshop for managing all the ins and outs on your account.When Using a Debit CardDon't Forget to• Keep sales receipts or copies.• Record your transactions in your check register assoon as possible or check transactions online.• Remember to account for any bank fees thatmay apply.• Review statements carefully. If you suspect amistake, call your financial institution immediately.Stop SurchargesMany banks charge a fee if you use another institution’sATM with your debit card, and they usually chargenon-account holders to use their ATMs. Instead ofpaying extra, choose a bank or credit union with ATMsconvenient to where you live and work or use yourdebit card to get cash back when making purchases.Be SecureFor maximum security, take advantage of free alertsfor your debit card. Some financial institutions offerautomatic account alerts by phone and email.RECEIVE CUSTOMIZED ALERTS WHEN:• ATM withdrawals or any debit card activityexceeds your set dollar limits• Your online ID or passwords change• Large transactions are madeKeep a SecretYour debit card will require a Personal IdentificationNumber (PIN) for security. Choose a unique number.Avoid obvious choices like your address, phonenumber or birth date.Always keep your PIN private. Memorize it. Don’twrite it down anywhere. And never tell it to anyone.If you feel your PIN has been compromised orsomeone may have identified it, change your numberimmediately by contacting your financial institution.Hit the Road, Plan AheadLike credit cards, debit cards are accepted at millionsof locations worldwide. Remember for your protection,usage across state and international lines can causea fraud or security alert with your financial institution ifit’s different from normal spending patterns. If possible,let your bank know your travel plans in advance.Know When They Hold ThemIn some cases, a transaction that is not yet completewill require that a certain amount of money in youraccount be held, or earmarked, for that transaction.When you check into a hotel, for instance, your cardis authorized and funds covering the length of yourstay are held. But the money isn't deducted fromyour account until you check out and the final cost,which may include room service charges or phonecalls, is known. This protects you and the hotel ownerby ensuring that the correct amount of money isavailable when the transaction is completed. Mosttransactions have a less-than-24-hour hold, and allholds are removed within 72 hours.