Full Annual Report 2005 - MAA Group

Full Annual Report 2005 - MAA Group

Full Annual Report 2005 - MAA Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

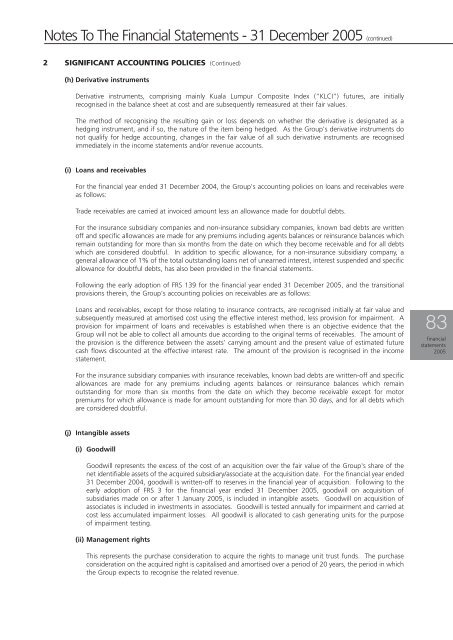

Notes To The Financial Statements - 31 December <strong>2005</strong> (continued)2 SIGNIFICANT ACCOUNTING POLICIES (Continued)(h) Derivative instrumentsDerivative instruments, comprising mainly Kuala Lumpur Composite Index (“KLCI”) futures, are initiallyrecognised in the balance sheet at cost and are subsequently remeasured at their fair values.The method of recognising the resulting gain or loss depends on whether the derivative is designated as ahedging instrument, and if so, the nature of the item being hedged. As the <strong>Group</strong>'s derivative instruments donot qualify for hedge accounting, changes in the fair value of all such derivative instruments are recognisedimmediately in the income statements and/or revenue accounts.(i) Loans and receivablesFor the financial year ended 31 December 2004, the <strong>Group</strong>'s accounting policies on loans and receivables wereas follows:Trade receivables are carried at invoiced amount less an allowance made for doubtful debts.For the insurance subsidiary companies and non-insurance subsidiary companies, known bad debts are writtenoff and specific allowances are made for any premiums including agents balances or reinsurance balances whichremain outstanding for more than six months from the date on which they become receivable and for all debtswhich are considered doubtful. In addition to specific allowance, for a non-insurance subsidiary company, ageneral allowance of 1% of the total outstanding loans net of unearned interest, interest suspended and specificallowance for doubtful debts, has also been provided in the financial statements.Following the early adoption of FRS 139 for the financial year ended 31 December <strong>2005</strong>, and the transitionalprovisions therein, the <strong>Group</strong>'s accounting policies on receivables are as follows:Loans and receivables, except for those relating to insurance contracts, are recognised initially at fair value andsubsequently measured at amortised cost using the effective interest method, less provision for impairment. Aprovision for impairment of loans and receivables is established when there is an objective evidence that the<strong>Group</strong> will not be able to collect all amounts due according to the original terms of receivables. The amount ofthe provision is the difference between the assets' carrying amount and the present value of estimated futurecash flows discounted at the effective interest rate. The amount of the provision is recognised in the incomestatement.83financialstatements<strong>2005</strong>For the insurance subsidiary companies with insurance receivables, known bad debts are written-off and specificallowances are made for any premiums including agents balances or reinsurance balances which remainoutstanding for more than six months from the date on which they become receivable except for motorpremiums for which allowance is made for amount outstanding for more than 30 days, and for all debts whichare considered doubtful.(j) Intangible assets(i) GoodwillGoodwill represents the excess of the cost of an acquisition over the fair value of the <strong>Group</strong>'s share of thenet identifiable assets of the acquired subsidiary/associate at the acquisition date. For the financial year ended31 December 2004, goodwill is written-off to reserves in the financial year of acquisition. Following to theearly adoption of FRS 3 for the financial year ended 31 December <strong>2005</strong>, goodwill on acquisition ofsubsidiaries made on or after 1 January <strong>2005</strong>, is included in intangible assets. Goodwill on acquisition ofassociates is included in investments in associates. Goodwill is tested annually for impairment and carried atcost less accumulated impairment losses. All goodwill is allocated to cash generating units for the purposeof impairment testing.(ii) Management rightsThis represents the purchase consideration to acquire the rights to manage unit trust funds. The purchaseconsideration on the acquired right is capitalised and amortised over a period of 20 years, the period in whichthe <strong>Group</strong> expects to recognise the related revenue.