The Campaign for St. Thomas Aquinas College

The Campaign for St. Thomas Aquinas College

The Campaign for St. Thomas Aquinas College

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

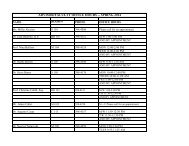

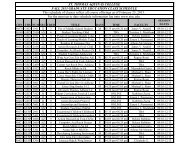

Making a Gift in Support of the <strong>Campaign</strong><strong>The</strong> <strong>Campaign</strong> <strong>for</strong> <strong>St</strong>. <strong>Thomas</strong> <strong>Aquinas</strong> is a comprehensive ef<strong>for</strong>t focused on generating support <strong>for</strong> all aspects of campuslife. This approach ensures that your generous donation will be used to address your area of interest while at the same timecounting toward our campaign goal.<strong>St</strong>. <strong>Thomas</strong> <strong>Aquinas</strong> <strong>College</strong> appreciates your support at all levels. Contributions are tax-deductible to the fullest extent ofthe law. Tax laws vary from state to state. Please consult with your financial advisor to confirm the exact tax implication ofyour gift.Preferred Methods of Giving❖ Write a CheckDonations can be made by check or money orderpayable to <strong>St</strong>. <strong>Thomas</strong> <strong>Aquinas</strong> <strong>College</strong>.Mail your donations to:<strong>St</strong>. <strong>Thomas</strong> <strong>Aquinas</strong> <strong>College</strong>125 Route 340Sparkill, NY 10976Attention: Office of Institutional Advancement❖ Use a Credit CardDonations using Amex, MasterCard, Visa or Discoverare accepted by calling the Office of InstitutionalAdvancement at 845-398-4020.❖ Matching Gifts can Double even Triple thevalue of your DonationMany companies support the charitable-givingactivities of their employees through a Matching GiftProgram. Such programs match donations dollar <strong>for</strong>dollar to a maximum annual level. Check with yourHR department to find out if your company has aMatching Gift program in place. If so, HR will provideyou with the appropriate <strong>for</strong>ms.❖ Other Ways to GiveGifts of appreciated securities, real estate, or lifeinsurance are also welcome and may provide valuabletax benefits to the donor. By naming the college as abeneficiary in a will or trust, you are able to realizeyour goal of making a substantial gift while alsopossibly reducing your estate tax obligations.❖ Planned Giving OptionsLife income plans such as Charitable Lead Trusts(CLT) and Charitable Remainder Trusts (CRT), as wellas gifts of life insurance and bequests, are just someof the planned giving options available as sources tosupport the campaign. For more in<strong>for</strong>mation aboutmaking a contribution or to discuss your plannedgiving and pledge gift options please call or e-mail:Mr. Kevin P. Duignan, '75, ’06 MBA, Vice Presidentof Institutional Advancement at 845-398-4017,kduignan@stac.edu.This is <strong>for</strong> in<strong>for</strong>mational purposes only. It is important that you consult yourlegal and financial advisors be<strong>for</strong>e making any decisions.14