Employee Benefits (IAS 19) - Actuarial Society of India

Employee Benefits (IAS 19) - Actuarial Society of India

Employee Benefits (IAS 19) - Actuarial Society of India

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

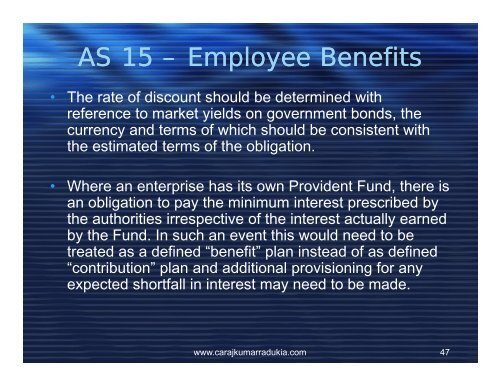

AS 15 – <strong>Employee</strong> <strong>Benefits</strong>• The rate <strong>of</strong> discount should be determined withreference to market yields on government bonds, thecurrency and terms <strong>of</strong> which should be consistent withthe estimated terms <strong>of</strong> the obligation.• Where an enterprise has its own Provident Fund, there isan obligation to pay the minimum interest prescribed bythe authorities irrespective <strong>of</strong> the interest actually earnedby the Fund. In such an event this would need to betreated as a defined “benefit” plan instead <strong>of</strong> as defined“contribution” plan and additional provisioning for anyexpected shortfall in interest may need to be made.www.carajkumarradukia.com 47