Investment Insights Dezember 2011 - DWS Investments

Investment Insights Dezember 2011 - DWS Investments

Investment Insights Dezember 2011 - DWS Investments

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

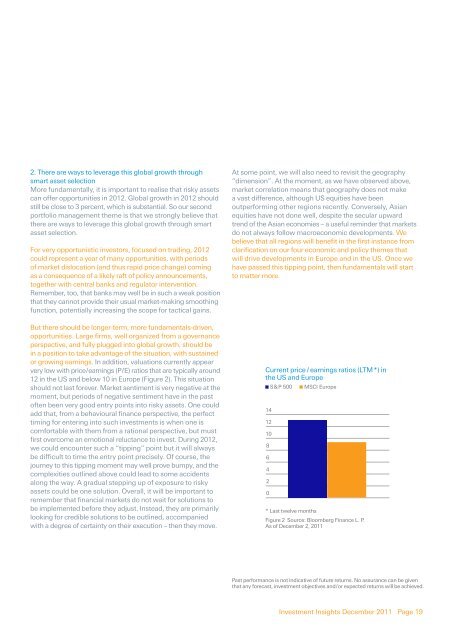

2. There are ways to leverage this global growth throughsmart asset selectionMore fundamentally, it is important to realise that risky assetscan offer opportunities in 2012. Global growth in 2012 shouldstill be close to 3 percent, which is substantial. So our secondportfolio management theme is that we strongly believe thatthere are ways to leverage this global growth through smartasset selection.For very opportunistic investors, focused on trading, 2012could represent a year of many opportunities, with periodsof market dislocation (and thus rapid price change) comingas a consequence of a likely raft of policy announcements,together with central banks and regulator intervention.Remember, too, that banks may well be in such a weak positionthat they cannot provide their usual market-making smoothingfunction, potentially increasing the scope for tactical gains.But there should be longer-term, more fundamentals-driven,opportunities. Large firms, well organized from a governanceperspective, and fully plugged into global growth, should bein a position to take advantage of the situation, with sustainedor growing earnings. In addition, valuations currently appearvery low with price / earnings (P/E) ratios that are typically around12 in the US and below 10 in Europe (Figure 2). This situationshould not last forever. Market sentiment is very negative at themoment, but periods of negative sentiment have in the pastoften been very good entry points into risky assets. One couldadd that, from a behavioural finance perspective, the perfecttiming for entering into such investments is when one iscomfortable with them from a rational perspective, but mustfirst overcome an emotional reluctance to invest. During 2012,we could encounter such a “tipping” point but it will alwaysbe difficult to time the entry point precisely. Of course, thejourney to this tipping moment may well prove bumpy, and thecomplexities outlined above could lead to some accidentsalong the way. A gradual stepping up of exposure to riskyassets could be one solution. Overall, it will be important toremember that financial markets do not wait for solutions tobe implemented before they adjust. Instead, they are primarilylooking for credible solutions to be outlined, accompaniedwith a degree of certainty on their execution – then they move.At some point, we will also need to revisit the geography“dimension”. At the moment, as we have observed above,market correlation means that geography does not makea vast difference, although US equities have beenoutperforming other regions recently. Conversely, Asianequities have not done well, despite the secular upwardtrend of the Asian economies – a useful reminder that marketsdo not always follow macroeconomic developments. Webelieve that all regions will benefit in the first instance fromclarification on our four economic and policy themes thatwill drive developments in Europe and in the US. Once wehave passed this tipping point, then fundamentals will startto matter more.Current price / earnings ratios (LTM*) inthe US and EuropeS&P 500 MSCI Europe14121086420* Last twelve monthsFigure 2 Source: Bloomberg Finance L. P.As of December 2, <strong>2011</strong>Past performance is not indicative of future returns. No assurance can be giventhat any forecast, investment objectives and/or expected returns will be achieved.<strong>Investment</strong> <strong>Insights</strong> December <strong>2011</strong> Page 19