matco-small-cap-fund-presentation

matco-small-cap-fund-presentation

matco-small-cap-fund-presentation

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

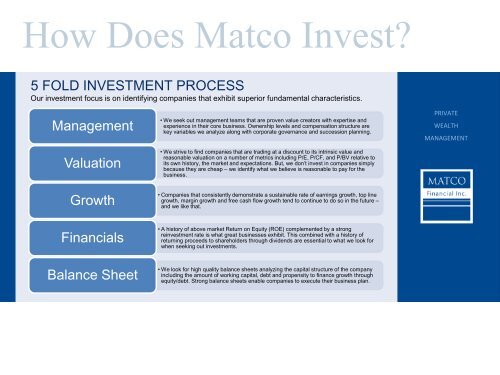

How Does Matco Invest?5 FOLD INVESTMENT PROCESSOur investment focus is on identifying companies that exhibit superior <strong>fund</strong>amental characteristics.ManagementValuation• We seek out management teams that are proven value creators with expertise andexperience in their core business. Ownership levels and compensation structure arekey variables we analyze along with corporate governance and succession planning.• We strive to find companies that are trading at a discount to its intrinsic value andreasonable valuation on a number of metrics including P/E, P/CF, and P/BV relative toits own history, the market and expectations. But, we don’t invest in companies simplybecause they are cheap – we identify what we believe is reasonable to pay for thebusiness.PRIVATEWEALTHMANAGEMENTGrowth• Companies that consistently demonstrate a sustainable rate of earnings growth, top linegrowth, margin growth and free cash flow growth tend to continue to do so in the future –and we like that.Financials• A history of above market Return on Equity (ROE) complemented by a strongreinvestment rate is what great businesses exhibit. This combined with a history ofreturning proceeds to shareholders through dividends are essential to what we look forwhen seeking out investments.Balance Sheet• We look for high quality balance sheets analyzing the <strong>cap</strong>ital structure of the companyincluding the amount of working <strong>cap</strong>ital, debt and propensity to finance growth throughequity/debt. Strong balance sheets enable companies to execute their business plan.