Efficient Portfolio Optimization with Conditional Value at Risk

Efficient Portfolio Optimization with Conditional Value at Risk

Efficient Portfolio Optimization with Conditional Value at Risk

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

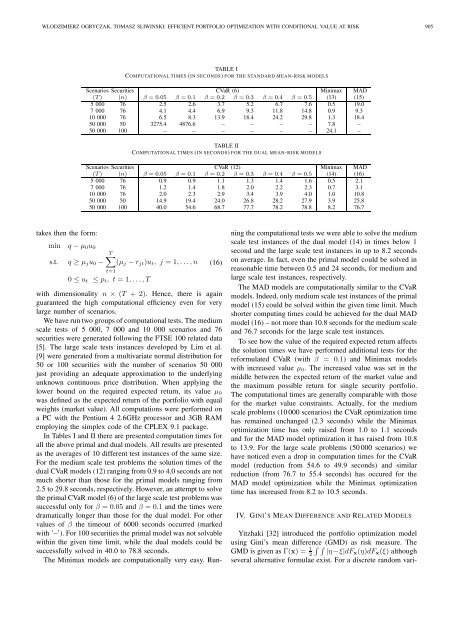

WLODZIMIERZ OGRYCZAK, TOMASZ SLIWINSKI: EFFICIENT PORTFOLIO OPTIMIZATION WITH CONDITIONAL VALUE AT RISK 905TABLE ICOMPUTATIONAL TIMES (IN SECONDS) FOR THE STANDARD MEAN-RISK MODELSScenarios Securities CVaR (6) Minimax MAD(T) (n) β = 0.05 β = 0.1 β = 0.2 β = 0.3 β = 0.4 β = 0.5 (13) (15)5 000 76 2.5 2.6 3.7 5.2 6.7 7.6 0.5 19.07 000 76 4.1 4.4 6.9 9.3 11.8 14.8 0.9 9.310 000 76 6.5 8.3 13.9 18.4 24.2 29.8 1.3 18.450 000 50 3275.4 4876.6 – – – – 7.8 –50 000 100 – – – – – – 24.1 –TABLE IICOMPUTATIONAL TIMES (IN SECONDS) FOR THE DUAL MEAN-RISK MODELSScenarios Securities CVaR (12) Minimax MAD(T) (n) β = 0.05 β = 0.1 β = 0.2 β = 0.3 β = 0.4 β = 0.5 (14) (16)5 000 76 0.9 0.9 1.1 1.3 1.4 1.6 0.5 2.17 000 76 1.2 1.4 1.8 2.0 2.2 2.3 0.7 3.110 000 76 2.0 2.3 2.9 3.4 3.9 4.0 1.0 10.850 000 50 14.9 19.4 24.0 26.8 28.2 27.9 3.9 25.850 000 100 40.0 54.6 68.7 77.7 78.2 78.8 8.2 76.7takes then the form:min q −µ 0 u 0s.t. q ≥ µ j u 0 −T∑(µ j −r jt )u t , j = 1,...,nt=10 ≤ u t ≤ p t , t = 1,...,T(16)<strong>with</strong> dimensionality n × (T + 2). Hence, there is againguaranteed the high comput<strong>at</strong>ional efficiency even for verylarge number of scenarios.Wehaveruntwogroupsofcomput<strong>at</strong>ionaltests.Themediumscale tests of 5 000, 7 000 and 10 000 scenarios and 76securities were gener<strong>at</strong>ed following the FTSE 100 rel<strong>at</strong>ed d<strong>at</strong>a[5]. The large scale tests instances developed by Lim et al.[9] were gener<strong>at</strong>ed from a multivari<strong>at</strong>e normal distribution for50 or 100 securities <strong>with</strong> the number of scenarios 50 000just providing an adequ<strong>at</strong>e approxim<strong>at</strong>ion to the underlyingunknown continuous price distribution. When applying thelower bound on the required expected return, its value µ 0was defined as the expected return of the portfolio <strong>with</strong> equalweights (market value). All comput<strong>at</strong>ions were performed ona PC <strong>with</strong> the Pentium 4 2.6GHz processor and 3GB RAMemploying the simplex code of the CPLEX 9.1 package.In Tables I and II there are presented comput<strong>at</strong>ion times forall the above primal and dual models. All results are presentedas the averages of 10 different test instances of the same size.For the medium scale test problems the solution times of thedualCVaRmodels(12)rangingfrom0.9to4.0secondsarenotmuch shorter than those for the primal models ranging from2.5 to 29.8seconds, respectively.However,an <strong>at</strong>tempt to solvetheprimalCVaRmodel(6)ofthelargescaletestproblemswassuccessful only for β = 0.05 and β = 0.1 and the times weredram<strong>at</strong>ically longer than those for the dual model. For othervalues of β the timeout of 6000 seconds occurred (marked<strong>with</strong> ’–’).For 100securitiesthe primalmodelwasnot solvable<strong>with</strong>in the given time limit, while the dual models could besuccessfully solved in 40.0 to 78.8 seconds.The Minimax models are comput<strong>at</strong>ionally very easy. Runningthecomput<strong>at</strong>ionaltestswe were ableto solvethe mediumscale test instances of the dual model (14) in times below 1second and the large scale test instances in up to 8.2 secondson average. In fact, even the primal model could be solved inreasonable time between 0.5 and 24 seconds, for medium andlarge scale test instances, respectively.The MAD models are comput<strong>at</strong>ionally similar to the CVaRmodels.Indeed,onlymediumscale test instancesofthe primalmodel (15) could be solved <strong>with</strong>in the given time limit. Muchshorter computing times could be achieved for the dual MADmodel(16)– not morethan 10.8secondsfor the mediumscaleand 76.7 seconds for the large scale test instances.To see how the value of the required expected return affectsthe solution times we have performed additional tests for thereformul<strong>at</strong>ed CVaR (<strong>with</strong> β = 0.1) and Minimax models<strong>with</strong> increased value µ 0 . The increased value was set in themiddle between the expected return of the market value andthe maximum possible return for single security portfolio.The comput<strong>at</strong>ional times are generally comparable <strong>with</strong> thosefor the market value constraints. Actually, for the mediumscale problems (10000 scenarios) the CVaR optimiz<strong>at</strong>ion timehas remained unchanged (2.3 seconds) while the Minimaxoptimiz<strong>at</strong>ion time has only raised from 1.0 to 1.1 secondsand for the MAD model optimiz<strong>at</strong>ion it has raised from 10.8to 13.9. For the large scale problems (50000 scenarios) wehave noticed even a drop in comput<strong>at</strong>ion times for the CVaRmodel (reduction from 54.6 to 49.9 seconds) and similarreduction (from 76.7 to 55.4 seconds) has occured for theMAD model optimiz<strong>at</strong>ion while the Minimax optimiz<strong>at</strong>iontime has increased from 8.2 to 10.5 seconds.IV. GINI’S MEAN DIFFERENCE AND RELATED MODELSYitzhaki [32] introduced the portfolio optimiz<strong>at</strong>ion modelusing Gini’s mean difference ∫ ∫ (GMD) as risk measure. TheGMD is given as Γ(x) = 1 2 |η−ξ|dFx (η)dF x (ξ) althoughseveral altern<strong>at</strong>ive formulae exist. For a discrete random vari-