Chapter II SUMMARY OF PERTINENT LAWS AND REGULATIONS

Chapter II SUMMARY OF PERTINENT LAWS AND REGULATIONS

Chapter II SUMMARY OF PERTINENT LAWS AND REGULATIONS

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

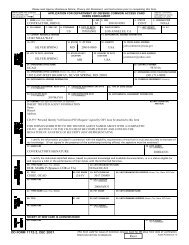

are codified at 2 U.S.C. SS601, et. seq., and SS901, et. seq.Gramm-Rudman-Hollings was supplemented and extended by enactment of theBalanced Budget and Emergency Deficit Control Reaffirmation Act of 1987.(P.L. 100-119; 101 Stat. 754) (September 29, 1987), the Budget ReconciliationAct of 1990 (P.L. 101-508, Title X<strong>II</strong>I; 104 Stat. 1388-608) (November 5, 1990),and most recently, the Budget Enforcement Act of 1997 (P.L.105 -33, Title X;111 Stat.667)(August 5, 1997).5. Title 31, U.S. Code - Money and FinanceThis legislation codifies and consolidates laws applicable to the budget process,e.g., the budget system, budgetary and fiscal information, appropriations,apportionments and accounting, including the requirements of the AntideficiencyAct which prohibit obligations or expenditure of funds in excess of amountsappropriated by law.6. The Government Performance and Results Act of 1993, (P.L.103-62; 107Stat.285)(August 3, 1993)This Act, commonly referred to as GPRA or the Results Act, requires that Federalagencies develop and implement an accountability system based on performancemeasurement, including setting goals and objectives and measuring progresstoward achieving them. To this end, agencies must provide strategic plans, annualperformance plans, and annual program performance reports to show what isbeing accomplished with their budgetary resources.7. The Federal Credit Reform Act of 1990, (P.L.101-508; 104 Stat.1388-609)(November 5, 1990)This Act instituted reforms in Federal credit programs that changed the budgetarymeasurement of direct loan and loan guarantee costs. The intent of this Act is toensure that the cost of Federal loan programs are measured accurately as possible,so that these costs can be taken into account in making budgetary decisions.B. Excerpts from Title 31 U.S.C.The following excerpts from Title 31 are particularly relevant for budget formulation andexecution.<strong>Chapter</strong> 11 The Budget and Fiscal, Budget, and Program Information1. Section 1104 - Budget and appropriations authority of the President(a)The President shall prepare budgets of the United States Governmentunder section 1105 of this title and propose deficiency and supplementalappropriations under section 1107 of this title. To the extent practicable,the President shall use uniform terms in stating the purposes and<strong>II</strong>(1)-2