Gold Market Update - Business Research and Insights - NAB

Gold Market Update - Business Research and Insights - NAB

Gold Market Update - Business Research and Insights - NAB

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

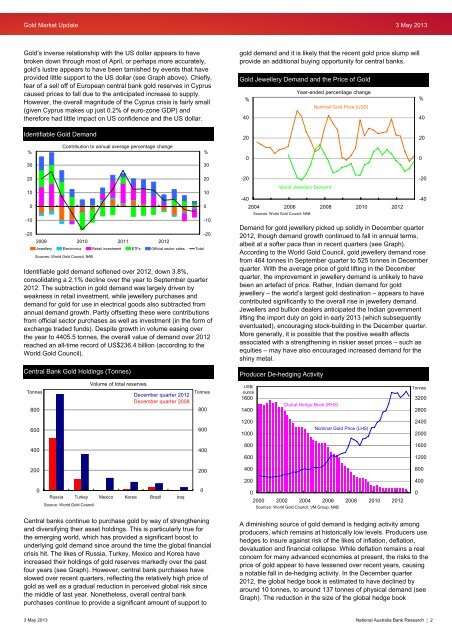

<strong>Gold</strong> <strong>Market</strong> <strong>Update</strong> 3 May 2013<strong>Gold</strong>’s inverse relationship with the US dollar appears to havebroken down through most of April, or perhaps more accurately,gold’s lustre appears to have been tarnished by events that haveprovided little support to the US dollar (see Graph above). Chiefly,fear of a sell off of European central bank gold reserves in Cypruscaused prices to fall due to the anticipated increase to supply.However, the overall magnitude of the Cyprus crisis is fairly small(given Cyprus makes up just 0.2% of euro-zone GDP) <strong>and</strong>therefore had little impact on US confidence <strong>and</strong> the US dollar.gold dem<strong>and</strong> <strong>and</strong> it is likely that the recent gold price slump willprovide an additional buying opportunity for central banks.<strong>Gold</strong> Jewellery Dem<strong>and</strong> <strong>and</strong> the Price of <strong>Gold</strong>Year-ended percentage change% %40Nominal <strong>Gold</strong> Price (USD)40Identifiable <strong>Gold</strong> Dem<strong>and</strong>Contribution to annual average percentage change% %303020020020100-10-202009 2010 2011 2012Jewellery Electronics Retail investment ETFs Official sector sales TotalSources: World <strong>Gold</strong> Council; <strong>NAB</strong>Identifiable gold dem<strong>and</strong> softened over 2012, down 3.8%,consolidating a 2.1% decline over the year to September quarter2012. The subtraction in gold dem<strong>and</strong> was largely driven byweakness in retail investment, while jewellery purchases <strong>and</strong>dem<strong>and</strong> for gold for use in electrical goods also subtracted fromannual dem<strong>and</strong> growth. Partly offsetting these were contributionsfrom official sector purchases as well as investment (in the form ofexchange traded funds). Despite growth in volume easing overthe year to 4405.5 tonnes, the overall value of dem<strong>and</strong> over 2012reached an all-time record of US$236.4 billion (according to theWorld <strong>Gold</strong> Council).20100-10-20-20-40World Jewellery Dem<strong>and</strong>2004 2006 2008 2010 2012Sources: World <strong>Gold</strong> Council; <strong>NAB</strong>Dem<strong>and</strong> for gold jewellery picked up solidly in December quarter2012, though dem<strong>and</strong> growth continued to fall in annual terms,albeit at a softer pace than in recent quarters (see Graph).According to the World <strong>Gold</strong> Council, gold jewellery dem<strong>and</strong> rosefrom 464 tonnes in September quarter to 525 tonnes in Decemberquarter. With the average price of gold lifting in the Decemberquarter, the improvement in jewellery dem<strong>and</strong> is unlikely to havebeen an artefact of price. Rather, Indian dem<strong>and</strong> for goldjewellery – the world’s largest gold destination – appears to havecontributed significantly to the overall rise in jewellery dem<strong>and</strong>.Jewellers <strong>and</strong> bullion dealers anticipated the Indian governmentlifting the import duty on gold in early 2013 (which subsequentlyeventuated), encouraging stock-building in the December quarter.More generally, it is possible that the positive wealth affectsassociated with a strengthening in riskier asset prices – such asequities – may have also encouraged increased dem<strong>and</strong> for theshiny metal.-20-40Central Bank <strong>Gold</strong> Holdings (Tonnes)Producer De-hedging ActivityTonnes800Volume of total reservesDecember quarter 2012December quarter 2008Tonnes800US$/ounce16001400Global Hedge Book (RHS)Tonnes3200280060060012001000Nominal <strong>Gold</strong> Price (LHS)24002000400400800600160012002002004008002004000Russia Turkey Mexico Korea Brazil IraqSource: World <strong>Gold</strong> Council002000 2002 2004 2006 2008 2010 2012Sources: World <strong>Gold</strong> Council; VM Group; <strong>NAB</strong>0Central banks continue to purchase gold by way of strengthening<strong>and</strong> diversifying their asset holdings. This is particularly true forthe emerging world, which has provided a significant boost tounderlying gold dem<strong>and</strong> since around the time the global financialcrisis hit. The likes of Russia, Turkey, Mexico <strong>and</strong> Korea haveincreased their holdings of gold reserves markedly over the pastfour years (see Graph). However, central bank purchases haveslowed over recent quarters, reflecting the relatively high price ofgold as well as a gradual reduction in perceived global risk sincethe middle of last year. Nonetheless, overall central bankpurchases continue to provide a significant amount of support toA diminishing source of gold dem<strong>and</strong> is hedging activity amongproducers, which remains at historically low levels. Producers usehedges to insure against risk of the likes of inflation, deflation,devaluation <strong>and</strong> financial collapse. While deflation remains a realconcern for many advanced economies at present, the risks to theprice of gold appear to have lessened over recent years, causinga notable fall in de-hedging activity. In the December quarter2012, the global hedge book is estimated to have declined byaround 10 tonnes, to around 137 tonnes of physical dem<strong>and</strong> (seeGraph). The reduction in the size of the global hedge book3 May 2013 National Australia Bank <strong>Research</strong> | 2