AUDITORS' REPORT - Ntpc

AUDITORS' REPORT - Ntpc

AUDITORS' REPORT - Ntpc

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

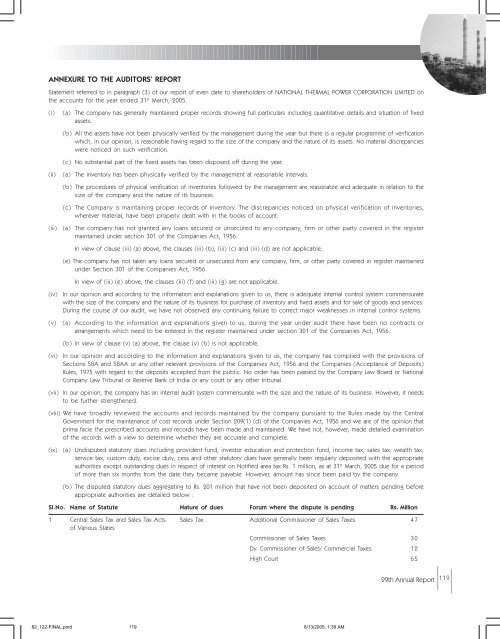

ANNEXURE TO THE AUDITORS’ <strong>REPORT</strong>Statement referred to in paragraph (3) of our report of even date to shareholders of NATIONAL THERMAL POWER CORPORATION LIMITED onthe accounts for the year ended 31 st March, 2005.(i)(a) The company has generally maintained proper records showing full particulars including quantitative details and situation of fixedassets.(b) All the assets have not been physically verified by the management during the year but there is a regular programme of verificationwhich, in our opinion, is reasonable having regard to the size of the company and the nature of its assets. No material discrepancieswere noticed on such verification.(c) No substantial part of the fixed assets has been disposed off during the year.(ii)(a) The inventory has been physically verified by the management at reasonable intervals.(b) The procedures of physical verification of inventories followed by the management are reasonable and adequate in relation to thesize of the company and the nature of its business.(c) The Company is maintaining proper records of inventory. The discrepancies noticed on physical verification of inventories,wherever material, have been properly dealt with in the books of account.(iii)(a) The company has not granted any loans secured or unsecured to any company, firm or other party covered in the registermaintained under section 301 of the Companies Act, 1956.In view of clause (iii) (a) above, the clauses (iii) (b), (iii) (c) and (iii) (d) are not applicable.(e) The company has not taken any loans secured or unsecured from any company, firm, or other party covered in register maintainedunder Section 301 of the Companies Act, 1956.In view of (iii) (e) above, the clauses (iii) (f) and (iii) (g) are not applicable.(iv)(v)In our opinion and according to the information and explanations given to us, there is adequate internal control system commensuratewith the size of the company and the nature of its business for purchase of inventory and fixed assets and for sale of goods and services.During the course of our audit, we have not observed any continuing failure to correct major weaknesses in internal control systems.(a) According to the information and explanations given to us, during the year under audit there have been no contracts orarrangements which need to be entered in the register maintained under section 301 of the Companies Act, 1956.(b) In view of clause (v) (a) above, the clause (v) (b) is not applicable.(vi)In our opinion and according to the information and explanations given to us, the company has complied with the provisions ofSections 58A and 58AA or any other relevant provisions of the Companies Act, 1956 and the Companies (Acceptance of Deposits)Rules, 1975 with regard to the deposits accepted from the public. No order has been passed by the Company Law Board or NationalCompany Law Tribunal or Reserve Bank of India or any court or any other tribunal.(vii) In our opinion, the company has an internal audit system commensurate with the size and the nature of its business. However, it needsto be further strengthened.(viii) We have broadly reviewed the accounts and records maintained by the company pursuant to the Rules made by the CentralGovernment for the maintenance of cost records under Section 209(1) (d) of the Companies Act, 1956 and we are of the opinion thatprima facie the prescribed accounts and records have been made and maintained. We have not, however, made detailed examinationof the records with a view to determine whether they are accurate and complete.(ix)(a) Undisputed statutory dues including provident fund, investor education and protection fund, income tax, sales tax, wealth tax,service tax, custom duty, excise duty, cess and other statutory dues have generally been regularly deposited with the appropriateauthorities except outstanding dues in respect of interest on Notified area tax Rs. 1 million, as at 31 st March, 2005 due for a periodof more than six months from the date they became payable. However, amount has since been paid by the company.(b) The disputed statutory dues aggregating to Rs. 201 million that have not been deposited on account of matters pending beforeappropriate authorities are detailed below :Sl.No. Name of Statute Nature of dues Forum where the dispute is pending Rs. Million1 Central Sales Tax and Sales Tax Acts Sales Tax Additional Commissioner of Sales Taxes 47of Various StatesCommissioner of Sales Taxes 30Dy. Commissioner of Sales/ Commercial Taxes 12High Court 6529th Annual Report 11982_122-FINAL.pmd1198/13/2005, 1:39 AM