Small Business Guide - Welcome to Alabama A&M University

Small Business Guide - Welcome to Alabama A&M University

Small Business Guide - Welcome to Alabama A&M University

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

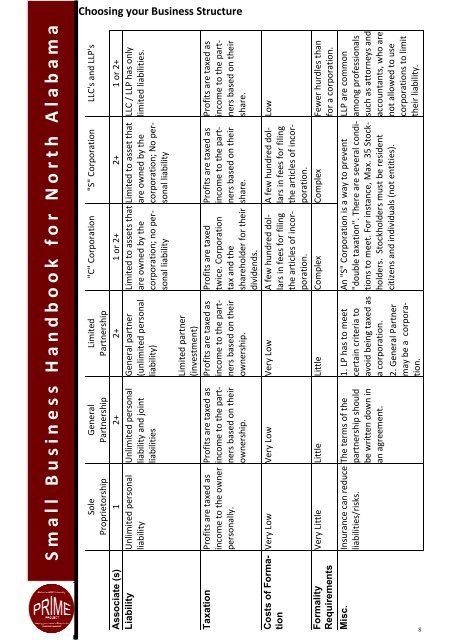

Choosing your <strong>Business</strong> StructureS m a l l B u s i n e s s H a n d b o o k f o r N o r t h A l a b a m a"C" Corporation "S" Corporation LLC's and LLP'sLimitedPartnershipGeneralPartnershipSoleProprie<strong>to</strong>rshipAssociate (s) 1 2+ 2+ 1 or 2+ 2+ 1 or 2+LLC / LLP has onlylimited liabilities.Limited <strong>to</strong> asset thatare owned by thecorporation; No personalliabilityLimited <strong>to</strong> assets thatare owned by thecorporation; no personalliabilityGeneral partner(unlimited personalliability)Unlimited personalliability and jointliabilitiesLiability Unlimited personalliabilityLimited partner(investment)Profits are taxed asincome <strong>to</strong> the partnersbased on theirshare.Profits are taxed asincome <strong>to</strong> the partnersbased on theirshare.Profits are taxedtwice. Corporationtax and theshareholder for theirdividends.Profits are taxed asincome <strong>to</strong> the partnersbased on theirownership.Profits are taxed asincome <strong>to</strong> the partnersbased on theirownership.Taxation Profits are taxed asincome <strong>to</strong> the ownerpersonally.LowA few hundred dollarsin fees for filingthe articles of incorporation.Very Low Very Low Very Low A few hundred dollarsin fees for filingthe articles of incorporation.Costs of FormationVery Little Little Little Complex Complex Fewer hurdles thanfor a corporation.FormalityRequirementsLLP are commonamong professionalssuch as at<strong>to</strong>rneys andaccountants, who arenot allowed <strong>to</strong> usecorporations <strong>to</strong> limittheir liability.An "S" Corporation is a way <strong>to</strong> prevent"double taxation". There are several conditions<strong>to</strong> meet. For instance, Max. 35 S<strong>to</strong>ckholders.S<strong>to</strong>ckholders must be residentcitizens and individuals (not entities).1. LP has <strong>to</strong> meetcertain criteria <strong>to</strong>avoid being taxed asa corporation.The terms of thepartnership shouldbe written down inan agreement.Misc. Insurance can reduceliabilities/risks.2. General Partnermay be a corporation.8