Guide to Trusts in Guernsey - Appleby

Guide to Trusts in Guernsey - Appleby

Guide to Trusts in Guernsey - Appleby

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

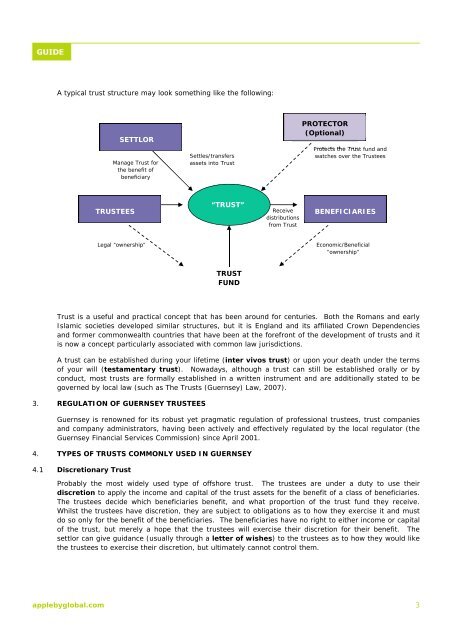

A typical trust structure may look someth<strong>in</strong>g like the follow<strong>in</strong>g:SETTLORManage Trust forthe benefit ofbeneficiarySettles/transfersassets <strong>in</strong><strong>to</strong> TrustPROTECTOR(Optional)Protects the Trust fund andwatches over the TrusteesTRUSTEES“TRUST”Receivedistributionsfrom TrustBENEFICIARIESLegal “ownership”Economic/Beneficial“ownership”TRUSTFUNDTrust is a useful and practical concept that has been around for centuries. Both the Romans and earlyIslamic societies developed similar structures, but it is England and its affiliated Crown Dependenciesand former commonwealth countries that have been at the forefront of the development of trusts and itis now a concept particularly associated with common law jurisdictions.A trust can be established dur<strong>in</strong>g your lifetime (<strong>in</strong>ter vivos trust) or upon your death under the termsof your will (testamentary trust). Nowadays, although a trust can still be established orally or byconduct, most trusts are formally established <strong>in</strong> a written <strong>in</strong>strument and are additionally stated <strong>to</strong> begoverned by local law (such as The <strong>Trusts</strong> (<strong>Guernsey</strong>) Law, 2007).3. REGULATION OF GUERNSEY TRUSTEES<strong>Guernsey</strong> is renowned for its robust yet pragmatic regulation of professional trustees, trust companiesand company adm<strong>in</strong>istra<strong>to</strong>rs, hav<strong>in</strong>g been actively and effectively regulated by the local regula<strong>to</strong>r (the<strong>Guernsey</strong> F<strong>in</strong>ancial Services Commission) s<strong>in</strong>ce April 2001.4. TYPES OF TRUSTS COMMONLY USED IN GUERNSEY4.1 Discretionary TrustProbably the most widely used type of offshore trust. The trustees are under a duty <strong>to</strong> use theirdiscretion <strong>to</strong> apply the <strong>in</strong>come and capital of the trust assets for the benefit of a class of beneficiaries.The trustees decide which beneficiaries benefit, and what proportion of the trust fund they receive.Whilst the trustees have discretion, they are subject <strong>to</strong> obligations as <strong>to</strong> how they exercise it and mustdo so only for the benefit of the beneficiaries. The beneficiaries have no right <strong>to</strong> either <strong>in</strong>come or capitalof the trust, but merely a hope that the trustees will exercise their discretion for their benefit. Thesettlor can give guidance (usually through a letter of wishes) <strong>to</strong> the trustees as <strong>to</strong> how they would likethe trustees <strong>to</strong> exercise their discretion, but ultimately cannot control them.applebyglobal.com 3