Tomato Specialized Bank

Tomato Specialized Bank

Tomato Specialized Bank

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

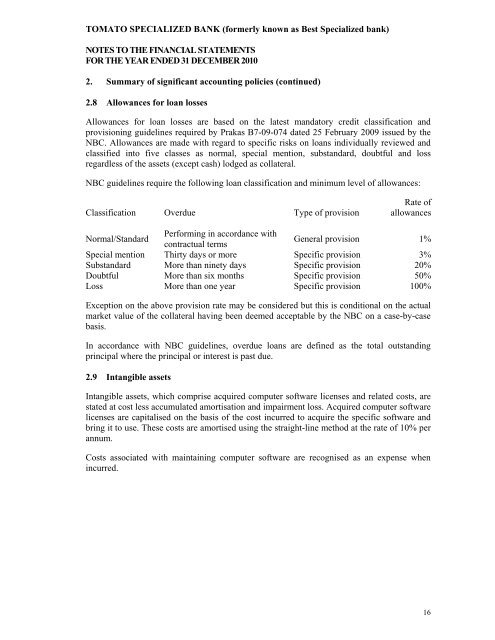

TOMATO SPECIALIZED BANK (formerly known as Best <strong>Specialized</strong> bank)NOTES TO THE FINANCIAL STATEMENTSFOR THE YEAR ENDED 31 DECEMBER 20102. Summary of significant accounting policies (continued)2.8 Allowances for loan lossesAllowances for loan losses are based on the latest mandatory credit classification andprovisioning guidelines required by Prakas B7-09-074 dated 25 February 2009 issued by theNBC. Allowances are made with regard to specific risks on loans individually reviewed andclassified into five classes as normal, special mention, substandard, doubtful and lossregardless of the assets (except cash) lodged as collateral.NBC guidelines require the following loan classification and minimum level of allowances:Classification Overdue Type of provisionRate ofallowancesNormal/StandardPerforming in accordance withcontractual termsGeneral provision 1%Special mention Thirty days or more Specific provision 3%Substandard More than ninety days Specific provision 20%Doubtful More than six months Specific provision 50%Loss More than one year Specific provision 100%Exception on the above provision rate may be considered but this is conditional on the actualmarket value of the collateral having been deemed acceptable by the NBC on a case-by-casebasis.In accordance with NBC guidelines, overdue loans are defined as the total outstandingprincipal where the principal or interest is past due.2.9 Intangible assetsIntangible assets, which comprise acquired computer software licenses and related costs, arestated at cost less accumulated amortisation and impairment loss. Acquired computer softwarelicenses are capitalised on the basis of the cost incurred to acquire the specific software andbring it to use. These costs are amortised using the straight-line method at the rate of 10% perannum.Costs associated with maintaining computer software are recognised as an expense whenincurred.16