gold reef resorts annual report 2009 analysis of the year - Tsogo Sun

gold reef resorts annual report 2009 analysis of the year - Tsogo Sun

gold reef resorts annual report 2009 analysis of the year - Tsogo Sun

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

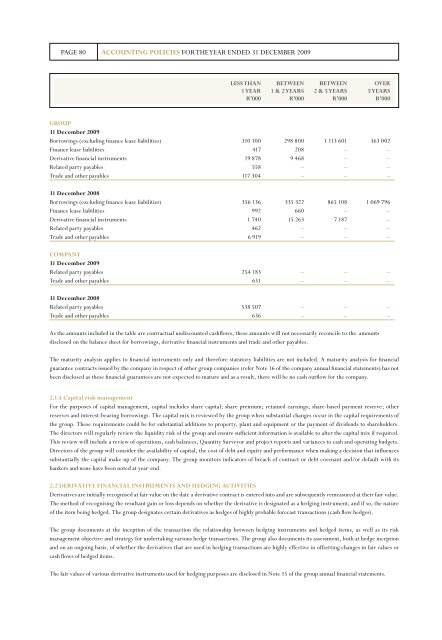

PAGE 80 ACCOUNTING POLICIES FOR THE YEAR ENDED 31 DECEMBER <strong>2009</strong>lESS THAN BETWEEN BETWEEN OVER1 YEAR 1 & 2 YEARS 2 & 5 YEARS 5 YEARSR’000 R’000 R’000 R’000GROUP31 December <strong>2009</strong>Borrowings (excluding finance lease liabilities) 310 100 298 800 1 113 601 363 002Finance lease liabilities 417 208 – –Derivative financial instruments 19 878 9 468 – –Related party payables 558 – – –Trade and o<strong>the</strong>r payables 117 304 – – –31 December 2008Borrowings (excluding finance lease liabilities) 356 136 335 322 865 108 1 069 796Finance lease liabilities 992 660 – –Derivative financial instruments 1 740 15 263 7 187 –Related party payables 462 – – –Trade and o<strong>the</strong>r payables 6 919 – – –COMPANY31 December <strong>2009</strong>Related party payables 254 183 – – –Trade and o<strong>the</strong>r payables 651 – – –31 December 2008Related party payables 538 507 – – –Trade and o<strong>the</strong>r payables 636 – – –As <strong>the</strong> amounts included in <strong>the</strong> table are contractual undiscounted cashflows, <strong>the</strong>se amounts will not necessarily reconcile to <strong>the</strong> amountsdisclosed on <strong>the</strong> balance sheet for borrowings, derivative financial instruments and trade and o<strong>the</strong>r payables.The maturity <strong>analysis</strong> applies to financial instruments only and <strong>the</strong>refore statutory liabilities are not included. A maturity <strong>analysis</strong> for financialguarantee contracts issued by <strong>the</strong> company in respect <strong>of</strong> o<strong>the</strong>r group companies (refer Note 16 <strong>of</strong> <strong>the</strong> company <strong>annual</strong> financial statements) has notbeen disclosed as <strong>the</strong>se financial guarantees are not expected to mature and as a result, <strong>the</strong>re will be no cash outflow for <strong>the</strong> company.2.1.4 Capital risk managementFor <strong>the</strong> purposes <strong>of</strong> capital management, capital includes share capital; share premium; retained earnings; share-based payment reserve; o<strong>the</strong>rreserves and interest-bearing borrowings. The capital mix is reviewed by <strong>the</strong> group when substantial changes occur in <strong>the</strong> capital requirements <strong>of</strong><strong>the</strong> group. These requirements could be for substantial additions to property, plant and equipment or <strong>the</strong> payment <strong>of</strong> dividends to shareholders.The directors will regularly review <strong>the</strong> liquidity risk <strong>of</strong> <strong>the</strong> group and ensure sufficient information is available to alter <strong>the</strong> capital mix if required.This review will include a review <strong>of</strong> operations, cash balances, Quantity Surveyor and project <strong>report</strong>s and variances to cash and operating budgets.Directors <strong>of</strong> <strong>the</strong> group will consider <strong>the</strong> availability <strong>of</strong> capital, <strong>the</strong> cost <strong>of</strong> debt and equity and performance when making a decision that influencessubstantially <strong>the</strong> capital make-up <strong>of</strong> <strong>the</strong> company. The group monitors indicators <strong>of</strong> breach <strong>of</strong> contract or debt covenant and/or default with itsbankers and none have been noted at <strong>year</strong>-end.2.2 DERIVATIVE FINANCIAL INSTRUMENTS AND HEDGING ACTIVITIESDerivatives are initially recognised at fair value on <strong>the</strong> date a derivative contract is entered into and are subsequently remeasured at <strong>the</strong>ir fair value.The method <strong>of</strong> recognising <strong>the</strong> resultant gain or loss depends on whe<strong>the</strong>r <strong>the</strong> derivative is designated as a hedging instrument, and if so, <strong>the</strong> nature<strong>of</strong> <strong>the</strong> item being hedged. The group designates certain derivatives as hedges <strong>of</strong> highly probable forecast transactions (cash flow hedges).The group documents at <strong>the</strong> inception <strong>of</strong> <strong>the</strong> transaction <strong>the</strong> relationship between hedging instruments and hedged items, as well as its riskmanagement objective and strategy for undertaking various hedge transactions. The group also documents its assessment, both at hedge inceptionand on an ongoing basis, <strong>of</strong> whe<strong>the</strong>r <strong>the</strong> derivatives that are used in hedging transactions are highly effective in <strong>of</strong>fsetting changes in fair values orcash flows <strong>of</strong> hedged items.The fair values <strong>of</strong> various derivative instruments used for hedging purposes are disclosed in Note 15 <strong>of</strong> <strong>the</strong> group <strong>annual</strong> financial statements.