9th Annual Conference - Euromoney Institutional Investor PLC

9th Annual Conference - Euromoney Institutional Investor PLC

9th Annual Conference - Euromoney Institutional Investor PLC

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

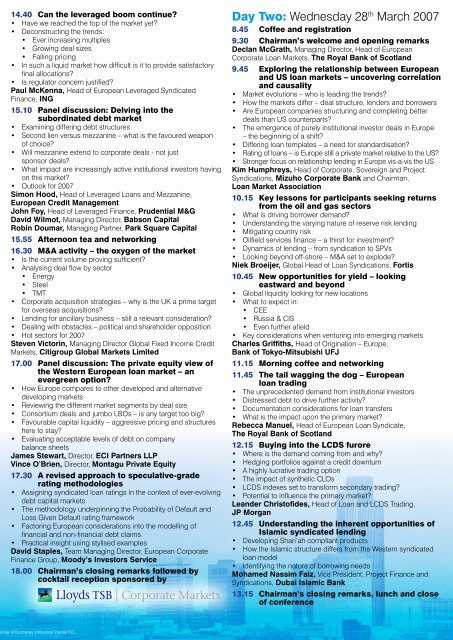

14.40 Can the leveraged boom continue?• Have we reached the top of the market yet?• Deconstructing the trends:• Ever increasing multiples• Growing deal sizes• Falling pricing• In such a liquid market how difficult is it to provide satisfactoryfinal allocations?• Is regulator concern justified?Paul McKenna, Head of European Leveraged SyndicatedFinance, ING15.10 Panel discussion: Delving into thesubordinated debt market• Examining differing debt structures• Second lien versus mezzanine – what is the favoured weaponof choice?• Will mezzanine extend to corporate deals - not justsponsor deals?• What impact are increasingly active institutional investors havingon this market?• Outlook for 2007Simon Hood, Head of Leveraged Loans and Mezzanine,European Credit ManagementJohn Foy, Head of Leveraged Finance, Prudential M&GDavid Wilmot, Managing Director, Babson CapitalRobin Doumar, Managing Partner, Park Square Capital15.55 Afternoon tea and networking16.30 M&A activity – the oxygen of the market• Is the current volume proving sufficient?• Analysing deal flow by sector• Energy• Steel• TMT• Corporate acquisition strategies – why is the UK a prime targetfor overseas acquisitions?• Lending for ancillary business – still a relevant consideration?• Dealing with obstacles – political and shareholder opposition• Hot sectors for 2007Steven Victorin, Managing Director Global Fixed Income CreditMarkets, Citigroup Global Markets Limited17.00 Panel discussion: The private equity view ofthe Western European loan market – anevergreen option?• How Europe compares to other developed and alternativedeveloping markets• Reviewing the different market segments by deal size• Consortium deals and jumbo LBOs – is any target too big?• Favourable capital liquidity – aggressive pricing and structureshere to stay?• Evaluating acceptable levels of debt on companybalance sheetsJames Stewart, Director, ECI Partners LLPVince O’Brien, Director, Montagu Private Equity17.30 A revised approach to speculative-graderating methodologies• Assigning syndicated loan ratings in the context of ever-evolvingdebt capital markets• The methodology underpinning the Probability of Default andLoss Given Default rating framework• Factoring European considerations into the modelling offinancial and non-financial debt claims• Practical insight using stylised examplesDavid Staples, Team Managing Director, European CorporateFinance Group, Moody’s <strong>Investor</strong>s Service18.00 Chairman’s closing remarks followed bycocktail reception sponsored byDay Two: Wednesday 28 th March 20078.45 Coffee and registration9.30 Chairman’s welcome and opening remarksDeclan McGrath, Managing Director, Head of EuropeanCorporate Loan Markets, The Royal Bank of Scotland9.45 Exploring the relationship between Europeanand US loan markets – uncovering correlationand causality• Market evolutions – who is leading the trends?• How the markets differ – deal structure, lenders and borrowers• Are European companies structuring and completing betterdeals than US counterparts?• The emergence of purely institutional investor deals in Europe– the beginning of a shift?• Differing loan templates – a need for standardisation?• Rating of loans – is Europe still a private market relative to the US?• Stronger focus on relationship lending in Europe vis-a-vis the USKim Humphreys, Head of Corporate, Sovereign and ProjectSyndications, Mizuho Corporate Bank and Chairman,Loan Market Association10.15 Key lessons for participants seeking returnsfrom the oil and gas sectors• What is driving borrower demand?• Understanding the varying nature of reserve risk lending• Mitigating country risk• Oilfield services finance – a thirst for investment?• Dynamics of lending – from syndication to SPVs• Looking beyond off-shore – M&A set to explode?Niek Broeijer, Global Head of Loan Syndications, Fortis10.45 New opportunities for yield – lookingeastward and beyond• Global liquidity looking for new locations• What to expect in:• CEE• Russia & CIS• Even further afield• Key considerations when venturing into emerging marketsCharles Griffiths, Head of Origination – Europe,Bank of Tokyo-Mitsubishi UFJ11.15 Morning coffee and networking11.45 The tail wagging the dog – Europeanloan trading• The unprecedented demand from institutional investors• Distressed debt to drive further activity?• Documentation considerations for loan transfers• What is the impact upon the primary market?Rebecca Manuel, Head of European Loan Syndicate,The Royal Bank of Scotland12.15 Buying into the LCDS furore• Where is the demand coming from and why?• Hedging portfolios against a credit downturn• A highly lucrative trading option• The impact of synthetic CLOs• LCDS indexes set to transform secondary trading?• Potential to influence the primary market?Leander Christofides, Head of Loan and LCDS Trading,JP Morgan12.45 Understanding the inherent opportunities ofIslamic syndicated lending• Developing Shari’ah compliant products• How the Islamic structure differs from the Western syndicatedloan model• Identifying the nature of borrowing needsMohamed Nassim Faiz, Vice President, Project Finance andSyndications, Dubai Islamic Bank13.15 Chairman’s closing remarks, lunch and closeof conferencevision of <strong>Euromoney</strong> <strong>Institutional</strong> <strong>Investor</strong> <strong>PLC</strong>.