The State and Future of U.S. Forestry and the Forest Industry (May ...

The State and Future of U.S. Forestry and the Forest Industry (May ...

The State and Future of U.S. Forestry and the Forest Industry (May ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

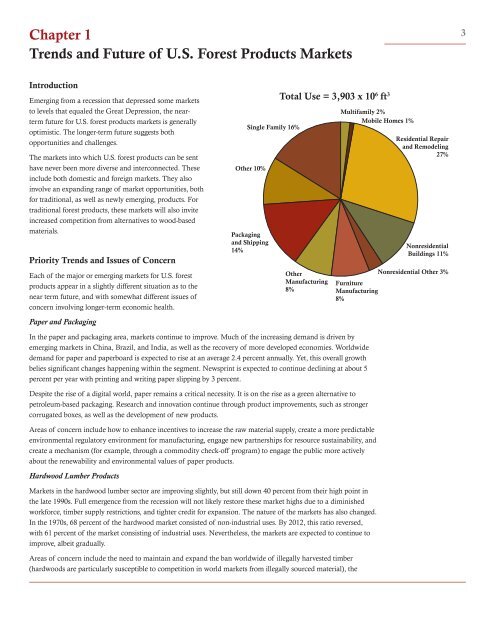

Chapter 1Trends <strong>and</strong> <strong>Future</strong> <strong>of</strong> U.S. <strong>Forest</strong> Products Markets3IntroductionEmerging from a recession that depressed some marketsto levels that equaled <strong>the</strong> Great Depression, <strong>the</strong> neartermfuture for U.S. forest products markets is generallyoptimistic. <strong>The</strong> longer-term future suggests bothopportunities <strong>and</strong> challenges.<strong>The</strong> markets into which U.S. forest products can be senthave never been more diverse <strong>and</strong> interconnected. <strong>The</strong>seinclude both domestic <strong>and</strong> foreign markets. <strong>The</strong>y alsoinvolve an exp<strong>and</strong>ing range <strong>of</strong> market opportunities, bothfor traditional, as well as newly emerging, products. Fortraditional forest products, <strong>the</strong>se markets will also inviteincreased competition from alternatives to wood-basedmaterials.Priority Trends <strong>and</strong> Issues <strong>of</strong> ConcernEach <strong>of</strong> <strong>the</strong> major or emerging markets for U.S. forestproducts appear in a slightly different situation as to <strong>the</strong>near term future, <strong>and</strong> with somewhat different issues <strong>of</strong>concern involving longer-term economic health.Paper <strong>and</strong> PackagingSingle Family 16%O<strong>the</strong>r 10%Packaging<strong>and</strong> Shipping14%Total Use = 3,903 x 10 6 ft 3O<strong>the</strong>rManufacturing8%Multifamily 2%Mobile Homes 1%Residential Repair<strong>and</strong> Remodeling27%NonresidentialBuildings 11%Nonresidential O<strong>the</strong>r 3%FurnitureManufacturing8%In <strong>the</strong> paper <strong>and</strong> packaging area, markets continue to improve. Much <strong>of</strong> <strong>the</strong> increasing dem<strong>and</strong> is driven byemerging markets in China, Brazil, <strong>and</strong> India, as well as <strong>the</strong> recovery <strong>of</strong> more developed economies. Worldwidedem<strong>and</strong> for paper <strong>and</strong> paperboard is expected to rise at an average 2.4 percent annually. Yet, this overall growthbelies significant changes happening within <strong>the</strong> segment. Newsprint is expected to continue declining at about 5percent per year with printing <strong>and</strong> writing paper slipping by 3 percent.Despite <strong>the</strong> rise <strong>of</strong> a digital world, paper remains a critical necessity. It is on <strong>the</strong> rise as a green alternative topetroleum-based packaging. Research <strong>and</strong> innovation continue through product improvements, such as strongercorrugated boxes, as well as <strong>the</strong> development <strong>of</strong> new products.Areas <strong>of</strong> concern include how to enhance incentives to increase <strong>the</strong> raw material supply, create a more predictableenvironmental regulatory environment for manufacturing, engage new partnerships for resource sustainability, <strong>and</strong>create a mechanism (for example, through a commodity check-<strong>of</strong>f program) to engage <strong>the</strong> public more activelyabout <strong>the</strong> renewability <strong>and</strong> environmental values <strong>of</strong> paper products.Hardwood Lumber ProductsMarkets in <strong>the</strong> hardwood lumber sector are improving slightly, but still down 40 percent from <strong>the</strong>ir high point in<strong>the</strong> late 1990s. Full emergence from <strong>the</strong> recession will not likely restore <strong>the</strong>se market highs due to a diminishedworkforce, timber supply restrictions, <strong>and</strong> tighter credit for expansion. <strong>The</strong> nature <strong>of</strong> <strong>the</strong> markets has also changed.In <strong>the</strong> 1970s, 68 percent <strong>of</strong> <strong>the</strong> hardwood market consisted <strong>of</strong> non-industrial uses. By 2012, this ratio reversed,with 61 percent <strong>of</strong> <strong>the</strong> market consisting <strong>of</strong> industrial uses. Never<strong>the</strong>less, <strong>the</strong> markets are expected to continue toimprove, albeit gradually.Areas <strong>of</strong> concern include <strong>the</strong> need to maintain <strong>and</strong> exp<strong>and</strong> <strong>the</strong> ban worldwide <strong>of</strong> illegally harvested timber(hardwoods are particularly susceptible to competition in world markets from illegally sourced material), <strong>the</strong>