download - Carnegie Mellon University

download - Carnegie Mellon University

download - Carnegie Mellon University

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

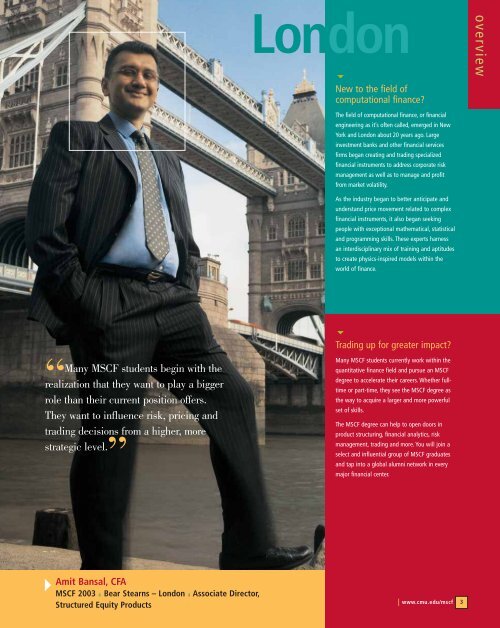

LondonNew to the field ofcomputational finance?overviewThe field of computational finance, or financialengineering as it’s often called, emerged in NewYork and London about 20 years ago. Largeinvestment banks and other financial servicesfirms began creating and trading specializedfinancial instruments to address corporate riskmanagement as well as to manage and profitfrom market volatility.As the industry began to better anticipate andunderstand price movement related to complexfinancial instruments, it also began seekingpeople with exceptional mathematical, statisticaland programming skills. These experts harnessan interdisciplinary mix of training and aptitudesto create physics-inspired models within theworld of finance.Trading up for greater impact?“Many MSCF students begin with therealization that they want to play a biggerrole than their current position offers.They want to influence risk, pricing andtrading decisions from a higher, morestrategic level.”Many MSCF students currently work within thequantitative finance field and pursue an MSCFdegree to accelerate their careers. Whether fulltimeor part-time, they see the MSCF degree asthe way to acquire a larger and more powerfulset of skills.The MSCF degree can help to open doors inproduct structuring, financial analytics, riskmanagement, trading and more. You will join aselect and influential group of MSCF graduatesand tap into a global alumni network in everymajor financial center.Amit Bansal, CFAMSCF 2003 4 Bear Stearns – London 4 Associate Director,Structured Equity ProductsI www.cmu.edu/mscf 3