notes to the financial statements - Sino

notes to the financial statements - Sino

notes to the financial statements - Sino

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

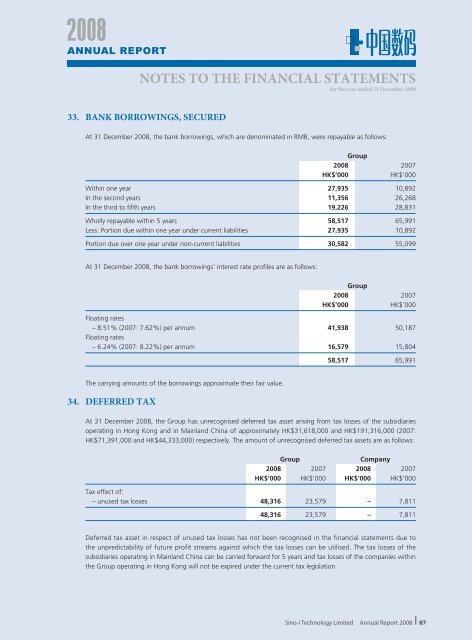

NOTES TO THE FINANCIAL STATEMENTSfor <strong>the</strong> year ended 31 December 200833. BANK BORROWINGS, SECUREDAt 31 December 2008, <strong>the</strong> bank borrowings, which are denominated in RMB, were repayable as follows:Group2008 2007HK$’000HK$’000Within one year 27,935 10,892In <strong>the</strong> second years 11,356 26,268In <strong>the</strong> third <strong>to</strong> fifth years 19,226 28,831Wholly repayable within 5 years 58,517 65,991Less: Portion due within one year under current liabilities 27,935 10,892Portion due over one year under non-current liabilities 30,582 55,099At 31 December 2008, <strong>the</strong> bank borrowings’ interest rate profiles are as follows:Group2008 2007HK$’000HK$’000Floating rates– 8.51% (2007: 7.62%) per annum 41,938 50,187Floating rates– 6.24% (2007: 8.22%) per annum 16,579 15,80458,517 65,991The carrying amounts of <strong>the</strong> borrowings approximate <strong>the</strong>ir fair value.34. DEFERRED TAXAt 31 December 2008, <strong>the</strong> Group has unrecognised deferred tax asset arising from tax losses of <strong>the</strong> subsidiariesoperating in Hong Kong and in Mainland China of approximately HK$31,618,000 and HK$191,316,000 (2007:HK$71,391,000 and HK$44,333,000) respectively. The amount of unrecognised deferred tax assets are as follows:GroupCompany2008 2007 2008 2007HK$’000 HK$’000 HK$’000 HK$’000Tax effect of:– unused tax losses 48,316 23,579 – 7,81148,316 23,579 – 7,811Deferred tax asset in respect of unused tax losses has not been recognised in <strong>the</strong> <strong>financial</strong> <strong>statements</strong> due <strong>to</strong><strong>the</strong> unpredictability of future profit streams against which <strong>the</strong> tax losses can be utilised. The tax losses of <strong>the</strong>subsidiaries operating in Mainland China can be carried forward for 5 years and tax losses of <strong>the</strong> companies within<strong>the</strong> Group operating in Hong Kong will not be expired under <strong>the</strong> current tax legislation.<strong>Sino</strong>-i Technology Limited Annual Report 200887