IFRS presentation to analysts and investors - About United Utilities

IFRS presentation to analysts and investors - About United Utilities

IFRS presentation to analysts and investors - About United Utilities

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

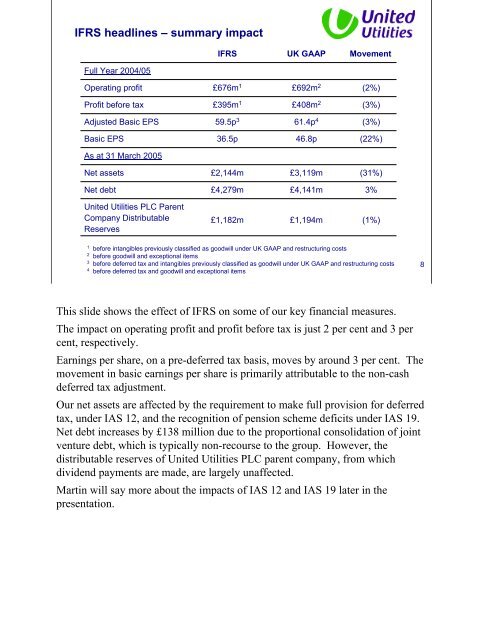

<strong>IFRS</strong> headlines – summary impactFull Year 2004/05<strong>IFRS</strong>UK GAAPMovementOperating profit£676m 1£692m 2(2%)Profit before tax£395m 1£408m 2(3%)Adjusted Basic EPS59.5p 361.4p 4(3%)Basic EPS36.5p46.8p(22%)As at 31 March 2005Net assets£2,144m£3,119m(31%)Net debt£4,279m£4,141m3%<strong>United</strong> <strong>Utilities</strong> PLC ParentCompany DistributableReserves£1,182m£1,194m(1%)1before intangibles previously classified as goodwill under UK GAAP <strong>and</strong> restructuring costs2 before goodwill <strong>and</strong> exceptional items3 before deferred tax <strong>and</strong> intangibles previously classified as goodwill under UK GAAP <strong>and</strong> restructuring costs4before deferred tax <strong>and</strong> goodwill <strong>and</strong> exceptional items8This slide shows the effect of <strong>IFRS</strong> on some of our key financial measures.The impact on operating profit <strong>and</strong> profit before tax is just 2 per cent <strong>and</strong> 3 percent, respectively.Earnings per share, on a pre-deferred tax basis, moves by around 3 per cent. Themovement in basic earnings per share is primarily attributable <strong>to</strong> the non-cashdeferred tax adjustment.Our net assets are affected by the requirement <strong>to</strong> make full provision for deferredtax, under IAS 12, <strong>and</strong> the recognition of pension scheme deficits under IAS 19.Net debt increases by £138 million due <strong>to</strong> the proportional consolidation of jointventure debt, which is typically non-recourse <strong>to</strong> the group. However, thedistributable reserves of <strong>United</strong> <strong>Utilities</strong> PLC parent company, from whichdividend payments are made, are largely unaffected.Martin will say more about the impacts of IAS 12 <strong>and</strong> IAS 19 later in the<strong>presentation</strong>.