Valuing Investment Property under Construction - EPRA

Valuing Investment Property under Construction - EPRA

Valuing Investment Property under Construction - EPRA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

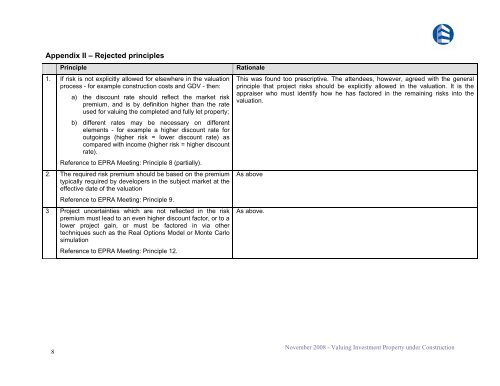

Appendix II – Rejected principlesPrinciple1. If risk is not explicitly allowed for elsewhere in the valuationprocess - for example construction costs and GDV - then:a) the discount rate should reflect the market riskpremium, and is by definition higher than the rateused for valuing the completed and fully let property;b) different rates may be necessary on differentelements - for example a higher discount rate foroutgoings (higher risk = lower discount rate) ascompared with income (higher risk = higher discountrate).Reference to <strong>EPRA</strong> Meeting: Principle 8 (partially).2. The required risk premium should be based on the premiumtypically required by developers in the subject market at theeffective date of the valuationReference to <strong>EPRA</strong> Meeting: Principle 9.3 Project uncertainties which are not reflected in the riskpremium must lead to an even higher discount factor, or to alower project gain, or must be factored in via othertechniques such as the Real Options Model or Monte CarlosimulationReference to <strong>EPRA</strong> Meeting: Principle 12.RationaleThis was found too prescriptive. The attendees, however, agreed with the generalprinciple that project risks should be explicitly allowed in the valuation. It is theappraiser who must identify how he has factored in the remaining risks into thevaluation.As aboveAs above.8November 2008 - <strong>Valuing</strong> <strong>Investment</strong> <strong>Property</strong> <strong>under</strong> <strong>Construction</strong>