HDFC Cash Management Fund - Sep 30, 2011 - HDFC Mutual Fund

HDFC Cash Management Fund - Sep 30, 2011 - HDFC Mutual Fund

HDFC Cash Management Fund - Sep 30, 2011 - HDFC Mutual Fund

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

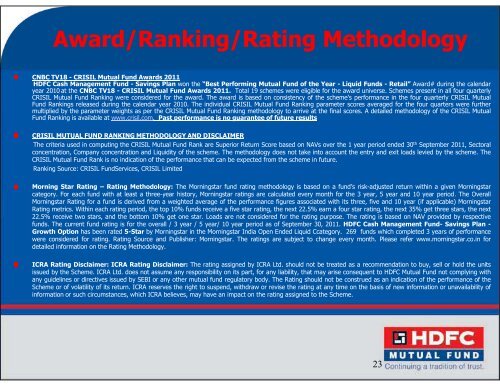

Award/Ranking/Rating MethodologyCNBC TV18 - CRISIL <strong>Mutual</strong> <strong>Fund</strong> Awards <strong>2011</strong><strong>HDFC</strong> <strong>Cash</strong> <strong>Management</strong> <strong>Fund</strong> - Savings Plan won the “Best Performing <strong>Mutual</strong> <strong>Fund</strong> of the Year - Liquid <strong>Fund</strong>s - Retail” Award# during the calendaryear 2010 at the CNBC TV18 - CRISIL <strong>Mutual</strong> <strong>Fund</strong> Awards <strong>2011</strong>. Total 19 schemes were eligible for the award universe. Schemes present in all four quarterlyCRISIL <strong>Mutual</strong> <strong>Fund</strong> Ranking were considered for the award. The award is based on consistency of the scheme’s performance in the four quarterly CRISIL <strong>Mutual</strong><strong>Fund</strong> Rankings released during the calendar year 2010. The individual CRISIL <strong>Mutual</strong> <strong>Fund</strong> Ranking parameter scores averaged for the four quarters were furthermultiplied by the parameter weights as per the CRISIL <strong>Mutual</strong> <strong>Fund</strong> Ranking methodology to arrive at the final scores. A detailed methodology of the CRISIL <strong>Mutual</strong><strong>Fund</strong> Ranking is available at www.crisil.com. Past performance is no guarantee of future resultsCRISIL MUTUAL FUND RANKING METHODOLOGY AND DISCLAIMERThe criteria used in computing the CRISIL <strong>Mutual</strong> <strong>Fund</strong> Rank are Superior Return Score based on NAVs over the 1 year period ended <strong>30</strong> th <strong>Sep</strong>tember <strong>2011</strong>, Sectoralconcentration, Company concentration and Liquidity of the scheme. The methodology does not take into account the entry and exit loads levied by the scheme. TheCRISIL <strong>Mutual</strong> <strong>Fund</strong> Rank is no indication of the performance that can be expected from the scheme in future.Ranking Source: CRISIL <strong>Fund</strong>Services, CRISIL LimitedMorning Star Rating – Rating Methodology: The Morningstar fund rating methodology is based on a fund’s risk-adjusted return within a given Morningstarcategory. For each fund with at least a three-year history, Morningstar ratings are calculated every month for the 3 year, 5 year and 10 year period. The OverallMorningstar Rating for a fund is derived from a weighted average of the performance figures associated with its three, five and 10 year (if applicable) MorningstarRating metrics. Within each rating period, the top 10% funds receive a five star rating, the next 22.5% earn a four star rating, the next 35% get three stars, the next22.5% receive two stars, and the bottom 10% get one star. Loads are not considered for the rating purpose. The rating is based on NAV provided by respectivefunds. The current fund rating is for the overall / 3 year / 5 year/ 10 year period as of <strong>Sep</strong>tember <strong>30</strong>, <strong>2011</strong>. <strong>HDFC</strong> <strong>Cash</strong> <strong>Management</strong> <strong>Fund</strong>- Savings Plan -Growth Option has been rated 5-Star by Morningstar in the Morningstar India Open Ended Liquid Ccategory. 269 funds which completed 3 years of performancewere considered for rating. Rating Source and Publisher: Morningstar. The ratings are subject to change every month. Please refer www.morningstar.co.in fordetailed information on the Rating Methodology.ICRA Rating Disclaimer: ICRA Rating Disclaimer: The rating assigned by ICRA Ltd. should not be treated as a recommendation to buy, sell or hold the unitsissued by the Scheme. ICRA Ltd. does not assume any responsibility on its part, for any liability, that may arise consequent to <strong>HDFC</strong> <strong>Mutual</strong> <strong>Fund</strong> not complying withany guidelines or directives issued by SEBI or any other mutual fund regulatory body. The Rating should not be construed as an indication of the performance of theScheme or of volatility of its return. ICRA reserves the right to suspend, withdraw or revise the rating at any time on the basis of new information or unavailability ofinformation or such circumstances, which ICRA believes, may have an impact on the rating assigned to the Scheme.23