RITC on credit notes, gifts,freedistribution,goods lost, destroyed or ...

RITC on credit notes, gifts,freedistribution,goods lost, destroyed or ...

RITC on credit notes, gifts,freedistribution,goods lost, destroyed or ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

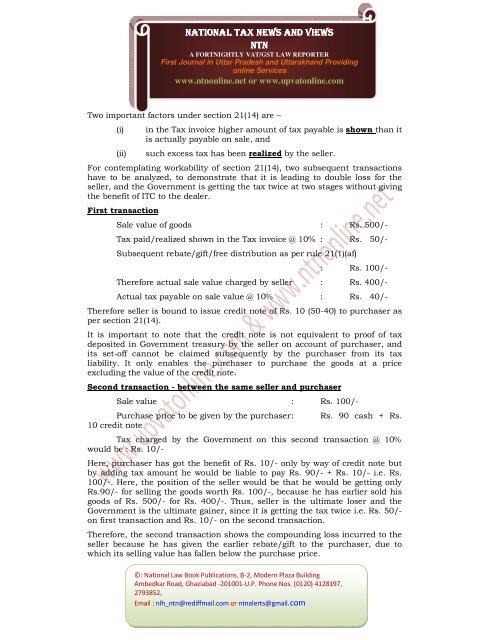

NATIONAL TAX NEWS AND VIEWSNTNA FORTNIGHTLY VAT/GST LAW REPORTERFirst Journal in Uttar Pradesh and Uttarakhand Providing<strong>on</strong>line Serviceswww.ntn<strong>on</strong>line.net <strong>or</strong> www.upvat<strong>on</strong>line.comTwo imp<strong>or</strong>tant fact<strong>or</strong>s under secti<strong>on</strong> 21(14) are –(i)(ii)in the Tax invoice higher amount of tax payable is shown than itis actually payable <strong>on</strong> sale, andsuch excess tax has been realized by the seller.F<strong>or</strong> c<strong>on</strong>templating w<strong>or</strong>kability of secti<strong>on</strong> 21(14), two subsequent transacti<strong>on</strong>shave to be analyzed, to dem<strong>on</strong>strate that it is leading to double loss f<strong>or</strong> theseller, and the Government is getting the tax twice at two stages without givingthe benefit of ITC to the dealer.First transacti<strong>on</strong>Sale value of <strong>goods</strong> : Rs. 500/-Tax paid/realized shown in the Tax invoice @ 10% : Rs. 50/-Subsequent rebate/gift/free distributi<strong>on</strong> as per rule 21(1)(af)©: Nati<strong>on</strong>al Law Book Publicati<strong>on</strong>s, B-2, Modern Plaza BuildingAmbedkar Road, Ghaziabad -201001-U.P. Ph<strong>on</strong>e Nos. (0120) 4128197,2793852,Email : nlh_ntn@rediffmail.com <strong>or</strong> ntnalerts@gmail.com: Rs. 100/-Theref<strong>or</strong>e actual sale value charged by seller : Rs. 400/-Actual tax payable <strong>on</strong> sale value @ 10% : Rs. 40/-Theref<strong>or</strong>e seller is bound to issue <strong>credit</strong> note of Rs. 10 (50-40) to purchaser asper secti<strong>on</strong> 21(14).It is imp<strong>or</strong>tant to note that the <strong>credit</strong> note is not equivalent to proof of taxdeposited in Government treasury by the seller <strong>on</strong> account of purchaser, andits set-off cannot be claimed subsequently by the purchaser from its taxliability. It <strong>on</strong>ly enables the purchaser to purchase the <strong>goods</strong> at a priceexcluding the value of the <strong>credit</strong> note.Sec<strong>on</strong>d transacti<strong>on</strong> - between the same seller and purchaserSale value : Rs. 100/-Purchase price to be given by the purchaser :10 <strong>credit</strong> noteRs. 90 cash + Rs.Tax charged by the Government <strong>on</strong> this sec<strong>on</strong>d transacti<strong>on</strong> @ 10%would be : Rs. 10/-Here, purchaser has got the benefit of Rs. 10/- <strong>on</strong>ly by way of <strong>credit</strong> note butby adding tax amount he would be liable to pay Rs. 90/- + Rs. 10/- i.e. Rs.100/-. Here, the positi<strong>on</strong> of the seller would be that he would be getting <strong>on</strong>lyRs.90/- f<strong>or</strong> selling the <strong>goods</strong> w<strong>or</strong>th Rs. 100/-, because he has earlier sold his<strong>goods</strong> of Rs. 500/- f<strong>or</strong> Rs. 400/-. Thus, seller is the ultimate loser and theGovernment is the ultimate gainer, since it is getting the tax twice i.e. Rs. 50/-<strong>on</strong> first transacti<strong>on</strong> and Rs. 10/- <strong>on</strong> the sec<strong>on</strong>d transacti<strong>on</strong>.Theref<strong>or</strong>e, the sec<strong>on</strong>d transacti<strong>on</strong> shows the compounding loss incurred to theseller because he has given the earlier rebate/gift to the purchaser, due towhich its selling value has fallen below the purchase price.

![2008 NTN (Vol. 36) - 107 [ALLAHABAD HIGH COURT] Hon'ble ...](https://img.yumpu.com/50102532/1/190x245/2008-ntn-vol-36-107-allahabad-high-court-honble-.jpg?quality=85)

![2010 NTN (Vol. 43) - 306 [ALLAHABAD HIGH COURT] Hon'ble ...](https://img.yumpu.com/35159282/1/190x245/2010-ntn-vol-43-306-allahabad-high-court-honble-.jpg?quality=85)